|

APRIL 1, 2015 to JULY 31, 2015

U.S. appeals court rejects Associated Press New York — Victims of apartheid in South Africa cannot sue IBM Corp. and Ford Motor Co. in New York because they cannot show that the companies' alleged offending behavior occurred in the United States, a federal appeals court said Monday. The 2nd U.S. Circuit Court of Appeals ruled against lawsuits brought 13 years ago against the Armonk, New York-based IBM and Dearborn, Michigan-based Ford. In its ruling, a three-judge panel cited a 2013 Supreme Court ruling severely limiting the legal reach of the 1789 Alien Tort Statute. The law was created in part to deal with piracy claims but in recent decades human rights lawyers have used it to pursue damages from individuals or companies alleged to have supported abuses around the world. In a decision written by Circuit Judge Jose A. Cabranes, the 2nd Circuit in Manhattan upheld a decision by Judge Shira A. Scheindlin last year that tossed out the lawsuits because the conduct at issue occurred abroad. Close to 80 companies initially were named in the lawsuits, but the vast majority of those claims were rejected. The lawsuits alleged that Ford provided specialized vehicles to the South African police and securities forces to help enforce apartheid — the country's former system of white minority rule — and shared information with government officials about anti-apartheid and union activists. They said IBM designed technologies that were essential for racial separation under apartheid. The 2nd Circuit said the claims against Ford fail because it was the automaker's South African subsidiary that was alleged to have assembled and sold specialized vehicles to the government. The subsidiary also was accused of providing information to the South African government about anti-apartheid activities. The appeals court said Ford could not be held directly responsible for its subsidiary's actions because well-settled principles of corporate law treat parent corporations and their subsidiaries as legally distinct entities. As for IBM, the 2nd Circuit said it cannot be held liable for the actions of its South African subsidiary, though the judges noted that the lawsuits allege that the parent company acted with knowledge that its acts might facilitate apartheid policies. Still, it found the allegations fell short of showing IBM acted purposefully. "Indeed, plaintiffs do not — and cannot — plausibly allege that by developing hardware and software to collect innocuous population data, IBM's purpose was to denationalize black South Africans and further the aims of a brutal regime," the court said. Lawyers in the case did not immediately respond to messages seeking comment. |

U.S. regulators impose record Reuters WASHINGTON (Reuters) - The U.S. auto safety watchdog, toughening its stance against manufacturer defects, on Sunday fined Fiat Chrysler Automobiles a record $105 million over lapses in safety recalls involving millions of vehicles, according to documents obtained by Reuters. Under a consent agreement with the National Highway Traffic Safety Administration, Fiat Chrysler agreed to give the owners of 1.5 million vehicles the option of selling their vehicles back to the manufacturer. Included were 1 million Jeep sport utility vehicles with fuel tanks that can leak and catch fire in rear-end collisions. According to the consent agreement, Fiat Chrysler also agreed to allow an independent monitor to audit its recall performance for three years. The agreement also requires Fiat Chrysler to spend at least $20 million to meet performance requirements and another $15 million if the monitor discovers additional violations. |

Ford Technology Develops

Wheels.ca Driving at night, particularly on unlit roads, can be a nerve-wracking experience. Ford Technology is developing new lighting technologies that will enable drivers to more easily identify potential hazards, including pedestrians, cyclists and animals. Ford's Camera-Based Advanced Front Lighting System can widen the beam at junctions and roundabouts to better illuminate hazards that are not in the direction of travel. New Spot Lighting technology helps draw the driver's attention to pedestrians, cyclists and even large animals in the vehicle's path or even just off the road. Camera-Based Advanced Front Lighting System builds upon Ford's Adaptive Front Lighting System and Traffic Sign Recognition, which are already available in Ford vehicles, to provide drivers with improved visibility at roundabouts, stop, and give way or yield signs. The system also uses GPS information to better illuminate bends and dips on a chosen route. Where GPS information is not available the technology uses a forward-facing video camera mounted in the rear-view mirror base to detect lane markings and predict the road's curvature, using the information to illuminate the area more effectively. In a further evolutionary step, in those instances, the camera stores the information in the navigation system. When next the driver uses the same road again, the headlights adapt to the course of the road automatically to better light the way. Camera-Based Advanced Front Lighting System was developed at Ford's European Research and Innovation Centre in Aachen, Germany, and Ford expects the technology to be available for customers in the near term. Spot Lighting – currently in the pre-development phase with Ford engineers in Aachen – uses an infra-red camera in the front grille to simultaneously locate and track up to eight people and bigger animals, including larger dogs, at a range of up to 120 metres. The system can spotlight two hazards for the driver with a spot and a stripe on the road surface, illuminated by two special LED lamps next to the fog lights. The highlighted objects are displayed on the screen inside the car, marked in a red or yellow frame, according to the proximity of the object and the level of danger presented. |

Ford critic Donald Trump

David Shepardson, Washington — Billionaire presidential candidate Donald Trump — who criticized Ford Motor Co. for plans to build a new plant in Mexico — is an investor in the company's credit arm, a campaign filing Wednesday shows. In financial disclosures with the Federal Election Commission made public Wednesday, Trump said he holds between $600,000 and $1.25 million in investments in Ford Motor Credit and earned between $17,500 and $55,000 in interest. He also listed a capital gain of between $100,000 and $1 million from the sale of Ford Motor Co. stock. Last month, Trump threatened Ford with likely illegal punitive taxes if it proceeds with a new $2.5 billion Mexican plant that he said will "take away thousands" of U.S. jobs. Trump vowed to impose 35 percent taxes on imported Ford vehicles and parts coming from the new Mexican plant. At the time, Trump said he would call Ford CEO Mark Fields — whom he identified only as "the head of Ford" — to explain the "bad news." "Let me give you the bad news: every car, every truck and every part manufactured in this plant that comes across the border, we're going to charge you a 35 percent tax — OK? — and that tax is going to be paid simultaneously with the transaction," Trump said. "They are going to take away thousands of jobs. In April, Ford said it would add 3,800 jobs in Mexico as part of a $2.5 billion investment — on top of the 11,300 Ford already employs in Mexico. The investment will include a new engine plant and new transmission plant allowing for exports of engines to the United States and elsewhere. Ford has had operations in Mexico for about 90 years. Asked about Trump's criticism last month, Ford spokeswoman Christin Baker pointed to the Dearborn automaker's U.S. investments. "We are proud that we have invested $6.2 billion in our U.S. plants since 2011 and hired nearly 25,000 U.S. employees. Overall, 80 percent of our North American investment annually is in the U.S., and 97 percent of our North American engineering is conducted in the U.S.," she said. Under the North American Free Trade Agreement and existing U.S. tax laws, it is not clear how Trump could take such an action unilaterally. Nearly all major automakers already have major plants in Mexico, including Detroit's Big Three automakers. Singling out one new auto plant for punitive taxes would almost certainly not be legal under American law. Companies are free to build plants where they want. Automakers are bypassing the U.S. for new plants in part because Mexico has dozens of free trade agreements around the world, low wages, free or nearly free land on which to build and fewer regulatory hurdles. BMW AG, Volkswagen AG and its Audi unit, Nissan Motor Co., Kia Motors and Fiat Chrysler Automobiles NV are among the automakers that have built or announced new plants or plant expansions — part of more than $20 billion in investments made or planned for Mexico since 2010. In addition to the Ford stock listed in the FEC filing, Trump also holds an investment in Toyota Motor Corp. credit worth between $500,000 and $1 million. He also reported capital gains of between $100,000 and $1 million from both the sale of General Motors Co. stock and Volkswagen AG through a U.S.-traded equity. He is an investor in Yahoo, Apple, John Deere, Boeing, Chevron, Mastercard, UPS, Costco, Walt Disney and dozens of other firms. Trump to visit border Donald Trump, provocateur of the Republican presidential race, now plans to go the Mexican border, a flashpoint in the primary contest ever since he declared that immigrants from Mexico are rapists and drug dealers. He will travel to Laredo, Texas, on Thursday, where he will hold a news conference at the border, meet members of the union that represents Border Patrol agents and speak to law enforcement officers, his campaign said. |

Ford and UAW begin

Michael Martinez Detroit — Ford Motor Co. and the United Auto Workers kicked off contract negotiations Thursday at Cass Technical High School as the threat of production moving to Mexico loomed over the talks. "Mexico continues to be an issue for us," UAW President Dennis Williams said during the ceremonial handshake event. "I want everything to be built in the United States, including tennis shoes." Ford in April said it was investing $2.5 billion in Mexico for a new engine and transmission plant. And earlier this month it said it was moving production of the Focus and C-Max out of Michigan Assembly Plant in Wayne in 2018; Mexico is the likeliest option. "We have to look at our overall business ... and how we can best improve overall profitability for the company," said John Fleming, executive vice president of manufacturing and labor affairs for Ford. "We look at how to best optimze the overall footprint. Mexico is part of that footprint, China is part of the footprint, Thailand is part of the footprint. We're going to continue to look at what's best for the global business, but also what's best for the North America business." Ford would not comment on where it was looking to move the Focus and C-Max. It said the announcement earlier this month was part of the company's normal product cadence and not related to negotiations. Both sides expressed optimism that Michigan Assembly Plant would not close when the products move in 2018. "We're looking for what products are the right products to go in there," Fleming said. "At the moment, closing a plant is not something we've got on the agenda." As Detroit's automakers enter negotiations with the UAW, they likely will use the threat of moving production out of the U.S. as a bargaining chip as they look to keep labor costs down. The Center for Automotive Research says average hourly labor costs in the United States — including benefits — are $57 at Ford, $55 an hour at GM and $48 at FCA. Honda Motor Co.'s cost is $49 an hour, and Toyota Motor Corp.'s is $48. Williams said he recently met with U.S. Secretary of Labor Tom Perez and President Barack Obama "about Mexico and what a problem it is" and Williams "has a plan" to help improve worker conditions there. A central part of negotitians will be the UAW's push to bridge the gap between the pay of its tier-one and tier-two workers. Veteran tier-one workers earn more than $28 an hour, while more recently hired second-tier workers earn up to $19.28 an hour for the same jobs. The union agreed to a lower-paid entry-level job classification in 2007, just ahead of the economic downturn. Partly because of that, automakers have hired thousands of workers. "There's some really important work ahead of all of us....we're very well-prepared," said Bill Dirksen, Ford's vice president of labor affairs. The ceremony had a positive feel, as both side talked about the strides they've made since the economic downturn of 2008. It was the first time a handshake event was held outside of a Ford facility, and the first time Ford and UAW negotiators from individual plants were invited. "We've made tremendous gains since 2007," said Jimmy Settles, vice president of the UAW-Ford department. Ford promised to hire about 12,000 hourly workers in the last negotiations. It hired more than 15,000. "I'm absolutely convinced that we'll continue to build, working together, a stronger Ford Motor Co. going forward," said CEO Mark Fields. Autoworkers' current four-year contracts expire Sept. 14. |

Ford recalling 8,000 vehicles David Shepardson, Washington — Ford Motor Co. said Wednesday it is recalling 8,000 new cars and SUVs because the parking brakes may not fully engage. The recall covers some 2015-16 Ford Explorer, 2015 Taurus, Flex, Lincoln MKS and MKT vehicles. The Dearborn automaker said it is not aware of any accidents or injuries associated with this issue. The recall includes 7,165 vehicles in the United States, 799 in Canada and one in Mexico. Dealers will inspect the vehicle and, if necessary, replace the parking brake control assembly. |

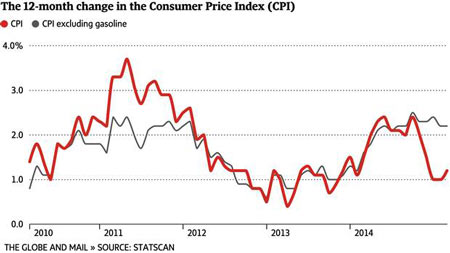

Health spending won't meet needs GLORIA GALLOWAY The independent office responsible for assessing the country's finances says limits imposed by the federal Conservative government on increases to health transfers will eventually make it impossible for provinces and territories to handle the costs of an aging population. The fiscal sustainability report released on Tuesday by the Parliamentary Budget Officer (PBO) looks at whether spending policies of the various levels of government will be viable 75 years into the future, given current economic and demographic predictions. While the report says the Canada Pension Plan and the Quebec Pension Plan can absorb what is expected to be a significant increase in the number of retirees over the coming decades, it says the provinces and territories will not be able to afford health care. "Subnational governments cannot meet the challenges of population aging under current policy," the PBO said. The federal government has been increasing health transfers to the provinces and territories by 6 per cent a year since the signing of a health accord in 2004. But Ottawa announced in 2011 that, after 2016-17, future increases would be tied to the growth in the nominal gross domestic product, which is a measure of real GDP plus inflation. With an aging population requiring medical care, the PBO report says health-care costs will increase significantly as a share of the GDP and the lower levels of government will be forced to foot an increasing share of the bill. "Provinces are responsible for health-care delivery," Melissa Lantsman, a spokeswoman for Finance Minister Joe Oliver, said in an e-mail. "Nevertheless, our government is increasing health funding at a higher rate than provinces are spending it. Record sustainable funding will reach $40-billion annually by the end of the decade." That is about the point when the PBO says the provinces and territories will be in the best financial position, after which, increasing health-care expenditures will force a long, steep slide toward deficits and, by 2034, their budgets will be chronically in the red. Premiers who met this month in St. John's called on the federal government to provide more money for health. Newfoundland Premier Paul Davis said the provinces and territories want Ottawa to increase the Canada Health Transfer to cover at least 25 per cent of their health-care British Columbia Health Minister Terry Lake told The Globe and Mail on Tuesday that the current system, in which the federal money is allotted on a per-capita basis, ignores the fact that some provinces have much older populations than others. "When an older province has higher health-care costs because we have older residents, that should be reflected in the Canada Health Transfer as a population-needs based approach," Mr.Lake said. The PBO report said some other recent federal expenditures should have little negative effect on the bottom line in the years to come. The universal child-care benefit, which was increased in this year's budget and resulted in the delivery of $3-billion in cheques to Canadians this week, will have only a minor impact on fiscal room because the cash transfers are not indexed to inflation, the report said. And, while the increase in the amount Canadians can put in a tax-free savings account will reduce government revenues, the PBO says those declines will be offset by increases elsewhere.The report also says the federal government is on track to eliminate its own net debt over the next 35 years. But, for the provinces, health-care spending will be a problem. Melissa Newitt, the national co-ordinator of the Canadian Health Coalition, an advocacy group for public health care, said the PBO report is more evidence that a new national health accord is needed. That accord, she said, should provide stable funding, set national standards and include a national drug plan and a national seniors plan. Opposition parties have been complaining for four years about the limits the Conservative government imposed on the health-care transfer. Irene Mathyssen, the seniors critic for the New Democrats, said the PBO report confirms that Conservative cuts to health-care spending will put significant pressure on the provinces. If the NDP forms the next government, Ms. Mathyssen said, it will work with the provinces to write a new accord. Hedy Fry, the Liberal health-care critic, agreed with the B.C. Health Minister that demographics should be considered in the health transfers. A Liberal government, she said, would take a collaborative approach with provinces and territories to find ways to maximize efficiencies and keep spending in check. |

Ford unveils new luxury

Michael Wayland, Ford Motor Co. is looking to raise the bar when it comes to the growing, profitable luxury pickup market. The Dearborn automaker on Tuesday announced the return of the F-150 Limited — the most-recent top-end version of its popular full-size pickup. The truck, which the company touts as its "most advanced and luxurious truck ever," features additional chrome exterior features, upgraded leather interior and a host of special "Limited" badging and technology features. "The F-150 Limited sets a new bar for what discerning customers should expect in a high-end truck," said Raj Nair, Ford group vice president, Global Product Development. "We're adding segment-exclusive technology, and features that improve productivity, convenience and capability with distinctive style." The 2016 F-150 Limited is expected to arrive in dealerships this winter. Pricing was not announced, but likely will top $51,585 — the starting price of the top-end F-150 Platinum. Ford first introduced a F-150 Limited model for the 2013 model year. "F-150 Limited surpasses the well-appointed Lariat, the Western-themed King Ranch and contemporary Platinum edition models," Ford said in a release. Industry analysts say the market for high-end pickups in the U.S. hasn't topped-out, even though average transaction price for large pickups, including full-size and heavy-duty models, increased 37.4 percent in the last decade to $42,103 in 2014, according to auto research and pricing website Edmunds.com. Without adjusting for inflation, that's nearly $10,000 more than the industry average last year, $16,500 more than a mid-size car and the highest growth of any mainstream segment in the U.S. since 2004. "I don't think we've hit the ceiling on trucks," said Edmunds.com senior analyst Jessica Caldwell. "The demand keeps growing for more expensive vehicles. There is definitely a status symbol of having the top-of-the-line Silverado or F-150." Pickups, which a decade ago often were no-frills and typically had fewer safety features than SUVs or cars, are now increasingly being used for other purposes as well as for work trucks. These more expensive vehicles are among the highest profit products for Detroit's Big Three automakers. "It isn't something that's a basic mode of transportation anymore," said Caldwell, who expects pickup prices to continue to grow. "It's definitely more of a symbol or statement of how well your business is doing, in the case of small business owners." The F-150 Limited comes months after Fiat Chrysler Automobiles NV announced its redesigned luxury 2015 Ram 1500 Laramie Limited starting at about $51,000. General Motors Co. also has its high-end Chevrolet Silverado High Country and GMC Sierra Denali ,which both start at nearly $50,000. The Limited comes standard with adaptive cruise control, active park assist, 360-degree camera system and remote tailgate release. The pickup also features the automaker's new SYNC3 with AppLink infotainment system and 3.5-liter EcoBoost V6 engine, which produces 365 horsepower and 420 pound-feet of torque. |

Flat Rock plant to steer Lincoln Continental's return

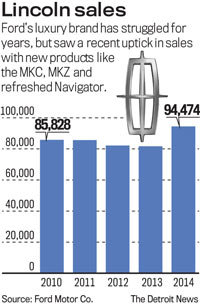

Michael Martinez, Lincoln's new Continental flagship sedan will be built at Ford Motor Co.'s Flat Rock Assembly Plant — good news for auto workers who learned last week that Ford was pulling production of its slow-selling Focus and C-Max from the nearby Michigan Assembly Plant in Wayne. Wednesday's announcement came just days before Ford formally begins contract talks with the United Auto Workers, whose negotiators are seeking assurances that American carmakers will continue building cars, and employing workers, in the U.S. It has been widely speculated by the UAW and others that the Focus could be headed to Mexico. The Dearborn automaker said its top-of-the-line Continental, shown as a concept car at this year's New York Auto Show, will go on sale in 2016 and will be built at the plant alongside its Mustang sports car and Fusion mid-size sedan. Jimmy Settles, vice president of the Ford-UAW Department, said the Flat Rock announcement followed "extensive discussions" between the union and Ford. "It goes without saying that anytime Ford, or any domestic automaker, commits to American manufacturing, it provides a win for our members, the American middle class, and communities all across this country," Settles said. The Continental announcement could be a goodwill offering to the UAW ahead of negotiations aimed at securing a new four-year contract this fall, according to Art Schwartz, president of business management consulting firm Labor and Economics Associates. "Ford just hit them with some bad news," Schwartz said. "Maybe this is a way of saying 'Hey, we're still partners.' Ford and the UAW have had a fairly collaborative relationship." While the new Lincoln will be built and sold in the U.S., its primary target is China, where the full-size sedan market is expected to grow. The Continental will enter a vigorously competitive top-luxury market whose rivals include Cadillac's new flagship sedan, the CT6. Production will begin late this year at General Motors Co.'s Detroit-Hamtramck Assembly Plant. The Flat Rock plant employs more than 3,100. A Ford spokesperson said the company plans to continue producing the Mustang and Fusion in Flat Rock. Stephanie Brinley, senior analyst at IHS Automotive, said the Continental likely will be built on the same platform as the Fusion, Edge, MKX and other vehicles. "It's a very familiar platform for Ford, which should allow them to execute a really strong program," she said. "A near-flawless launch should be possible." IHS expects the Mustang will remain the top-volume product in Flat Rock, while it predicts Ford will produce between 25,000-30,000 Continentals annually. The concept Continental shown in New York is extremely close to the production version planned for 2016. Ford discontinued the Continental name in 2002, and while it hasn't confirmed the production vehicle will use the name, executives have said they're very pleased with the positive reaction it's gotten. The car shown in New York looked dramatically different from any vehicle in the Lincoln lineup and is designed to become the new face of the luxury brand. Gone is the split-wing "bow wave" front grille design that's been around since the 1930s, replaced by a sleeker, cleaner front that emphasizes the Lincoln logo. Ford said the car will be powered by a 3-liter V-6. "The Continental is dramatic," Brinley said. "It does move the design language forward quite a bit and it has the opportunity to make quite a statement." Kelley Blue Book Senior Analyst Karl Brauer said the new Continental represents a significant change for Lincoln, which has struggled to find its footing in a crowded luxury market. "It will help validate Lincoln as a world-class luxury brand, and the plant that produces it enjoys increased prestige and visibility as a result," Brauer said. The Continental will replace the Lincoln MKS, which is made at Ford's Chicago Assembly Plant. Settles said the move will not result in any loss of jobs at the Chicago plant. Lincoln is coming off a year in which sales rose 15.6 percent in the U.S., its best year since 2008. Lincoln sales through the first six months of 2015 are up 5.8 percent to 47,112, mostly due to its Navigator SUV and new MKC crossover. Last year, Ford said it would invest $2.5 billion in Lincoln by 2020, and the brand hopes to triple its volume to 300,000 vehicles by that time. Last November, the brand launched in China with a handful of dealers, and hopes to expand to 60 by the end of 2016. |

|

TORONTO – The United Steelworkers and Crown Holdings have reached a tentative agreement aimed at ending a 22-month strike at a beer can manufacturing plant in Toronto. The tentative agreement was reached Wednesday night with the assistance of the Ontario Labour Relations Board. The proposed contract will be presented to striking workers and submitted to a ratification vote during the weekend of July 18-19. Details of the agreement will not be released prior to the ratification vote. “I commend the members of Steelworkers Local 9176 and their negotiating committee for the incredible solidarity and character they exhibited throughout this prolonged struggle,” said Marty Warren, United Steelworkers Ontario Director. “I thank the Toronto and York Region Labour Council, the Canadian Labour Congress and the many other unions, community groups and residents who provided tremendous financial and moral support to these working families over the last 22 months,” Warren said. ********************************************* After 22 long months, the strike against Crown Holdings is over. It took two long winters of constant picketing, political action, and hard work by the entire labour movement to defeat the company’s intention to bust the union. The members of USW Local 9176 vote this weekend on a new contract. Only one person crossed the picket line during the entire strike. The workers’ courage through this whole time was absolutely inspiring. Marty Warren, Director of USW District 6 thanked the Labour Council and the many unions that provided support for the strikers. Together we helped keep up the pressure on the government to bring closure to this long dispute.

|

Harper government tries to Federal Finance Minister Joe Oliver says Ottawa won't provide administrative support for retirement scheme. Robert Benzie With an election looming, the federal Conservatives have fired a salvo at Ontario's Liberal government in a bid to derail Premier Kathleen Wynne's new provincial pension plan. In a letter leaked to the media before it was sent to Queen's Park, federal Finance Minister Joe Oliver said Ottawa won't provide administrative support for the retirement scheme because the Tories disagree with it. Ontario's proposed pension plan would "take money from workers and their families, kill jobs and damage the economy," Oliver, a Toronto MP, wrote with an eye toward the Oct. 19 election. "For these reasons, we will not assist the Ontario government in the implementation of the ORPP," he said, referring to the Ontario Retirement Pension Plan, Wynne's cornerstone election promise in the June 2014 campaign. "Administration of the ORPP will be the sole responsibility of the Ontario government, including the collection of contributions and any required information." Ontario Finance Minister Charles Sousa said it was "incredibly disappointing that the federal government is refusing to recognize the need for people to achieve a secure retirement future." "The ORPP is a central part of our government's platform that is supported by a majority mandate from Ontarians," Sousa said in a statement Thursday. "Our proposal to use existing infrastructure would have ensured cost-effective delivery of the ORPP, while minimizing compliance costs for employers," he said, noting the Tories' roadblock will cost the public money. "Like other arrangements between the federal and provincial governments, our expectation was to enter into a service agreement with the CRA or Service Canada — something that would have tremendous advantages for businesses, and employees," Sousa said. "As well, Ontario offered to compensate the federal government for any additional costs through a fee-for-service agreement," he said. "The federal government's refusal to work with Ontario puts politics ahead of practicality. It is especially disappointing given that co-operation would have resulted in lower costs to business." Sousa stressed the ORPP is "moving forward" regardless of Ottawa's brinkmanship. Wynne pitched the Ontario scheme because Prime Minister Stephen Harper refused to beef up the Canada Pension Plan, which pays out a maximum benefit of little more than $12,000 annually. |

Software firm suing Ford Michael Martinez, Southfield — An attorney for Texas-based software company Versata — which is suing Ford Motor Co. for more than a billion dollars for allegedly stealing trade secrets — said at a press event Thursday his client plans to take the case to trial and win. "We intend to prove that our software and our design was stolen, stolen through deceitful activities, and that now we're watching a coverup unfold," said Lanny Davis, attorney for the software company. The software in question can gather every possible configuration of an automobile — engine sizes, optional features, etc. — and determine which ones would be unfeasible (for example, a car with a sunroof couldn't including rear air conditioning ducts on the roof). Versata says it's invested about $300 million to develop the technology and that it saves Ford significant time and money. Ford began working on its own software in 2010, Versata says. Versata alleges that at a meeting in December 2014 in which it believed its contract with Ford would be extended, Ford told Versata it would terminate the contract since it had developed its own version of the software. Versata alleges between 10-15 Ford employees who worked on its new technology also knew of and worked with Versata. "We clearly have discovered numerous bad deeds that we believe warrant illumination," Mike Richards, president of Versata, told reporters Thursday. "I'm completely baffled by what we've observed." The automaker issued a statement saying: "Ford's patented software does not use or infringe any Versata intellectual property and Versata has provided no basis for their claims against us. We are confident that we will ultimately prevail in this case and we look forward to the opportunity to present our evidence at trial." Versata has worked with Ford on the technology for 15 years and currently works with FordDirect and Ford's information technology department, but Richards says this lawsuit is likely to sour its relationship and hurt its business with the automaker. Versata also works with other automakers. Versata in May filed a lawsuit against Ford in Texas and issued an injunction requesting Ford to immediately stop using the software in question. Ford is requesting a trial in Michigan. Verstata expects a decision on where the trial will be held within the next few months. |

Home care for Ontario ELIZABETH CHURCH Ontario's home-care system is changing how it delivers care to some clients, a move that will see an array of non-profit agencies take responsibility for services to tens of thousands of seniors who rely on regular support to remain in their homes. The change to how some personal support is delivered in Canada's largest province is the latest response from a cash-strapped public system that is being asked to deliver the kind of medical care in the community that was once reserved for the hospital ward. As the needs of home-care clients become more complex, those who rely on help with bathing or with medications and meals – the very people who once made up the bulk of those receiving home care – are being squeezed out by provincial agencies struggling to balance their budgets. Supporters of the switch say it will free up staff at the province's 14 Community Care Access Centres (CCACs) – the local government agencies that co-ordinate home care in Ontario – to focus their attention on higher needs clients, while making the most of non-profit community organizations such as the March of Dimes. The shift makes better use of medical expertise and limited financial resources, they say, similar to pharmacists giving flu shots rather than doctors. "This is just putting the client where the client should be," said Deborah Simon, the chief executive officer of the Ontario Community Support Association, which represents hundreds of non-profit agencies. "Our organization has lobbied for years that we can do this." Critics say the new policy introduces another layer of complexity to a provincial system that has long been criticized as overly bureaucratic and difficult to navigate. In practical terms, it means many seniors will face a choice between changing the person who comes into their homes each week, often to help with intimate tasks such as bathing, or paying out of pocket to keep their care provider. In a three-month investigation, The Globe and Mail talked to dozens of previous and current patients as well as front-line staff, community groups, unions, for-profit and non-profit home-care providers and industry organizations, and found that Ontario's home-care system is plagued by inconsistent standards of care, byzantine processes and a troubling lack of transparency. The Globe also found that, in an effort to save money, some CCACs have been handing off lower-needs clients to the non-profit sector in an ad hoc fashion for years, long before last summer's regulatory change. Trudie Davies was told in the fall of 2012 that her weekly services would be cut from two CCAC-funded baths to one at her apartment in Oakville, Ont. The arthritis-wracked widow, now 83, was offered a second weekly bath from a local non-profit organization called Links2Care. Reluctant to invite a new worker into her home, Ms. Davies, with the help of her son, Glen Davies, appealed the cut to a quasi-judicial panel called the Health Services Appeal and Review Board. The family agreed to drop the appeal in the spring of 2013 when the Mississauga Halton CCAC allowed Ms. Davies to keep her two CCAC-funded weekly appointments because, by that time, Links2Care had a waiting list and could not provide help to Ms. Davies. In the course of the abandoned appeal, Mr. Davies obtained an Oct. 1, 2012, internal memo from the CCAC's then-vice-president of client services that described how "financial pressures" were forcing the agency to direct lower-needs clients to non-profit agencies. Despite that policy being in place for two years, the memo's author noted that nearly 700 mild-needs clients who remained on the organization's roster still had to be "navigated" out of the CCAC system and into the non-profit sector. This spring, the CCAC cut Ms. Davies's weekly baths from two to one. Mr. Davies, certain another appeal would be futile, agreed to pay out of pocket for the second weekly visit of his mother's long-time caregiver. "What's so disturbing about all this is I don't know what vulnerable people do who don't have someone to advocate for them. The bureaucracy is impenetrable," Mr. Davies said. The local CCAC said that "for many patients, receiving care from a local community-based agency works well." Reducing Ms. Davies's services to one bath a week is "consistent with our CCAC's service guidelines," a spokeswoman said by e-mail, adding that Ms. Davies was given six weeks to adjust to the change and allowed to keep the caregiver with whom she had formed a close bond. Sherry Kerr heads up Participation House, a small non-profit agency in Brantford, Ont., that was asked last fall to take part in the recent changes enabled by last year's regulations. Her agency has hired and trained staff and is expecting to more than double its caseload with the arrival of as many as 120 new clients. The transition has not been as straightforward as first expected, and the agency has responded by building in extra time to each transfer so that elderly clients have a chance to adjust and say goodbye to care providers who have been in their homes for five or six years. "At first, as a team we thought we would do it quickly, but we didn't understand the number of people who have had the same caregiver for so long," Ms. Kerr said. So far, two clients have refused to make the change, she said. Under the existing system, a dollar marked for home care by Ontario's Ministry of Health and Long-Term Care must pass through one of 14 Local Health Integration Networks, or LHINs, which then send it to the corresponding CCAC for the region. That dollar is then passed on to the contracted care provider, which actually delivers the service. Until the change, local CCACs alone were responsible for assessing clients and case management, as well as contracting out care to third-party service providers. Now, the province's 14 LHINs can directly send money to community support service organizations, such as Participation House, to provide personal support in the home, freeing up the CCAC to focus on higher needs clients. Ontario's home-care system is already criticized as highly fragmented, and switching over the care for stable clients with low or moderate care needs has the potential to add even more groups to the mix. Who manages waiting lists, what to do with clients as their needs increase, and how best to keep track of those in the system are all issues that will need to be tackled. The provincial government, for its part, envisions a seamless system – whether care is managed by a local CCAC, as it has been in the past, or a community non-profit that will now receive provincial dollars to deliver home care. "There is no 'wrong door' to go through for clients to receive information or to access one or more home and community services," states a provincial policy document explaining the 2014 regulation change. Stacy Daub, CEO of Toronto Central CCAC, argues adding more entry points to the system increases complexity. "This idea of 'no wrong door' has made the system more difficult," she said in an interview. "Why do we need a million doors?" One early attempt to shift clients to community-care agencies that was later abandoned shows just what can go wrong. Last fall, the Champlain CCAC, which oversees home care in the Ottawa area, attempted to move individuals identified as stable and having mild to moderate needs over to seven local non-profit agencies as a way to address a funding shortfall. After that effort was stopped, a follow-up survey found that just 17 per cent of those identified to make the switch did so. Another 62 per cent turned to friends and family for help and 21 per cent purchased care. Chantale LeClerc, chief executive officer of the Champlain LHIN, stresses that all clients were given the option of moving, even if they did not. "I think it was successful to some degree in the sense that many people did decide to move to the community sector," she said. At Mills Community Support in Lanark County, west of Ottawa, Clem Pelot, the director of community supports and services, says he has no idea what happened to seven of the nine clients they were expecting to get. "We were gearing up to hire staff, do new scheduling, but they never came," he said. Only two made the switch from the CCAC's care, and his organization had to give back to the LHIN the funds it had received to care for the other seven. In the Hamilton area, the local LHIN has earmarked $4-million this year for seven non-profit agencies to provide personal support services. Those groups range from large national organizations such as March of Dimes to local non-profits such as Brantford's Participation House. Officials stress that there is no turning back. From now on, this is the way home care will be delivered, they say, so that CCAC case managers can focus on servicing higher needs patients who would otherwise occupy expensive hospital and long-term care beds. "We don't see it as another layer," said Rosalind Tarrant, director of access to care for the Hamilton, Niagara, Haldimand, Brant LHIN. "We are working together as one sector." |

Ford fixing Edge crossovers Michael Martinez, Ford Motor Co. on Tuesday said it's attempting to fix about 29,000 2015 Edge crossovers due to the possibility of water entering the cabin. The Dearborn automaker has not issued a formal recall, but has notified about 19,000 customers with vehicles built at its Oakville Assembly Plant in Canada prior to April 28. Dealers have been notified to inspect and fix an additional 10,000 vehicles still on lots before they sell them. Water could seep through a body seam in the cabin, and dealers can fix the issue by sealing the seam. Ford said the issue could take about a day to fix, but would take more time if the vehicle has gotten wet. The Edge went on sale in March. |

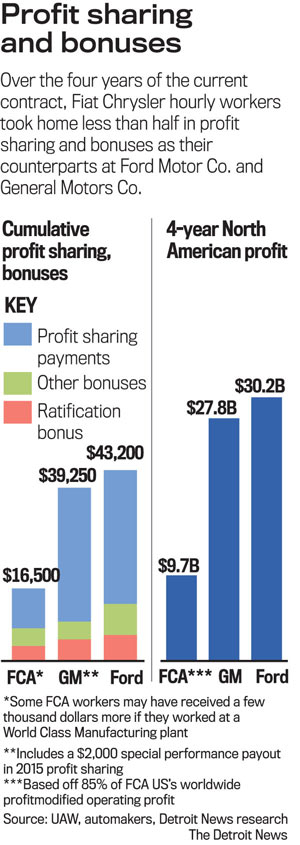

Good times, big expectations Daniel Howes, Profitability, smiles and handshakes guarantee nothing. As the United Auto Workers and the Detroit automakers this week formally open national contract talks, the rite aiming to manage prosperity with optimism also carries seeds of potential confrontation. You want evidence that pieces of Old Detroit still exist in the post-meltdown model? This is it. Instead of ensuring some measure of stability and good times, fat U.S. profits are challenging a status quo forged from restructuring, bailouts and labor-management cooperation imposed by the federal government. UAW President Dennis Williams is right: This won't be easy. First, less than two weeks before talks begin, Ford Motor Co. confirms it will end production of Focus compacts and C-Max hybrids at its Wayne Assembly plant in 2018. Unless and until a new product line is assigned to the union shop in Wayne, the most likely beneficiary will be Ford's operations in Mexico. In the UAW lexicon, "made in Mexico" remain fighting words. Eight years of retrenchment and reinvestment in Michigan (thanks, in part, to massive tax incentives extended in the waning days of the Granholm administration) look to be imperiled by a) the de facto end to the the state incentives and b) the press to more closely align profit margins with labor costs. Eight years after former CEO Alan Mulally agreed to build compact cars in Wayne in exchange for a competitive labor agreement, Ford clearly is moving to build smaller-margin products in lower-cost markets like Mexico and reserve higher-margin products for sites closer to home. The implication is clear: Company bargainers are prepared to use their Mexican operations as leverage to exert downward pressure on a labor-cost gap they know they cannot close in a single contract. But they want to show progress. Second, Fiat Chrysler Automobiles NV CEO Sergio Marchionne continues to press his case for a merger with General Motors Co., irrespective of GM's flat rejection of the idea. Any such transaction would have profound implications for Metro Detroit and the union, whose support would be necessary to consummating any deal. The merger pot-stirring adds a layer of complexity to the contract talks, presumably because Marchionne likely would tie investment commitments and substantial movement in second-tier wage rates to union support for a possible play for GM. Third, a GM led by CEO Mary Barra seems determined to wear the white hat in these negotiations. At Monday's "handshake" marking the official start to bargaining, she said GM would "truly listen" to the UAW. GM sweetened profit-sharing checks earlier this year; continues to announce reinvestments in U.S. plants; confirmed that the automaker has "no plans" to abandon its small-car project at its Lake Orion facility. How all of this good cheer will affect negotiations, if at all, remains to be seen. GM clearly is opening talks on a positive note, even as Marchionne is likely to work his longstanding relationship with Williams and Ford is likely to rely on its seasoned executive team and its deep ties to UAW-Ford Vice President Jimmy Settles. Fourth, UAW members don't just want base-wage increases; they expect them. Sweetening profit-sharing formulas or enriching signing and lump-sum bonuses are not likely to be sufficient to ensure ratification — not when the three companies have booked North American profits totaling $67.7 billion during the four years of the existing contract. That combined number will get even larger when the companies release their second-quarter financials in the coming weeks. As symbols, facts and the dynamics of national bargaining go, profits like that in the United States — the only market that matters when it comes to UAW compensation — cannot be overlooked. Fifth, health-care costs continue to grow at alarming speed, increasing the likelihood that company bargainers will push for union members to pay a higher percentage of their annual health care costs. Doesn't much matter that white-collar salaried employees at all three companies already do. Cadillac-style health care is a core expectation among the rank-and-file. A push to increase deductibles, or boost premium-sharing, in anything beyond token amounts would be fiercely resisted, especially at a time of fat profits and an expanding market. This is new territory for Detroit's automakers and their major union. Six years after the global financial meltdown pushed the industry to the brink of collapse, prosperity is back. Managing it is tough. |

Health care costs key Melissa Burden and Automaker spending on health care for hourly workers and their families likely will top $2 billion this year. In just the past four years, it's grown 45 percent for Ford Motor Co. and 77 percent for Fiat Chrysler Automobiles US. The United Auto Workers has been resistant to giving up the gold-plated health care coverage it has for more than 135,000 hourly workers. But with surging costs, Detroit automakers are looking for relief in contract negotiations that officially kick off Monday between General Motors Co. and the UAW. UAW hourly workers enjoy some of the best health care benefits in the country: There are virtually no premiums or deductibles and minimal co-pays for doctor visits and prescriptions. Two-tier workers have higher deductibles. That comes at a high cost. Ford says its health care cost for hourly employees is about $800 million this year — up from $550 million in 2011. FCA says it will pay $615 million this year, compared to $347 million it spent in 2011. GM reportedly spent $665 million on health care for hourly employees and families in 2011. The automaker would not say what its current spending is, but said its increases are "on par" with Ford and FCA. Health care is a "go to war issue" for the UAW as it seeks to maintain or expand benefits without adding more cost-sharing, said Kristin Dziczek, director of the Industry & Labor Group with the Center for Automotive Research. But the automakers see it differently, Dziczek said during a recent event in Detroit. "They need to cut the cost of their single most expensive benefit, and they think that people who have skin in the game make different decisions about their health care," she said. "They're going to push for some cost-share," she added. "And that's going to be a hard fight." Health care costs are not the only top issues the UAW and automakers will hash out over the next few months ahead of the current contract expiring Sept. 14. Others include pay raises for tier-one workers who haven't had one in a decade; bridging the pay gap between tier-one and tier-two workers; and securing product commitments for U.S. plants instead of Mexico. Labor experts say challenges to the UAW's health care coverage could be a strikeable issue. GM and FCA workers have the ability to strike for the first time since the 2007 talks; the UAW gave up that right for the 2011 talks as a condition of GM and Chrysler's government bailouts. "I doubt if it's untouchable; we're not the only ones putting demands on the table," Jimmy Settles, vice president of the UAW-Ford department, said about health care in a recent interview. "There's always ways to do things better." UAW President Dennis Williams last month told reporters he is considering creating a pool for active workers to help reduce overall health care costs, similar to the program it has for retirees. "The more people that pool together in this health care system, the more leverage you have against institutions such as hospitals, clinics and insurance companies, and that's the focus right now," Williams said. "The fact of the matter is health care is very important to corporations, as it is to our members. The healthier the employee, the more productive the employee is." Beginning in 2018, Detroit automakers will be on the hook for the so-called Cadillac tax, a 40 percent excise tax on company-sponsored health plans as part of the Affordable Care Act. Employers will be taxed on health coverage that costs more than $10,200 for individuals or $27,500 for a family. FCA said its average health care cost for a tier-one employee is $18,000 a year and is less for entry-level workers, though FCA expects new hires will cost just as much in the future. Currently, FCA hourly workers pay about 6 percent of costs; that compares to FCA salaried employees who pay about a third. Ford spends an average of $15,000 on each hourly employee per year for health care. Ford hourly workers pay between 5 percent and 10 percent of their total costs, the company said. The average person in the United States pays nearly 29 percent of their health care costs a year, or $4,823, according to a Kaiser Family Foundation survey. It found premiums for company-sponsored health coverage hit $16,834 last year. "We look forward to discussing many different options with our UAW partners that will allow us to have a fair and competitive labor agreement, and to provide jobs and investment here in the U.S.," Ford said in a statement. An FCA spokeswoman declined to comment on whether FCA hopes to have hourly workers pick up a bigger share of costs. A GM spokesman said in a statement, "Health care cost is one element of doing business that continues to grow for all employers. We're committed to working with our UAW partners to continue delivering benefits our employees value, while improving the long-term competitiveness of the company." The UAW VEBA (Voluntary Employee Beneficiary Association) is a health care trust used by Detroit's Big Three automakers to fund health care for about 750,000 UAW hourly worker retirees and dependents. The trust, created as part of UAW talks with carmakers in 2007, reduced the companies' labor cost by about $15 an hour, according to Labor and Economic Associates. Ultimately, Dziczek said she thinks the automakers and UAW will agree to put active employees into a pool like they've done with retirees in the VEBA — or possibly use the VEBA. "Your health care costs don't come from a little bit from everybody. There's a little bit from everybody, and there's a few people who are very costly to manage," Dziczek said. "And if you help those folks, make sure they take their medications, make sure they see their doctors, make sure their doctors are talking to each other, you end up with less hospitalizations and less chronic disease and problems that cost a lot of money. |

Top 7 issues in UAW negotiations Melissa Burden, Bargaining talks between automakers and the United Auto Workers officially begin in the coming days as they seek to negotiate a four-year contract for more than 135,000 hourly workers at General Motors Co., Ford Motor Co. and Fiat Chrysler Automobiles US. GM CEO Mary Barra, UAW President Dennis Williams and other company and union leaders will meet at 11 a.m. Monday at the UAW-GM Center for Human Resources in Detroit to officially kick off negotiations. Fiat Chrysler Automobiles and the UAW meet Tuesday, and Ford and the UAW will kick off bargaining July 23. The union's current contract expires Sept. 14. Top issues for the union and automakers are: ■Pay increases for veteran tier-one employees: Veteran hourly workers have not had a wage increase in as long as a decade and securing a base wage increase is among key goals for the union. Automakers, if they agree to it, may try to keep the raise low enough that hourly wages remain less than $30 an hour. ■Bridging the pay gap between tier-one and tier-two employees: The UAW wants to bridge the gap between tier-one workers, who earn more than $28 an hour, and more recently hired tier-two workers, who can earn up to $19.28 for doing the same work. FCA employs the most entry-level workers — estimated at more than 40 percent — while GM has less than 20 percent and Ford is at about 28 percent. ■Capping percentages of two-tier workers: Companies would like to keep and expand use of tier-two workers, agreed to in the 2007 contract, because it helps lower labor costs. They've hired thousands of new workers because of it. But many in the union want to end the two-tier system. It's possible caps would be set for percentages of entry-level workers at FCA and GM (unlike Ford, they don't have caps on the percentage of tier-two workers now). Or the companies and union could agree to do away with the two-tier over several years. ■Securing vehicle commitments for U.S. plants: Last week, the UAW said the Ford Focus will shift small car production from the Michigan Assembly factory in Wayne after 2018 to a plant outside the United States. Lower wages, an improved workforce and free trade agreements entice automakers to move or add work in Mexico. The union wants to secure new jobs in the U.S. and as many vehicle commitments to U.S. plants as possible. ■Profit sharing: The union wants to continue the benefit, which has poured thousands of dollars into workers' pockets as companies have turned profits. The automakers generally are on board with continuing the practice because they only pay it in good times. ■Controlling health care costs: Automakers have seen huge spikes in annual health care costs for hourly workers who enjoy some of the best benefits in the country. They are hoping workers will pick up more of the cost. Williams said he is considering a health care pool to help control costs. ■Reducing overall labor costs: Automakers, particularly Ford and GM, want to shave as much off their hourly labor costs (which are higher than FCA and Japanese automakers) as possible. The Center for Automotive Research says average hourly labor costs — including benefits — are $58 an hour at GM, $57 at Ford and $48 at FCA. Honda Motor Co. in the U.S. has a cost of $49 an hour, followed by Toyota Motor Corp. at $48. |

Fiat Chrysler CEO fires GREG KEENAN Ontario risks reducing its competitive position in the auto industry even further with policies such as a provincial pension plan and a cap-and-trade system for pollutants, Sergio Marchionne, chief executive officer of Fiat Chrysler Automobiles says. "These are all things that add cost to the running of an operation," Mr. Marchionne told reporters Friday after speaking at a conference in Toronto. He made his comments after sitting beside Ontario Premier Kathleen Wynne during the conference luncheon. "This is not what I would call the cheapest jurisdiction in which to produce," he added during a question-and-answer session after the luncheon. His comments come as Ms. Wynne's government and the federal government seek to land new automotive investment – and retain existing assembly plants – amid a flood of new spending by auto makers in Mexico. The governments recently appointed former Toyota Motor Manufacturing Canada Inc. chairman Ray Tanguay as a special adviser on the auto sector to come up with ideas to help Ontario attract new automotive investment. One of the actions Ontario could take, Mr. Marchionne said, is to create a mini Silicon Valley to develop ideas and startup companies that could develop new technologies. "Let the kids run," he said. "Give them the toys and let them play." Fiat Chrysler Automobiles NV operates two vehicle assembly plants in Canada, one of which was the recent recipient of about $2.6-billion in new investment to build a new generation of minivans, one of the products that has generated billions of dollars in profit for Chrysler's North American operations since the early 1980s. Mr. Marchionne noted that the Windsor plant can produce close to 400,000 vehicles annually and if there's $1,000 of costs built into those minivans that isn't found in other jurisdictions, then they're not competitive. "It's a very large number," he noted. "It will drastically change your ability to retain capital." The costs to FCA Canada of the cap and trade system and the potential addition of another pension plan aren't known yet, Mr. Marchionne said, but he pointed out that it makes little sense to add another pension system to the existing defined benefit plan that already exists for unionized workers represented by Unifor at the company's manufacturing plants in Ontario. Ms. Wynne was "incredibly responsive," Mr. Marchionne said. "I think we had confirmation that the argument is not falling on deaf ears." What has so far fallen on deaf ears is a plea the Italian-Canadian executive made in April for the auto industry to consolidate in part to help reduce the cost of new environmental technologies and provide a decent return on capital to investors. FCA has approached General Motors Co. and other unnamed auto makers and received several rejections of proposals – at least in public. A combination of FCA and GM makes the most sense, Mr. Marchionne said Friday, noting that he outlined his proposal in a three-page letter to GM CEO Mary Barra, who has said the GM board of directors considered the idea but declined. Those two companies combined would generate the highest level of savings of any of the combinations FCA officials examined, he said. The auto industry's destruction of capital is one reason why such technology giants as Apple Inc. and Google Inc. likely won't make their own vehicles, he said. "Don't overestimate Google's interest, he said. "These are very smart people."

|

Ford's Wayne plant cuts vault Michael Martinez, Ford Motor Co.'s decision to end production of two slow-selling models at its Michigan Assembly plant in Wayne, confirmed Thursday, signals the critical role Mexico is likely to play in high-stakes wrangling with the United Auto Workers. The Dearborn automaker said it was reviewing "several possible options" for production of the slow-selling Focus compact and C-Max hybrids, which would end in Wayne in 2018. But in a bulletin handed out to UAW members at the plant, Local 900 Chairman Bill Johnson said production of the Focus would move "to a location outside of the United States," most likely Mexico. The move comes days before Ford, and its crosstown rivals, are set to begin national contract talks with the UAW. A key issue for Ford, as well as General Motors Co., will be closing their all-in labor cost gap, executives say, and one of the leverage points in bargaining and contract ratification is expected to be the real threat of moving some production to Mexico. Ford and GM both are investing heavily in their Mexican operations, partly to exert pressure on the UAW to hold the line on labor costs and partly to take advantage of lower wages and more favorable trade agreements. In April, Ford said it would invest $2.5 billion in Mexico for two engine and transmission plants, creating 3,800 jobs. "I think Ford has a trump card in their hand as they walk into negotiations," said Dave Sullivan, manager of product analysis with AutoPacific Inc. "It sends a message that now the UAW has to negotiate for jobs and (Ford) can close a plant and move it to another, lower-cost facility." Ford said in an emailed statement it is "actively pursuing future vehicle alternatives to produce at Michigan Assembly and will discuss this issue with UAW leadership" as part of contract bargaining. The company declined to elaborate. Jimmy Settles, vice president of the UAW-Ford Department, said in a statement that the union is "extremely confident that a new product commitment will be secured during the upcoming 2015 negotiations and that the Michigan Assembly Plant will maintain a full production schedule." The 5-million-square-foot plant employs about 4,700, according to Ford's website. In April, Ford said it would cut a shift at Michigan Assembly amid slumping sales for small cars, electrics and hybrids. The Dearborn automaker started to indefinitely lay off 673 hourly employees and 27 salaried employees on the "C Crew" at the plant June 22. Michigan Assembly got new life after the industry meltdown in 2008-09, a result of former CEO Alan Mulally's pledge to the UAW to bring new production to Wayne in exchange for a competitive labor agreement. Under terms of a $5.9 billion loan from the Energy Department, Michigan Assembly received a $550 million overhaul. Its 4,700-member workforce builds the Focus, Focus Electric, Focus ST, C-Max Hybrid and C-Max Energi. As part of that investment, Ford was awarded a $123 million state tax credit for the facility, in addition to $15.3 million from the city of Wayne, a $30 million brownfield tax credit and a $6.4 million state and local tax capture. In 2010, Ford was awarded a $10 million brownfield tax credit to redevelop the Wayne Stamping Plant, which is part of the facility. It worked, for a while. But comparatively low gas prices and booming demand for larger crossover vehicles are taking their toll. Sales of the Focus are down 3.2 percent so far this year; C-Max Hybrid sales are down 16.9 percent. "That's just the nature of the market right now," said Michelle Krebs, senior analyst with Autotrader.com. "The American car buyer doesn't really want cars, they want crossovers and sport utilities." A new model of the Focus is expected to come out in 2018, according to a recently published "Car Wars" report by Bank of America Merrill Lynch analyst John Murphy. He expects a new C-Max in 2019. The Focus is also built in China, Argentina, Germany, Russia, Thailand, Vietnam and Taiwan for overseas markets. The C-Max is also built in Germany. Until 2005, the Focus hatchback was made at Ford's assembly plant in Hermosillo, Mexico. In January, President Barack Obama came to the plant to tout the resurgent American automotive industry, even as the plant was closed that week because of lagging demand for its small gasoline-powered and hybrid cars. Ford made the decision to close the plant to reduce the supply of small cars before the White House approached the company about holding the event. Securing vehicles for specific plants will be among top goals for the UAW during upcoming talks, said Kristin Dziczek, director of the Industry & Labor Group for the Center for Automotive Research, during a CAR event last month in Detroit. She said Mexico is the biggest competitor now for UAW work. "The job security is now product-based," she said. "They're going to want to see product commitments and investment commitments, business case dependent as they always are. I think we'll be looking at some more product plans coming out in the negotiations this fall." In contrast to Ford's Wayne announcement, GM has spent the past few months announcing plans to invest $5.4 billion in U.S. plants over three years, creating 650 new jobs. GM, which builds the only subcompact in the U.S., the Chevrolet Sonic, recently announced about $400 million in investment at its Orion Assembly Plant in Orion Township for two new products: the Chevrolet Bolt all-electric car and another new GM vehicle. City officials from Wayne spoke with Ford on Thursday, said Peter J. McInerney, the city's Community Development director. He said the city did not have an immediate comment, given the issue will be negotiated. Ford's Wayne plant is the largest employer in the city of more than 19,000. Other big employers include Wayne-Westland Community Schools and Oakwood Hospital Wayne. A closure of the plant would hurt the city's tax revenue and employment base, among other issues. U.S. Rep. Debbie Dingell, D-Dearborn, said she was upset by Ford's decision to shift small-car production out of Michigan — and suggested it could be moving out of the country in part because of Congress' failure to address currency manipulation. She said until Congress acts on currency manipulation, "we're going to start seeing more jobs going to Mexico." Profit margins on compact vehicles is small, and she said Ford told her "they've got to make decisions based on where the profit is. We can't afford to have our small-car production and the jobs it creates going overseas." |

Is 'New Detroit' touted Daniel Howes, Ever since two of Detroit's three automakers emerged from bankruptcy six years ago, this town's eponymous auto industry has been trumpeting its model of new. It's newly profitable at home, thanks to tough restructuring requiring shared sacrifice. Its metal is newly designed and desirable. Its relationship with organized labor is newly pragmatic and cooperative, alleged evidence of enlightened management and union leadership. After decades of "going out of business," as former Ford Motor Co. CEO Alan Mulally often said, Detroit automakers and the United Auto Workers are running according to normal business principles, hewing to the basic laws of economics. Gone for good is the peculiar Detroit version skilled at destroying enormous amounts of capital, right? Starting next week, both sides get the opportunity to show just how new that New Detroit really is. For the first time since 2007, national contract talks will take place without the specter of imminent financial collapse or the bullying of a federal government protecting its taxpayer-funded bailout and driving its environmental agenda. The stakes could be higher, like they were in 2008 and 2009, but the symbolism could not be. Investors and bureaucrats, customers and employees, will be looking for evidence that the bad, old days really are dead and buried. Or whether they aren't, precursors to more pain in the next downturn. Proof will be in what both sides do in bargaining between now and mid-September, not increasingly heated rhetoric as the deadline nears, union members grow anxious and some take to social media in ways they could not during the '07 talks and before. If there's a wild card in this year's talks, its the power of Facebook and Twitter to turn rumor into fact. In seconds, as UAW leaders have repeatedly warned their own bargaining teams, old information and discarded proposals overheard at the dinner table or in a union local office can be spread by anyone with a smartphone, an iPad and the urge to emote. Expect that to fuel more than a few media frenzies over the next few months. A process shaped for decades by strategic leaks from both sides, a solid understanding of the industry and old-fashioned relationship building will be forced to contend with information flows it cannot easily control. There are other risks and potential flashpoints as both sides encounter something else entirely new: managing prosperity, not decades of decline, in their home market. A welcome change, that, but it will not be easy to meet the expectations of various constituencies, chiefly UAW members and Wall Street. Looming will be unresolved product allocation decisions for key plants, such as Ford's Michigan Assembly in Wayne and Chrysler's trademark Wrangler plant in Toledo; the threat of investment in Mexico as bargaining leverage over sites in the States; and global instability in places like Europe and China that could alter expectations for the booming U.S. market. Success carries its own cost. Even as Ford, General Motors Co. and FCA US LLC's Chrysler unit booked a combined $67.7 billion during the life of the four-year contract expiring in September — an enormous total, considering the troubled arc of the past 15 years — GM and Ford, in particular, still lag the all-in labor costs of FCA and their Japanese rivals. The tension: GM and Ford need to make progress on closing the cost gap, even as UAW bargainers will be pushing to "bridge the gap" between the hourly rate earned by so-called legacy employees and second-tier employees who get substantially less pay for doing the same jobs. Something will have to give, and the smart money is on the automakers recognizing that they cannot expect new, four-year deals to be ratified without base-wage increases — most likely different percentage increases — for both groups of workers. None of this will happen in a vacuum. Despite the positive change of the past six years, despite the profits and product plaudits, Detroit's two largest players enter the talks trailing most of the industry in all-in labor costs. FCA CEO Sergio Marchionne and his boss, FCA Chairman John Elkann, are openly lobbying for a partner to help them navigate a fraught future. The UAW, under President Dennis Williams and a mostly new crew of vice presidents, faces a delicate balance. They aim for a bigger chunk of profits for their members without a confrontation that would sully a carefully cultivated image as a "mature" labor union, as one insider said, and would complicate efforts to organize auto plants in the South. This is a test of a New Detroit. Here, the actions of management and labor should demonstrate an understanding that hyper-competition is a fact of life to be continually managed — and never ignored. |

Ford's China sales fall Michael Martinez, Ford Motor Co. on Wednesday said its sales in China fell 3percent last month compared to the same month last year as demand continues to cool there. The Dearborn automaker said it sold 83,506 vehicles in China last month, and has sold 543,488 vehicles there through the first half of the year, spurred by the sale of new models like the Kuga. Ford said its China sales are flat through the first half of the year. "Our sales for the first half of the year were steady in a weakening industry," John Lawler, chairman and CEO of Ford Motor China, said in a statement. "We expect to see a stronger second half as new products we've been launching continue to build momentum and as we launch additional products, including the new Ford Taurus, which has been uniquely designed to cater to the needs and demands of Chinese consumers. We are pleased that China's discerning car buyers continue to choose Ford and we are committed to bringing them Ford's high-quality, safe, smart and fuel-efficient global portfolio of vehicles." Changan Ford Automobiles, Ford's passenger joint car venture, sold 394,987 vehicles through the first six months of 2015. Its June sales were down 3 percent to 61,979 vehicles. Jiangling Motors Corporation, Ford's commercial vehicle partner, said sales through the first half of the year were up 3 percent to 133,654. Its June sales were down 5 percent to 19,016. Ford's sales in China were led by performance models. First-half sales of its Fiesta ST, Focus ST and Mustang increased 120 percent to 1,263 vehicles. SUV sales, including the EcoSport, Kuga, Edge and Explorer, reached 118,719 vehicles through the halfway mark of the year. Ford's second half new vehicle introductions include the new Taurus, Everest, Explorer, Focus and Focus ST. General Motors Co. said earlier this week its China sales fell 0.4 percent in June, but sales are up 4.4 percent through the first half of the year. Citi Research analyst Itay Michaeli said Wednesday in an investor note that U.S. auto stocks were underperforming because of concerns in China, including weak June sales numbers and the stock market sell-off happening there. Ford shares closed Wednesday down 3.23 percent to $14.37 a share. GM shares closed Wednesday down 5.08 percent to $31.19, nearly two dollars below its initial public offering prices of $33 a share. |

NDP viewed as clearest alternative

DANIEL LEBLANC The NDP is seen as the party that offers the best-defined alternative to the Conservative government before an election in which Canadians will be asked to choose between political stability and renewal, a Globe and Mail/Nanos Research poll has found. Fifty-two per cent of respondents said the NDP "represents the clearest change from the current Stephen Harper government." The Liberal Party was far behind at 19 per cent, with the Green Party at 10 per cent. Change – and who can best deliver it – will be an essential issue in the Oct. 19 election, with Prime Minister Stephen Harper countering that voters should opt for stability. Both the New Democrats and the Liberal Party are positioning themselves as agents of change after 10 years of Conservative rule, but the findings suggest the Liberals have failed to differentiate themselves clearly from the Harper government to this point. The poll also shows the NDP is nearly tied with the Liberal Party on economic issues. Asked to name the opposition party that they "trust most on matters related to the Canadian economy," 30 per cent of respondents named the Liberal Party, and 27 per cent opted for the NDP. (Thirty per cent said none of the opposition parties had earned their trust on economic issues.) Confirming that Canada is headed for a three-way contest, the poll found a tight race to be the party with the "most appealing" policy platform. The NDP came in first at 28 per cent, followed by the Conservatives at 27 per cent and the Liberals at 25 per cent. Pollster Nik Nanos said the NDP has staked out the clearest policy positions in opposition to the Conservative Party, while the Liberals have a more nuanced approach. "The NDP and Tom Mulcair have been able to fashion themselves as the party of clear change," Mr. Nanos said in an interview. "For Canadians who are not happy with the current government, it looks like they have a clear sense the New Democrats are the ones who will be the most different." Mr. Harper lumped the NDP and the Liberal Party together in a weekend speech at the Calgary Stampede, stating voters will face a stark choice. "We've come too far to take risks with reckless policies. That's why I'm confident that, this October, Canadians will choose security over risk," the Conservative Leader said. The NDP and the Liberal Party are clearly working the same terrain. Mr. Mulcair and Liberal Leader Justin Trudeau spent Canada Day in the Greater Toronto Area, then went to the Calgary Stampede, and spoke one after the other to the Assembly of First Nations in Montreal on Tuesday. The NDP has been working hard to reassure Canadians its economic policies would be largely in line with those of the current government. The biggest change proposed by the NDP is to increase corporate taxes, although party officials said the planned rate, to be revealed in coming months, would be "reasonable." Party officials said the NDP is looking for candidates with an economic background who could serve as ministers of finance or industry. The recent upswing in the polls could make that easier. The Liberals went through a tough period in the fall and winter as Mr. Trudeau stumbled on the combat mission in Iraq and struggled to find the right balance on the anti-terrorism legislation. In a bid to gather momentum, Mr. Trudeau has recently unveiled a proposal for an enhanced child benefit, plans for a more open government and a new environmental platform. The Liberals are also banking on a promise to increase personal income tax for Canadians making more than $200,000 a year and bring down the rate for middle-income earners. While both parties want to replace the Conservatives, their partisans have been at one another's throats. Last week, the Liberals suggested Mr. Mulcair's flirtation with the Conservatives in 2007 undermined the NDP's promises to clean up the environment. The NDP responded by parroting lines from the Liberals and Mr. Trudeau, taking to social media to call on Canadians to "replace the politics of fear and division with hope and optimism." The Nanos poll was a hybrid telephone and online survey of 1,000 Canadians, carried out from June 27 to 29, providing an accuracy rate of plus or minus 3.1 percentage points, 19 times out of 20. |