GMAC

`back in the game'

on lending

Auto financing firm modifies credit criteria following cash injection

Dec 31, 2008

Edmund L. Andrews

Bill Vlasic

THE New York Times

GMAC, the automobile financing company, said yesterday it would immediately resume financing to a wider range of car buyers, a day after the U.S. Treasury Department injected billions of dollars into the lender.

GMAC said it would modify its credit criteria to include financing for customers with a credit score of 621 or above, a significant expansion of credit compared with the 700 minimum score put in place two months ago. GMAC had significantly cut back on the number of loans it offered as it struggled to stay afloat.

And General Motors said yesterday it would begin to offer zero-per cent financing on some models as it tries to jump-start sales.

"That brings a lot more customers into play for us," said Mark LaNeve, GM's vice-president for North American sales and marketing.

"It's a strong signal that GMAC is back in the game, and that GM dealers are back in the game of financing vehicles."

On Monday, the Treasury Department injected $5 billion (U.S.) into GMAC as part of a deal that will let the lender convert itself into a bank holding company to reduce borrowing costs and thus borrow at low rates from the Federal Reserve.

"This is exactly what some of the government money was intended to do – stimulate credit, stimulate business," LaNeve said.

The deal came as the Treasury was preparing to provide General Motors and Chrysler with $4 billion each in the first part of a bailout plan for the car companies.

Under the financing deal, the Treasury will buy $5 billion worth of preferred equity shares in GMAC, which used to be the financing subsidiary of General Motors and is now owned jointly by GM and Cerberus Capital Management, the private equity firm that owns Chrysler.

A Treasury official said on Monday the deal had closed and that GMAC already had the money. In addition, the Treasury said it would lend General Motors $1 billion so it could purchase additional equity offered by GMAC.

"We will immediately put our renewed access to capital to use to facilitate the purchase of cars and trucks in the U.S.," GMAC president William Muir said yesterday.

GMAC said, however, that it would not finance higher risk transactions characterized by a credit bureau score of 620 or below.

The Treasury deal, using money from the $700 billion Troubled Asset Relief Fund set up for financial institutions, came after intense efforts to prevent a collapse of GMAC, a crucial source of automobile sales financing. It has been reeling from both the paralysis in credit markets and huge losses from its mortgage lending subsidiary, Residential Capital.

|

Kerkorian's Tracinda

sells

last of Ford stake

Dec 30, 2008

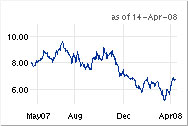

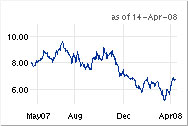

Billionaire investor Kirk Kerkorian has sold off his remaining shares of Ford Motor Co., a spokesperson for his investment firm, Tracinda Corp, said yesterday.

Tracinda, which ranked as Ford's largest outside investor earlier this year, said in a regulatory filing in October that it had started working with bankers to sell the 133.5 million shares it held at the time.

It was not clear when Tracinda had completed selling the stock.

The pullout from Ford completed a costly retreat for Kerkorian, who has a mixed investment track record at the Big Three automakers in Detroit.

Kerkorian surprised analysts and investors in April when he began buying Ford shares.

He spent more than $1 billion (U.S.) to take a stake in Ford at an average per-share price of $7.10.

Since then, Ford's shares have traded between a low of $1.02 in November to a high of $3.54 earlier this month.

|

Ford announces new

self-parking technology

Dec 30, 2008 07:08 AM

ERIN CONROY

The Associated Press

NEW YORK – Sit back, relax and let your car parallel park itself – without a single scratch or ding to your bumper.

That's what Ford Motor Co. said Tuesday about its new self-parking technology, which it announced will debut as an option on the 2010 Lincoln MKS sedan and the new seven-passenger Lincoln MKT luxury crossover vehicle.

The technology uses ultrasonic sensors on the front and rear of the vehicle, combined with electric power steering to angle and guide it into a snug parking space – all with the push of a button.

Ford isn't the first to introduce cars that practically park themselves. Toyota Motor Corp.'s Lexus luxury line has a video camera-based parking system that can calculate whether the vehicle has enough clearance for a particular spot.

But Ford's technology is easier to use and works in downhill parking situations, unlike competing systems, according to Ford's president of the Americas, Mark Fields.

"This one-touch function will be much safer to use and less intimidating," Fields said. "It's all part of our strategy to introduce smart technology to a vehicle that will make our lives easier.''

The driver will still need to shift the transmission and operate the gas and brake pedals, as a visual or audible driver interface advises about the proximity of other cars, objects and people. Still, the driver never has to touch the steering wheel.

The sensor system also monitors blind spots, and can notify the driver with a warning indicator light in the side view mirror if something is detected or if traffic is approaching. Meanwhile, the electric power steering can improve fuel economy and reduce carbon emissions because it is powered by the vehicle's battery rather than hydraulic pump systems, Ford said.

The company plans to fit nearly 90 per cent of its Ford, Lincoln and Mercury vehicles with electric power steering by 2012.

The parking assistance technology will be featured at the North American International Auto Show in Detroit in January, and will be available in its new models in mid-2009.

Among Detroit's auto makers, Ford is considered the best positioned to weather the industry slump and has said it does not need federal loans to survive, but its sales have withered and its stock has plunged.

Fields said pricing on the new models wasn't available, but added he believes it's an affordable way to eliminate unease about parking.

"I don't know about you, but when I was taking my driving test, parallel parking was the most stressful part," he said.

|

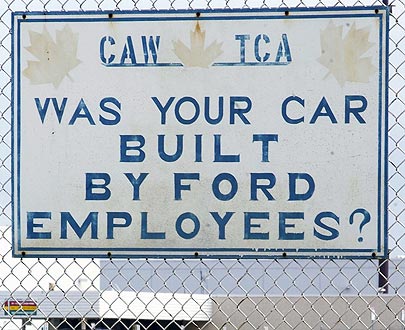

Massive CAW clawbacks

likely: expert

DesRosiers: 'They have no choice'

Jamie Sturgeon, Financial Post

Ken Lewenza, the chief of the Canadian Auto Workers, said yesterday the union felt no pressure to agree to wage concessions for its 27,800 workers at troubled automakers General Motors Corp., Chrysler LLC and Ford Motor Co.

"I don't imagine there will be anything happening until after the holiday season," said Mr. Lewenza, referring to when union officials meet with the Canadian arms of GM and Chrysler to begin hammering out restructuring plans required by Ottawa and Ontario in exchange for emergency loans.

Mr. Lewenza said the companies won't likely be in touch until Jan. 5, the date work usually resumes in the new year.

That leaves the automakers and union just six weeks to negotiate "acceptable" restructuring plans that are due on Feb. 20 and that "include specific actions sufficient to ensure long-term viability," according to the loan terms, "including agreement with all stakeholders of needed reductions in structural costs."

Six weeks to table plans designed to reinvent the companies, or the $4-billion loans could be called in.

But while there is no apparent pressure on union wage concessions, there will be pressure, when the time comes, on the union to accept massive clawbacks on at least non-wage benefits that have become an achilles heel for Canadian autoworkers, said Dennis DesRosiers, president of independent industry researcher DesRosiers Automotive Consultants Inc.

"You're going to have to see a very proactive approach in January," he said yesterday. "At one level, they have no choice. They'll have to give up a substantial amount of non-wage benefits."

Chiefly, "a very long list" of so-called penny funds that the companies pay a certain amount per hour per employee into to fund a litany of perks -- from workers' legal bills when buying a home to scholarship funds and charitable causes.

"All in, it amounts to millions and millions of dollars a year," said Mr. DesRosiers. "There's no negotiation ... gone."

The 10 or so Special Paid Absence -- or SPA -- days workers get on top of normal sick leave and paid vacation days will almost assuredly be cut, the analyst said.

Many of the targeted extras don't extend to United Auto Workers in the United States. Instead, they've been built up over years of bargain negotiations to offset health-care savings GM, Ford and Chrysler receive because of Canada's publicly funded systems.

Begun last year, the U. S. union started making arrangements to handle medical costs for workers and retirees with their Voluntary Employment Benefit Associations (VEBAs), Mr. DesRosiers said.

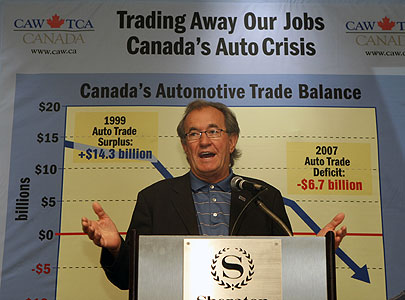

The result works out to be around a $15-per-hour cost advantage for U. S. assembly workers, he said, making Canada the "highest-cost location anywhere in the GM, Ford and Chrysler worlds for manufacturing vehicles."

"That's not a good position to be in."

Before the VEBAs were commissioned in Detroit, average compensation plus benefits -- the total cost -- for factory labour was about US$75 an hour, whereas in Canada it is US$67 at Big Three operations, the analyst said. With the implementation of the VEBAs, labour costs are heading toward US$55.

Canadian compensation fares worse against foreign-based suppliers such as Honda and Toyota, where costs stand at about US$45.

"This is why Canada is in so much trouble from a labour perspective," said Mr. DesRosiers.

"At the end of the day, the labour cost differential is very real and if they don't address it, they'll continue to lose market share."

|

Canada needs its own car czar

(STAR EDITORIAL)

Dec 27, 2008 04:30 AM

Restructuring the North American auto industry is a complicated challenge. There are three different assembly companies involved (General Motors, Chrysler and Ford) with plants on both sides of the border, hundreds of suppliers of auto parts, tens of thousands of dealers and hundreds of thousands of employees.

That's why President-elect Barack Obama is considering the appointment of a "car czar" with powers not unlike those of a bankruptcy overseer to spread the pain of restructuring and make the sector viable again, with perhaps just two assembly companies instead of three emerging from the process.

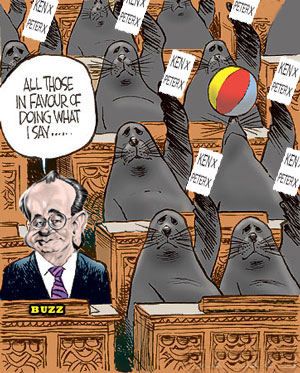

Among those rumoured for the position is Paul Volcker, the redoubtable former chair of the U.S. Federal Reserve Board. He's someone who would command respect from all sides.

It's a good idea, one that should be picked up by the Canadian government. If Ottawa were to appoint someone of similar stature – say, David Dodge, former governor of the Bank of Canada – with similar powers, that person could work with the U.S. car czar to ensure that Canadian interests are given full consideration.

There is a real danger that restructuring – essentially a euphemism for closing plants and consolidating assembly in fewer locations – will be done at Canada's expense. Take, for example, Chrysler's minivans. Until two months ago, they were assembled at two different locations, St. Louis, Mo., and Windsor. With sales falling, Chrysler decided to idle the St. Louis plant and do all the assembly in Windsor. Under prodding from the U.S. car czar, that decision could be reversed.

A Canadian car czar could enter into tough negotiations with his or her U.S. counterpart to ensure that not all the trade-offs favour the Americans.

But Ottawa does not appear inclined toward such an appointment. Indeed, the governing Conservatives seem to be headed in the opposite direction. Last week, they severed connections with Jim Arnett, the corporate executive (former Molson CEO, current chair of Hydro One) whom they appointed just a few weeks ago to help them do "due diligence" on any auto bailout. "I'm not sure we need a new special adviser just yet," an unnamed "high-ranking" government official told the Star.

When asked directly this week whether consideration was being given to the appointment of a car czar, a spokesperson for federal Industry Minister Tony Clement replied that "there will be stringent oversight" of the auto bailout and added:

"As for a czar or any option to head up that oversight function on a long-term basis, we are looking at all options to determine what is best for the Canadian auto industry, as I understand Mr. Obama is in the United States. Given that, it is premature to say what will be best for either Canada or the U.S. in that respect."

This ambiguous response could be interpreted in one of two ways: either Ottawa is waiting for Obama to move first, or the appointment of a czar is not on Ottawa's agenda.

If the former, why not get ahead of the Americans by appointing our own czar before Obama does?

If the latter, will the auto bailout and restructuring be run out of the Prime Minister's Office? Now that is a frightening thought.

|

Bush's tough auto talk

puts CAW in crosshairs

GREG KEENAN

Tuesday, December 23, 2008

With just a few words, U.S. President George Bush has done what the Detroit Three were unable to achieve with decades of negotiating: eliminate the iron grip the mighty United Auto Workers union has held for decades on setting labour rates in the auto industry.

Chrysler LLC, Ford Motor Co. and General Motors Corp. have been effectively ordered to make their labour rates competitive with Japanese auto makers in the United States.

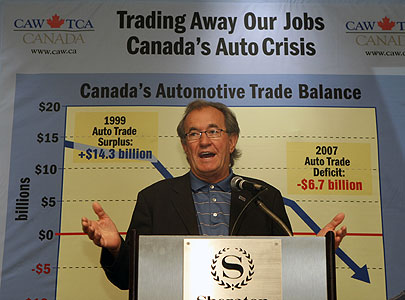

In the process, Mr. Bush has cast the future of those companies' operations in Canada into the hands of the Canadian Auto Workers union, which divorced from the UAW in 1986, but now will have to find ways to match what the UAW does or risk watching about 30,000 jobs in this country vanish.

Prime Minister Stephen Harper echoed Mr. Bush's thoughts in announcing a $4-billion rescue package for Chrysler Canada Inc. and General Motors of Canada Ltd. on Saturday when he said all stakeholders will have to make sacrifices.

The CAW "would have to sign on to the same deal" as the UAW, said Sean McAlinden, an expert on automotive labour issues and chief economist of the Center for Automotive Research, an industry think tank in Ann Arbor, Mich.

The problem for the unions, Mr. McAlinden noted yesterday, will come during the GM restructuring talks, when the largest Detroit company asks holders of its debt to trade that debt for equity.

"The bondholders are going to say: 'Why should we swap debt for equity, unless we see a really rich, big union concession in Canada and the United States?' " he said.

But the key question is which labour rate will set the benchmark: Will it be the approximately $49 (U.S.) hourly costs at the Georgetown, Ky., operations of Toyota Motor Corp., or will it be the new Honda Motor Co. Ltd. plant in Indiana, where wages are about $21?

The $49 Toyota figure creates a competitive gap of about $18 an hour at unionized Canadian plants, using the CAW figure of $67 (Canadian) an hour for labour costs in this country based on the two currencies trading at par and excluding payments to retired workers.

CAW economist Jim Stanford argues that labour costs here equate to $53.60 when the dollar is trading at 80 cents (U.S.). Given the volatility of currency markets, however, and wild fluctuations in the commodity prices that propel the Canadian dollar, that advantage can be wiped out virtually overnight.

The Detroit Three will find it impossible to invest in their Canadian operations if the UAW agrees to cut labour costs and the CAW does not, said industry analyst Dennis DesRosiers, president of DesRosiers Automotive Consultants Inc. in Richmond Hill, Ont.

Talks with GM Canada will likely begin in early January, Chris Buckley, president of CAW local 222 in Oshawa, Ont., said yesterday.

He said he's confident the CAW can reduce costs without touching base wage rates of $35 (Canadian) an hour.

Sticking deeply in the craw of Canadian managers are the so-called SPA days, or special paid absense: two weeks off the job that have been criticized in the vocal public debate about whether to offer financial assistance to Detroit.

Even if the CAW agrees to cut costs to match new UAW labour rates, some assembly plants operated by the companies in Canada are in danger as the three auto makers slash production over the next few years to make themselves more competitive.

Detroit Three production will drop by about two million vehicles between 2008 and 2010, Michael Robinet, vice-president of global vehicle forecasts for consulting firm CSM Worldwide Inc., said in a presentation in Detroit earlier this month.

That's the equivalent of about eight assembly plants. Some of those have already been announced, such as the GM truck plant in Oshawa as well as Chrysler and Ford factories in the U.S. Midwest.

The obvious decisions about plant shutdowns have already been made.

"The facilities that are going to have to close from here on out, it's going to hurt," Mr. Robinet said yesterday.

Ottawa and Ontario offered the loans in part to ensure Canada maintains its 20-per-cent share of North American production, but as that production shrinks, the Canadian plants become vulnerable.

One of the wild cards is whether Chrysler can survive even with the $4-billion (U.S.) in loans Washington earmarked for it on Friday and the $1-billion (Canadian) Ottawa outlined the next day.

There is a widespread belief in the industry that Chrysler will be forced into bankruptcy and its assets sold off. Its minivan plant in Windsor, Ont., is viewed as a valuable asset, but there is uncertainty about whether a buyer would be interested in its Brampton, Ont., large-car facility.

FORD (F)

Close: $2.59 (U.S.), down 36¢

GENERAL MOTORS (GM)

Close: $3.52, down 97¢

© The Globe and Mail

|

Ford Will Likely

Benefit From Bailout

GM, Chrysler Will Seek Concessions From

Suppliers, Unions, Dealers and Debt Holders

DETROIT -- As the lone Big Three auto maker passing on a federal bailout, Ford Motor Co. won't have to undergo an intrusive government review of its books and its business plans to become a viable company in order to qualify for --and keep -- the low-interest loans authorized by the Bush Administration Friday.

At the same time, the Dearborn, Mich. car company is likely to benefit from many of the concessions that General Motors Corp. and Chrysler LLC exact from the suppliers, unions, dealers and debt holders shared by all three companies.

"The clear winner in this game is Ford," Kimberly Rodriguez, a principal at Grant Thornton consulting firm and an adviser to Ford senior management, said in an interview Friday.

The Bush administration said it would provide a total of $17.4 billion in loans for GM and Chrysler. As part of the bailout, GM and Chrysler will have to open their books to the government and meet restructuring targets such as reducing their debt and hammering out deals with the United Auto Workers to cut labor costs.

Ford is still seeking a $9 billion line of credit from the government, though it adds it may not need to tap it. In addition, Ford wants $5 billion from the Energy Department program.

Most experts agree that Ford is in better shape than GM and Chrysler, in large part because it mortgaged almost all of its assets in 2006 to raise $24.5 billion.

"As we told Congress, Ford is in a different position. We do not face a near-term liquidity issue, and we are not seeking short-term financial assistance from the government," Ford Chief Executive Alan Mulally said in a statement Friday.

Still the company needed the Bush Administration to rescue GM and Chrysler because of fears that a failure of one or both of those companies could imperil their shared base of auto-part suppliers. "The U.S. auto industry is highly interdependent, and a failure of one of our competitors would have a ripple effect that could jeopardize millions of jobs and further damage the already weakened U.S. economy," Mr. Mulally said.

In the third quarter, Ford burned through $7.7 billion in cash, which left it with $18.9 billion. At the current rate Ford is using up cash, however, the company would have enough money to last only until April. Ford also has $10.7 billion in available credit lines, which could give it another four months of breathing room. But the auto maker has said that the company does not expect to continue to burn cash at the same rate in the fourth quarter.

To conserve cash, Ford is laying off salaried employees and cutting between $500 million and $1 billion in capital expenditures in both 2009 and 2010. Company officials have said the cutbacks would only slightly delay -- and not irreparably harm -- the auto maker's ability to bring new products to showrooms.

As part of their plan submitted to Congress earlier this month, Ford pledged to accelerate their efforts to bring new gas-electric hybrids and plug-in electric vehicles to market.

Still the overall decline in sales for cars and trucks continues to weigh Ford down greatly. The company this week confirmed it would extend its two-week holiday shutdown by an extra week at 10 plants in order to meet a goal of lower production.

|

Concessions loom for auto workers

PM, McGuinty stress cuts in labour costs

will be needed in exchange for $4 billion in loans

Dec 21, 2008 04:30 AM

Tony Van Alphen

Robert Benzie

STAFF REPORTERS

The federal and Ontario governments increased the pressure on thousands of auto workers at General Motors, Chrysler, Ford and scores of suppliers yesterday to accept concessions in efforts to keep the reeling automakers alive.

In announcing $4 billion in loans to GM and Chrysler, Prime Minister Stephen Harper and Ontario Premier Dalton McGuinty emphasized that in exchange for the money, all stakeholders – including unionized workers – would need to cut costs soon.

Pressure had been building for weeks as the automakers pleaded for public aid. On Friday, the Bush administration announced a $17.4 billion (U.S.) rescue package in exchange for major concessions from auto industry employees there.

Ottawa and the provincial government underlined the need for cuts in labour costs as a condition of the aid packages. They also noted that even with the reductions in those costs, there would be unidentified job losses.

In Canada, that would mean a reopening of contracts and concessions from the tens of thousands of unionized auto workers at GM, Chrysler and Ford.

Ford didn't seek any immediate aid but it has sought a $2 billion line of credit, if necessary.

Production technicians at the three automakers currently earn $33.90 an hour, including cost of living allowance.

Harper and McGuinty also said the automakers would need reductions in costs from their suppliers. That could affect the wages and benefits of more than 20,000 parts workers who are primarily represented by the Canadian Auto Workers and the United Steelworkers unions.

Many of those workers have already accepted concessions in recent years as the automakers tried to stay competitive against surging foreign-based companies.

CAW president Ken Lewenza said yesterday there would be "pain" but it was difficult to comment on the extent of concessions.

He noted the United Auto Workers union in the U.S. is hoping president-elect Barack Obama will soften conditions for concessions when he assumes power next month and that could affect the situation here.

"The automakers haven't specifically indicated what they want from us," he said. "But we will be part of any solution to retain our competitive edge in productivity."

Meanwhile, Ontario NDP Leader Howard Hampton, who attended the Harper-McGuinty press conference, told reporters that workers shouldn't have to bear the brunt of the restructuring. |

In 1949, a pamphlet was published that argued that the American auto industry should pursue a different direction. Titled "A Small Car Named Desire," the pamphlet suggested that Detroit not put all its bets on bigness, that a substantial share of American consumers would welcome smaller cars that cost less and burned fuel more efficiently.

The pamphlet's author was the research department of the United Auto Workers.

By the standards of the postwar UAW, there was nothing exceptional about "A Small Car Named Desire." In its glory days, under the leadership of Walter Reuther, the UAW was the most farsighted institution -- not just the most farsighted union -- in America. "We are the architects of America's future," Reuther told the delegates at the union's 1947 convention, where his supporters won control of what was already the nation's leading union.

Even before he became UAW president, Reuther and a team of brilliant lieutenants would drive the Big Three's top executives crazy by producing a steady stream of proposals for management. In the immediate aftermath of Pearl Harbor, Reuther, then head of the union's General Motors division, came up with a detailed plan for converting auto plants to defense factories more quickly than the industry's leaders did. At the end of the war, he led a strike at GM with a set of demands that included putting union and public representatives on GM's board.

That proved to be a bridge too far. Instead, by the early 1950s, the UAW had secured a number of contractual innovations -- annual cost-of-living adjustments, for instance -- that set a pattern for the rest of American industry and created the broadly shared prosperity enjoyed by the nation in the 30 years after World War II.

The architects did not stop there. During the Reuther years, the UAW also used its resources to incubate every up-and-coming liberal movement in America. It was the UAW that funded the great 1963 March on Washington and provided the first serious financial backing for César Chávez's fledgling farm workers union.

The union took a lively interest in the birth of a student movement in the early '60s, providing its conference center in Port Huron, Mich., to a group called Students for a Democratic Society when the group wanted to draft and debate its manifesto.

Later that decade, the union provided resources to help the National Organization for Women get off the ground and helped fund the first Earth Day. And for decades after Reuther's death in a 1970 plane crash, the UAW was among the foremost advocates of national health care -- a policy that, had it been enacted, would have saved the Big Three tens of billions of dollars in health insurance expenses, but which the Big Three themselves were until recently too ideologically hidebound to support.

Narrow? Parochial? The UAW not only built the American middle class but helped engender every movement at the center of American liberalism today -- which is one reason that conservatives have always held the union in particular disdain.

Over the past several weeks, it has become clear that the Republican right hates the UAW so much that it would prefer to plunge the nation into a depression rather than craft a bridge loan that doesn't single out the auto industry's unionized workers for punishment. (As manufacturing consultant Michael Wessel pointed out, no Republican demanded that Big Three executives have their pay permanently reduced to the relatively spartan levels of Japanese auto executives' pay.)

Today, setting the terms of that loan has become the final task of the Bush presidency, which puts the auto workers in the unenviable position of depending, if not on the kindness of strangers, then on the impartiality of the most partisan president of modern times.

Republicans complain that labor costs at the Big Three are out of line with those at the non-union transplant factories in the South, factories that Southern governors have subsidized with billions of taxpayer dollars. But the UAW has already agreed to concessions bringing its members' wages to near-Southern levels, and labor costs already comprise less than 10 percent of the cost of a new car. (On Wall Street, employee compensation at the seven largest financial firms in 2007 constituted 60 percent of the firms' expenses, yet reducing overall employee compensation wasn't an issue in the financial bailout.)

In a narrow sense, what the Republicans are proposing would gut the benefits of roughly a million retirees. In a broad sense, they want to destroy the institution that did more than any other to raise American living standards, and they want to do it by using the power of government to lower American living standards -- in the middle of the most severe recession since the 1930s. The auto workers deserve better, and so does the nation they did so much to build.

|

PM, McGuinty pledge

$4B in auto aid

Dec 20, 2008 11:05 AM

Robert Benzie

Queen's Park Bureau Chief

Tony Van Alphen

Business Reporter

Prime Minister Stephen Harper and Premier Dalton McGuinty have announced a $4 billion (Cdn.) bailout for General Motors Canada and Chrysler Canada.

Following the $17.4 billion (US) rescue package announced yesterday by President George W. Bush, the two leaders this morning announced the long-awaited deal.

"This is a regrettable but necessary step to protect the Canadian economy," the Prime Minister said.

"Today's announcement is not a blank cheque."

McGuinty, who has been fighting for such an aid plan for weeks, praised the agreement.

"Here in Ontario, we've got thousands of people and their families who rely on the auto industry to be on firm ground so they can put food on the table and keep a roof over their heads," the premier said.

The accord, which represents 20 per cent of the U.S. scheme, will loan GM $3 billion and Chrysler $1 billion. Ford, which has been seeking a standby line of credit if necessary, is not part of today's announcement.

It's not immediately known how many jobs are guaranteed under this deal. |

Detroit faces change

imposed from the outside

Dec 20, 2008 04:30 AM

David Olive

As stays of execution go, the Detroit Three bailout unveiled yesterday by U.S. President George W. Bush was done on the cheap.

Time was, the $17.4 billion (U.S.) with which Washington rescued General Motors Corp. and Chrysler LLC would have been considered a lot of money.

But that sum works out to a mere 1.1 per cent of the combined $700 billion effort by the U.S. to bail out its crippled banking system and the $850 billion stimulus package that U.S. President-elect Barack Obama is preparing to roll out soon after his inauguration Jan. 20, rumoured in yesterday's Washington Post.

Previous estimates have put Obama's planned stimulus only as high as $700 billion. But U.S. economic conditions are deteriorating rapidly. So this might not be the time, in a year when the American workforce already has shed 2 million jobs, to let GM and Chrysler go to the wall, jeopardizing Ford Motor Co. as well since it shares key suppliers with its rivals. The result would be to risk inflating the dole by another million or so auto assembly workers, parts-plants employees and dealership personnel.

The American taxpayer is spending a comparatively small sum to spare the U.S. the fate of Canada and Britain in being the only G8 nations without a substantial domestically owned auto sector. But Bush has been crafty enough to provide only just enough emergency loans to get GM and Chrysler through the year – a mere $13.4 billion upfront for GM and Chrysler combined, with another $4 billion to come in February.

Bush won't be president then, of course, and The Economist was quick to observe that the automakers' plight is now "Barack Obama's problem." The Detroit automakers will be back for more – tens of billions of dollars more – to finance their urgently required restructuring. With Obama as president, Detroit is likely to get its money. But the individuals asking for it might not be around to collect it.

Every year for the past two decades, Detroit has vowed to reconnect with American motorists and offer them the vehicles they want to buy. And every year it has reneged. America's domestic auto industry has few rivals for insularity. Can a century-old industry long protected from foreign competition learn new tricks? Is it willing even to try? Evidence suggests no.

Last year, Candidate Obama, in a Motown speech, blasted the Detroit Three for "failing to make changes they should have made 30 years ago," and offered that federal assistance should he become president would be tied to meaningful progress on fuel efficiency and a focus on the small cars the U.S. market now demands. More recently, President-elect Obama has vowed to save Detroit, but neither with a "blank cheque" nor the same Detroit management that so stubbornly resists change.

To save Detroit – the city and its mainstay industry – will require a radical transformation that could see its three players merged into one. Or just the opposite, the breaking up of GM, Ford and Chrysler into nimbler competitors.

What appears certain is that the change will have to be imposed from outside Detroit, where countless layers of middle management know things that are no longer true. With a "car czar" waiting in the wings – often rumoured to be Paul Volcker, the most successful chairman in the history of the U.S. Federal Reserve Board – Detroit either will propose its own radical restructuring next spring or have one forced on it by a president elected by lunch-bucket votes in the auto-producing heartland of the U.S. Midwest.

David Olive writes on politics and economics. |

PM, McGuinty to announce Canadian bailout

Dec 19, 2008

Prime Minister Stephen Harper and Ontario Premier Dalton McGuinty will announce an aid package for the Canadian auto industry tomorrow after the U.S. government announced a $17.4-billion (U.S.) bailout package for its own auto industry today.

No details of the Canadian aid package have been issued but it is expected to be worth several billion dollars, since both the federal and Ontario governments have said they would provide a package proportional to the size of the industry in Canada.

That would be about 20 per cent of production capacity in North America.

Kory Teneycke, communications director for Prime Minister Stephen Harper, said that McGuinty and Harper "will address the Canadian response tomorrow."

Asked if the Canadian bailout will include the kinds of concessions and controls the United States is insisting on, he said: "You'll see similar things in a Canadian package," that will give governments a larger say in how the companies restructure.

"We're a partner, but a minority partner in this, and we'll be a partner to the extent to which we are a part of this industry. Canada will work to maintain its market share in the North American auto industry."

Harper will make the announcement alongside McGuinty in Toronto.

McGuinty's aides at Queen's Park were scrambling today to organize the event. There were concerns about whether the prime minister could make it from Winnipeg to Toronto in the fierce winter storm.

U.S. President George W. Bush said earlier today that his government will provide the beleaguered automakers with emergency loans while they implement plans to restructure. The aim is to prevent an industry collapse that could send the economy into a deeper and longer recession.

The Detroit Three - General Motors Corp, Ford Motor Co and Chrysler - have been hit hard by the sharp slowdown in U.S. demand.

GM and Chrysler have asked for bridge loans and credit guarantees to keep them alive while restructuring. Ford has asked for a line of credit to tap into in case their finances worsen more than expected.

The companies have until the end of March to present viable restructuring plans.

"We don't know what GM or Chrysler has put on the table in terms of Canadian operations," said Richard Cooper, executive director of Canadian operations at J.D. Power & Associates.

"For GM to remain viable, they are going to have to make a lot of changes. For Chrysler to remain viable, they are going to have to make a lot of changes and we don't know what those changes are going to look like and how they will impact the Canadian operations."

The sudden announcement of the U.S. government package appeared to send aides to Harper and McGuinty scrambling to put together a joint announcement of the Canadian package. Harper, in Winnipeg today, was scheduled to travel to Calgary to begin Christmas holidays with his family but will instead head to Toronto for the announcement.

Details were still not available about where they would unveil the package.

As late as last night, while taping an interview to air tomorrow, Harper told CTV that no deal had been reached.

"The truth is we haven't settled on a dollar figure nor have we have we settled on a package. We're working with the United States Administration with them on what they are putting together."

Harper said the Canadian and American auto industries are so entwined that "we cannot have a solution unless we have an integrated approach and an integrated action with the United States administration."

But Harper suggested the Canadian package will mirror much of the controls that the U.S. is prescribing.

"I think it's safe to say if you look at what's on the table in the United States right now, there will be some significant say of governments in the future of those companies."

Harper said the Canadian government and the government of Ontario "have concluded we either do our share of the restructuring or we will have no share of that industry in Canada."

"If the United States does all the restructuring themselves, the industry will move to the United States. That's not acceptable to the government of Canada. So we will work with the Americans, make sure that we get our share of a restructured industry.

"Obviously as public money goes into that, there will be more public say about how that money is used, but we should be under no illusions: there is going to be significant restructuring. And the aim at the end of this is to make sure that, while those companies will be smaller, they will be viable and they will make money."

Harper admitted he finds himself "uneasy" as a small-c conservative at all the government intervention in the economy that he finds himself forced to adopt.

"As a conservative, not ideal circumstances, but this is — my training as an economist tells me — that these are the policies we must adopt under these circumstances."

He said his main goal is to help ordinary people and communities in transition. He also said he wants the country to emerge from the recession without a "permanent deficit."

|

Bush offers Detroit $17.4B

Tim Harper

Washington Bureau Chief

Dec 19, 2008

WASHINGTON–President George W. Bush threw the staggering U.S. auto industry a short-term $17.4 billion (U.S.) lifeline today.

With General Motors and Chrysler on the verge of collapse, the U.S. president stepped in after Republicans in the Senate last week blocked congressional approval of a similar bailout plan.

The White House plan gives automakers three months to restructure themselves and make themselves "viable,'' Bush said, but if that cannot be done, these loans would allow them to make the necessary preparations to declare bankruptcy.

If new, acceptable business plans are not completed by March 31, Bush said, the money must be repaid.

The $13.4 billion in short-term financing will be drawn from the $700 billion Wall Street rescue program, White House officials said, with another $4 billion to be made available in February.

"The American people want the auto company to succeed and so do I,'' Bush said.

He said he grappled with a thorny question involving the proper role of government in grim economic times.

"If we were to allow the free market to take its course now, it would almost certainly lead to disorderly bankruptcy,'' Bush said.

Under ordinary circumstances, Bush said, he would allow the collapse, but in the current economic crisis, he cannot allow that, the president said.

"These are not ordinary circumstances,'' he said.

"In the midst of a financial crisis and a recession, allowing the U.S. auto industry to collapse is not a responsible course of action.

Bankruptcy at this point would not be an option, Bush said, because consumers would shun the companies.

Ford will receive none of the money and, in submissions to the U.S. Congress, the company said it would seek taxpayers help only if one or both of its competitors declared bankruptcy, creating a ripple effect throughout the industry.

General Motors is expected to receive $9.4 billion of the money immediately available, with Chrysler receiving $4 billion.

Bush also stressed that a responsible business plan will include concessions from management, unionized workers and industries which depend on the automakers.

"The convergence of (economic) factors means there is too great a risk that bankruptcy now would lead to a disorderly liquidation of American auto companies,'' Bush said.

"My economic advisers believe that such a collapse would deal an unacceptably painful blow to hardworking Americans far beyond the auto industry.

"It would worsen a weak job market and exacerbate the financial crisis.

"It could send our suffering economy into a deeper and longer recession.''

Chrysler announced an extended shutdown earlier this week, idling their plants beginning today and keeping them dark until the third week of January.

Canadian government reaction is expected later this morning.

|

Ford vehicles finalists

for U.S. top car

Dec 19, 2008 07:41 AM

The Associated Press

DETROIT–Two Ford Motor Co. large vehicles are finalists for the 2009 North American Car and North American Truck of the Year awards.

The Ford Flex, a seven-passenger crossover vehicle will be considered for top car of the year. Ford's F-150 truck is a finalist for best truck of the year.

Winners will be announced on Jan. 11, the first press day of the North American International Auto Show in Detroit.

Both the 2009 Flex and the F-150 made the Insurance Institute for Highway Safety's list of the safest new cars last month.

Other finalists include the Hyundai Genesis luxury sedan and Volkswagen Jetta TDI in the car category. The Mercedes-Benz ML 320 Bluetec and Dodge Ram pickup were the other finalists in the truck category.

Ford's Lincoln MKS, a luxury crossover vehicle, was a candidate in the car category, but did not make the finalist list.

Shares of Ford dropped 30 cents or 9.6 per cent Thursday to $2.84.

|

$3.4 billion bailout

just 'bit of a lifeline'

McGuinty admits cash will keep industry alive only in the short term

Dec 18, 2008 04:30 AM

Robert Benzie

Robert Ferguson

Queen's Park Bureau

The proposed $3.4 billion auto industry bailout from Ontario and Ottawa is just the beginning of help for the troubled Detroit Three, Premier Dalton McGuinty acknowledged yesterday.

"This is a bit of a lifeline at this point in time to sustain the industry," the premier said as the White House in Washington continued to mull the size of an aid package for General Motors, Ford and Chrysler.

The Canadian money – designed to help the automakers stay afloat while they restructure – is contingent on the U.S. providing assistance first.

When asked how big the Canadian bailout could be, McGuinty said: "We don't know right now because we haven't completed our due diligence, and neither has Washington, to get a good sense of what's going to be involved ultimately."

The Canadian Taxpayers Federation continues to oppose a bailout, saying the automakers have been loaned or granted $782 million from taxpayers in the last five years.

"Throwing good money after bad won't fix big auto but it will drive Canada and Ontario further into deficit," warned spokesperson Kevin Gaudet, calling GM, Ford and Chrysler a "bottomless pit."

"Each announcement of government cash support was followed by downsizing, layoffs of Canadian workers, and the demand for even more cash by the Big Three. Be assured, these companies will be back for more before spring."

The $3.4 billion in aid from Canada was based on last week's failed U.S. plan for $14 billion (U.S.) in emergency cash for the automakers – a 20 per cent share when the exchange rate is taken into account. That plan was rejected in the Senate, leaving the White House scrambling for alternatives.

McGuinty said he wants to ensure that the Detroit Three's operations in Ontario come out with a 20 per cent share of their parent companies' North American production following the restructuring.

Meanwhile, NDP Leader Howard Hampton urged McGuinty to do an immediate $2 billion made-in-Ontario stimulus package without waiting for Ottawa or the U.S. to rescue the Detroit Three.

"Ontario simply can't afford to wait for Washington to act," Hampton told a news conference yesterday at Queen's Park.

He implored McGuinty to expedite auto aid, accelerate spending on infrastructure, expand a "buy Ontario" policy for transit and other expenditures, implement an industrial hydro rate to provide cheaper power to manufacturers and mills, and raise the minimum wage to $10.25 right away to inject cash into the economy.

In a sign not every segment of the economy is suffering, the premier attended an unpublicized $5,000-a-plate Ontario Liberal fundraiser at a Forest Hill mansion with about 20 guests last night. Liberal sources told the Star the event was a chance to give lobbyists private face time with the premier. The dinner was left off McGuinty's official itinerary because it was deemed "private." |

Ford builds image as

strongest of Big 3

But a GM bankruptcy could sink Blue Oval; suppliers grow jittery.

Bryce G. Hoffman / The Detroit News

DEARBORN -- Ford Motor Co. is trying to pull itself up by its own bootstraps, and it hopes America notices.

As crosstown rivals General Motors Corp. and Chrysler LLC ask the White House for $14 billion in emergency loans just to tide them over until March, the Dearborn automaker maintains it has enough cash to weather the current economic crisis. It is still asking the federal government for a $9 billion line of credit, but it is not asking the Bush administration for immediate cash assistance.

Ford executives think this fact has not been lost on the American people, and it is hoping to use its comparative financial strength to position itself as the most viable of Detroit's Big Three. That might not be saying much -- particularly given that Ford does not expect to post a profit until at least 2011 -- but experts agree that the situation represents an opportunity for Ford to begin rebuilding its brand image.

But this strategy is not without its risks. The biggest danger facing Ford today is a GM bankruptcy, which could pull Ford into bankruptcy court, too. It also knows that suppliers are becoming increasingly jittery about the state of the entire domestic automobile industry and could begin demanding quicker payments than Ford could make. The last thing Ford wants is to be too heavy-handed with its message and risk exacerbating these problems.

"We are trying to tell our story, but we also think it's very important that we don't appear to be turning our back on our industry," Executive Chairman Bill Ford Jr. said Tuesday. "The good news for us is we're starting to get some separation in the customers' minds and people see that we're trying to make it on our own. We're hearing comments in the showroom to that effect."

December is "starting off relatively well," Bill Ford said, noting that his company has already gained a point of market share over the past couple of months -- a significant accomplishment for a business that has seen its share steadily erode for more than a decade.

Analyst Erich Merkle of Crowe Horwath says Ford stands to gain even more market share.

Like most analysts, he thinks Ford has enough cash to make it through until next year when the full benefits of its landmark labor agreement with the United Auto Workers kicks in. As GM and Chrysler struggle just to stay out of bankruptcy court, consumers are less inclined to consider their cars and trucks. And Merkle says Ford has a slew of new products coming out over the next year that should demonstrate just how much progress it has made in its turnaround campaign.

"They're very well positioned for when we come out of this and people start buying cars again," he said, though he added the company needs to be careful not to be too assertive. "Ford can separate itself, but to do that now with everything the industry is going through -- particularly GM and Chrysler -- could hurt everyone."

Ford Americas President Mark Fields says it is all about striking the right balance. "Our job going forward is to be confident, but not arrogant," he told The Detroit News Tuesday.

The recent Congressional hearings have focused the national spotlight on the domestic automobile industry like never before. For the first time in a long time, the American people want to hear what Detroit's Big Three have to say. Ford sees that as an opportunity to speak to millions of potential customers.

"They clearly understand that Ford is in a different place," said Ford CEO Alan Mulally. "The most important thing is that we help everybody understand where Ford is and where it's going. We're looking at every medium we have to tell that story."

Over the past couple of weeks, the Dearborn automaker has been making its executives available -- not only to major media outlets, but also to newspapers and television stations around the country. Bill Ford himself was the scheduled guest on Larry King Live last night. The company is also being more aggressive in trying to get its message out through online social media Web sites like Facebook.

But analyst Jim Hall of 2953 Analytics LLP says the company could do more. He says Ford needs to make consumers feel like they are part of its solution.

"What you do is say, 'We're working through this with " he said. "You make the your help. Vote for Ford with your dollars,' customer one of the winners. And you can do that without taking the mallet to anyone else."

Even with the right marketing message, Ford still needs to contend with the economy. Its market share may be up, but like every other automaker its sales are down sharply, and there is no sign of a recovery anytime soon.

"At a certain point, if customers are just completely stressed out and tapped out, all the messaging in the world isn't going to get them in," Bill Ford said.

Moreover, while Ford may not need government help today, its finances are still a disaster. The company has lost $24 billion since 2005, its stock is trading for just over $3 a share and its bonds are worth pennies on the dollar.

But Ford continues to aggressively restructure its business to match the actual demand for its cars and trucks, to consolidate its global operations and shed what it calls "non-core operations" like Jaguar and Land Rover to concentrate its resources on saving the Blue Oval itself.

It is finally getting credit for the strides it has made in quality, safety and reliability. And Ford is about to begin one of the most aggressive product launch cycles in recent automotive history.

Jim Farley, Ford's global sales and marketing chief, says that's the story Ford needs to share with the American people.

"They're all ready to listen and they're all paying attention," he said. "It may not be the best starting point, but Americans love a good underdog."

|

Detroit's Problem:

It's Health Care,

not the Union

by Christopher R. Martin

The Senate's failure to pass the bailout of the U.S. auto industry strikes a big blow at one of labor's last stands in manufacturing in the U.S.

What's at stake? According to the bill: 355,000 workers in the U.S. directly employed by the automobile industry; 4,500,000 employed in related industries (the auto industry has the highest job creation multiplier effect of any industry); 1,000,000 retirees (with pensions and health care benefits).

Vice President Dick Cheney, mindful of his administration's economic legacy, reportedly pleaded to fellow Republicans in the Senate, "If we don't do this, we will be known as the party of Herbert Hoover forever."

Welcome to forever, Dick.

It's too late for Cheney, as his party and their think tank associates celebrated the opportunity of Detroit's woes to pin blame on their perennial target, labor unions. In September, the conservative Heritage Foundation, with a barely concealed smirk, was already spreading disinformation:

"There are plenty of auto industry jobs being created every day right here in America - and with no government help. Toyota recently opened a new plant in Texas, and is building another factory in Mississippi. Toyota already produces more than 1.5 million cars in America, and that number is set to soar as more factories like those in Texas and Mississippi come on line. Unlike the Detroit automakers, Toyota has a union-free workforce, which gives the company a huge competitive advantage. Toyota still pays good wages but its workforce is younger, not burdened by seniority rules, and the company has smarter and lower benefit costs."

Two contentions - that foreign automakers in the U.S. have received no government help, and that union workers are grossly overpaid - are either misleading or completely untrue.

First, let's start with government assistance. It's easy to forget that there are government subsidies other than the ones asked for in Congressional hearings. For foreign automakers such as Toyota, Nissan, Honda, Hyundai, Mercedes, and BMW, the better way of wringing out public subsidies is to get Southern states to battle for your plants by offering a bevy of tax abatements, infrastructure projects, and even employee recruitment, screening and training. According to the Center for Automotive Research at the University of Michigan, between 1998 and 2003, the Southern states paid out an average of $87,700 in "government help" per nonunion auto job created - an average of $143 million per facility - compared to $50,180 per job created in the haplessly unionized North.

The second contention - that the unionized autoworkers of the north are grossly overpaid - is misleading. In fact, Sen. Bob Corker (R-Tennessee), one of the opponents of the bailout, encouraged the deception. The Chattanooga Times Free Press reported the Senator "said the automakers pay their rank-and-file employees an average of $70 to $74 an hour, including benefits, while foreign automakers pay an average of $42 to $44 an hour." The quote, repeated nearly everywhere in the news media over the past few weeks, obscures the situation.

Only a very few news organizations - Jonathan Cohn at the New Republic and David Leonhardt at the New York Times, among the few - bothered to break it down. As it turns out, the base wages are fairly close - about $29 an hour for Detroit's three automakers, and about $26 for the foreign automakers in the U.S. What nearly every Republican politician and news report fails to mention, though, is that wages in Detroit are already dropping. The UAW gave major concessions to GM, Ford, and Chrysler in 2005 and 2007, setting a new second tier starting wage at $14. This lower wage will continue to decrease the base wage cost going into the future.

Another difference in North vs. South autoworker wages is benefits. Adding in things like healthcare, training, vacation, and overtime, Big Three autoworkers make about $55 compared to about $46 for nonunion workers. True enough, unionized workers do better here. But a big part of this expense is healthcare.

Healthcare also is part of the largest difference between North and South: what the industry calls "legacy costs" - the pensions and health care of retirees. The foreign auto companies currently don't have these costs, since they've been operating in the U.S. for only about 25 years or less, and have few retirees. But, the Big Three have more than a million retirees and their families to cover. Corker and others unfairly lump this into average wage costs and arrive at something over $70 an hour.

So, when the Senate Republicans are talking about equalizing wages, what they are really talking about is taking pensions and healthcare away from retirees. That doesn't sound as nice as "equalizing" the wage of current workers, so they never say it that way.

The UAW has made a number of concessions over the years, but that's where they said no. They wouldn't sell out the dignity and well being of their retirees.

Back in 2006, GM vice president Bob Lutz famously said, "Sometimes it feels like we're a health-care company that tries to sell enough cars to pay the bills."

Exactly. Hello Washington? This is a primarily a health care problem, not an auto problem.

Corker and his colleagues might begin with a better comparison for the Big Three's unionized autoworkers -- their union colleagues in Canada. Their work and wages are similar, except that Canada has a public healthcare system that evens the playing field for all companies. According to the Canadian Labour Congress in 2006, health benefits for unionized autoworkers in Canada cost $120 per car. In the same year, health benefits for Big Three autoworkers cost $1,500, and they're still rising.

If Corker and his colleagues are truly serious about changing the structure of the auto industry, they should start by working to give people health care, not take it away. And if the news media wants to get to the bottom of Detroit's problems, health care is what they should be writing about.

Christopher R. Martin is an associate professor in journalism at the University of Northern Iowa in Cedar Falls, Iowa. His research has been published in Journalism Studies, Journal of Communication Inquiry, Communication Research, Labor Research Journal, Popular Music and Society, Journal of Communication, Z magazine and the Web journal Images. With Richard Campbell and Bettina Fabos, he is co-author of Media and Culture: An Introduction to Mass Communication (Bedford/St. Martin's, 2008), now in its 6th edition update, and author of an award-winning book on how labor unions are covered in the news media, Framed! Labor and the Corporate Media (Cornell University Press, 2004). Martin previously taught at Miami University (Ohio), and holds a Ph.D. from the University of Michigan.

|

517,000 Ontario

jobs at risk

If Big Three automakers go out of business,

the entire

economy will be devastated, report says

Dec 16, 2008 04:30 AM

Robert Benzie

Rob Ferguson

QUEEN'S PARK BUREAU

Ontario would lose 517,000 jobs within five years if the Big Three automakers went out of business, according to a new provincial report obtained by the Star.

The review, prepared for the Ministry of Economic Development and to be released today, warns the collapse of General Motors, Ford and Chrysler would send lasting shock waves through the economy.

If auto output by U.S.-based manufacturers in Canada were cut in half, at least 157,000 jobs would be lost right away, 141,000 of them in Ontario. By 2014, job losses would rise to 296,000 nationally, including 269,000 here.

If production were to cease completely, 323,000 jobs would be lost immediately in Canada, including 281,800 in this province, rising to 582,000 nationally and 517,000 in Ontario by 2014.

The Ontario Manufacturing Council, an arm's-length provincial government panel, commissioned the 11-page report, which was prepared by the Centre for Spatial Economics. The report paints a gloomy picture if governments at Queen's Park, in Ottawa, and in Washington do not bail out the automakers.

"The depreciation of the dollar, lower interest rates, and lower production costs eventually help the economy to partially recover (over the following five years, 2015 to 2019) but the loss of the Detroit Three leaves a permanent dent in Canada's economy in terms of jobs and output," the report says.

"For any Canadians who feel that the auto industry is expendable to our economy, this report is a wake-up call," Economic Development Minister Michael Bryant said in an interview yesterday.

"This report suggests that even under a scenario where half the auto sector is lost, our economy (in Ontario) basically craters and brings the whole rest of the (Canadian) economy with it," Bryant said.

The damage would extend well beyond the auto and related parts industries to housing and a broad range of consumer spending, said Jayson Myers, an economist who is president of Canadian Manufacturers and Exporters.

Myers is a co-chair of the manufacturing council with Jim Stanford, economist for the Canadian Auto Workers union.

"We were surprised how big the impact is. ... It shows the importance of ensuring we maintain production here."

The impact on citizens would be huge, Bryant predicted.

"If the auto industry is somehow allowed to part (from) our economy, it's the equivalent of a nuclear winter with lasting effects ... and would require enormous cuts to public services plus massive deficits every year."

North American automobile demand is already down to 11 million vehicles from a previous 19 million.

"Let's hope that doesn't last long," said Myers. "I'm pretty certain we will see demand rebound, but certainly it won't rebound to 19 million units."

Because automakers have been offering plenty of sales incentives and rebates in the past few years, which eat into future sales, "it's not going to be easy" to get demand up given the economic crunch facing consumers, Myers said.

Nor could Japanese-based automakers like Toyota and Honda, which already build cars and trucks in Ontario, be expected to fill the void left by GM, Ford and Chrysler.

"The economic impacts estimated by this analysis are likely to understate the true economic impact for several reasons, despite the possibility that foreign vehicle producers could expand production in Canada," the report states.

First, "a permanent contraction of the motor vehicle industry would negatively impact the U.S. and, indeed, the global economy, reducing the demand for Canadian exports from all industries."

That would depress prices of commodities such as oil and minerals, hurting resource-rich provinces like Alberta and Saskatchewan.

Second, the bankruptcy of any of the Big Three automakers might have serious implications for their pension funds and retirees' incomes.

Third, the study suggests "more than 80 per cent of the parts industry would vanish in the event of the failure of all three Detroit companies," which would temporarily disrupt foreign automakers' production in North America.

A subsequent housing slump would cast a pall over construction jobs as well as hurt the retail, insurance, real estate and financial services sectors, the report said.

Bryant said it underscores the necessity of keeping the Big Three in business.

"We have to mitigate the impact as much as possible."

The study comes as Ottawa and Queen's Park are preparing a $3.4 billion (Cdn.) emergency aid package if Washington comes through with a $14 billion (U.S.) rescue.

The U.S. Senate last week rejected a $14 billion bailout, but President George W. Bush is expected to resurrect it as early as this week.

In Canada, both levels of government are still determining how much money Ottawa and Queen's Park would each contribute.

Both Prime Minister Stephen Harper and Premier Dalton McGuinty have been in constant contact and Ottawa is talking with the White House to track the status of the U.S. bailout, Bryant said.

In the wake of Harper's offer of help for automakers, Alberta Premier Ed Stelmach yesterday urged assistance for his province as well.

Stelmach asked Ottawa to match the $2 billion Alberta is spending on carbon capture and storage technology to fight climate change, saying it would generate tax revenue and create manufacturing jobs across the country.

|

CAW warns plants could go south

Union chief says government bailout package must

be contingent on auto jobs staying in Canada

Dec 14, 2008 04:30 AM

Kenyon Wallace

Staff Reporter

Canadian governments must intervene to prevent the loss of whole auto assembly plants to the United States, says the president of the Canadian Auto Workers.

Despite $3.4 billion in conditional emergency aid promised to Canada's ailing auto makers Friday by the Ontario and federal governments, Ken Lewenza says excess capacity at Canadian auto plants must be protected or General Motors, Ford and Chrysler could move plants and equipment south of the border.

"If the Canadian government doesn't do anything ... you've got to believe that over time, our products would be moved," Lewenza said yesterday in an interview. "We don't want GM to pick up and say, it's been nice doing business in Oshawa but sorry we've got a better deal in the United States. We want to ensure that when the Americans put their legislation together, it isn't on the backs of Canadian jobs."

Lewenza also said that thousands of jobs could still be lost even with additional aid unless the money is contingent on manufacturers keeping workers in jobs and plants open.

Lewenza's warning comes on the heels of Federal Industry Minister Tony Clement's announcement late Friday of the conditional $3.4 billion for Canadian operations of General Motors, Ford and Chrysler based on the $14 billion (U.S.) the White House is contemplating in rescue money for the Detroit Big Three.

The Bush administration spent yesterday weighing its options, but details were scarce as to how much interim financial aid the U.S. government would provide to stave off a collapse of the troubled industry. On Thursday, Republicans in the U.S. Senate refused to pass a $14 billion (U.S.) rescue bill, throwing the future of the Big Three into doubt. GM and Chrysler have already warned they could run out of cash in a matter of weeks without immediate government aid.

But Ontario's assembly plants are already on the brink. Chrysler's Windsor minivan plant will be shut down for the month of January, while GM's car plant in Oshawa is scheduled for a six-week closure starting at the same time. Lewenza said Ford's Oakville plant is also anticipating shutting down operations for two weeks early in the New Year. The three companies employ more than 30,000 people in Ontario.

|

Gettelfinger blasts GOP's tactics

He says union was 'set up'; Corker says

he couldn't get a date for union to take pay cuts.

Louis Aguilar / The Detroit News

December 13, 2008

Union Auto Workers President Ron Gettelfinger and Senate Republicans from the South spent Friday blaming each other for killing the congressional bailout that would have provided emergency loans to keep the domestic auto industry going until January.

Hours after the Washington deal fell apart, Gettelfinger was at Detroit's Solidarity House charging that a minority of southern Republicans was trying to "set up" the union by demanding concessions no other party -- the automakers and bondholders, for example -- were being asked to accept.

The breaking point of the negotiations was the UAW's refusal to agree to lower wage and benefit rates as soon as next year, Gettelfinger said.

"The GOP caucus was insisting the restructuring had to be done on the backs of workers and retirees rather than have all stakeholders come to the table," Gettelfinger said. "They were trying to pierce the heart of organized labor while representing foreign brands," that have plants in the southern United States and use non-union workers.

Shortly after the UAW press conference in Detroit, Republican Sen. Bob Corker of Tennessee roared back at the union from Washington. Corker suggested the union bore the burden for the measure's failure.

"I offered them a solution," Corker said of the Thursday talks. "Our caucus was 100 percent behind it. Do we own it, or does the UAW own it?" Corker chided Gettelfinger for not participating in the discussions. "I asked him to come to the table, not assign somebody to come back and forth. It didn't work out."

Corker said he proposed that wages and benefits of UAW members be lowered next year to match rates at American plants run by foreign automakers, and gave the UAW the chance to pick the date when the pay cuts would be made. He could not sell a compromise to other Republicans without that agreement. "We just could not get a date," Corker said of his Thursday discussions with the UAW. "It was an amazing thing to me."

Gettelfinger countered there is no way to tell what Republicans mean by competitive wage and benefit rates. In the 2007 labor agreement, the UAW agreed to slash starting wages and benefits for newly hired autoworkers at the Detroit automakers to as low as $14 an hour. Those cuts don't affect current workers, whose hourly pay and compensation is about $55 an hour. The figure climbs to more than $70 an hour when automakers' costs for health care for retired workers and retirement benefits are factored in.

The hourly pay and compensation at foreign automakers is about $45 an hour, labor analysts say. Gettelfinger said that excluding benefits, UAW workers earn just over $28.12 an hour in wages, on average. That compares with $30.45 an hour, which includes profit-sharing bonuses, for non-union workers at Toyota's Georgetown, Ky., plant.

The UAW's back is up against the wall, said Gary Chaison, labor professor at Clark University in Massachusetts.

"This whole bailout, at least today, has become a debate that is very ideological and geographical, and the UAW is in a very difficult position now," Chaison said. "It's become about the American labor movement, about North versus South, about labor and anti-labor, about free trade versus regulation. Gettelfinger must be frustrated because he's a practical guy, but, with this ideological fight now, it limits his options and how much he can bargain."

Gettelfinger indicated Friday "we were prepared to make further concessions" but didn't provide details.

The debate over UAW wages and benefits is something that's often argued, even in Detroit. UAW members such as Local 22 President George McGregor say they occasionally have to defend themselves to other working-class residents.

"I get it sometimes from the cashier where I buy my groceries over on the east side," of Detroit, McGregor said, who represents workers at GM's Hamtramck Cadillac plant. "I'm wearing my shirt with the UAW logo, and I'm paying cash, when the cashier asks, 'How come you all make so much money? " McGregor said. It's unfair,'

In the student center at Wayne State University on Friday, a group of classmates also were discussing the pros and cons of UAW wages and benefits.

"If you put in the seniority, I don't see why you should lay blame towards them," said Courtney Griffith Jr., 18, of Detroit, whose father is a GM hourly worker.

But Mikaela Manley, 18, of Oak Park, says the wages of UAW workers should be cut. "A lot of them don't even have college degrees, and here we are, working hard and sacrificing to get an education, and yet they will get paid more than us," Manley said.

|

Every assembly plant

in Ontario facing cuts

Lengthy downtime bound to trigger layoffs at auto-parts suppliers

Dec 13, 2008

Tony Van Alphen

Isabel Teotonio

Staff Reporters

Tens of thousands of anxious workers in Ontario's auto industry will be off the job during the next few months as plunging sales in the U.S. hammer production here.

Company and union officials confirmed yesterday a new round of production cuts for December and the first few months of next year that will hit every assembly plant in Ontario for some time.

The lengthy downtime at some assembly plants in Oshawa, Oakville and Windsor will also trigger significant layoffs at scores of parts makers who supply them.

"All of our (auto) workplaces in Canada are experiencing reductions and temporary layoffs," said Ken Lewenza, national president of the Canadian Auto Workers. "Every company is being very stringent on overbuilding now."

Industry leader General Motors of Canada Ltd. said it will idle its Oshawa car plant for three more weeks in January and February, in addition to the two weeks announced earlier. The plant, which primarily builds Chevrolet Impalas, is also reducing output from three to two shifts.

The company, whose U.S. sales have crashed more than 40 per cent in recent months, has already scheduled four weeks of downtime at its adjacent Oshawa truck plant in the first few months of next year. That plant will close later in the year.

The growing cuts are increasing anxiety among workers. At My Sister's Place, a popular bar around the corner from the Oshawa complex, much of the talk centred on the pending shutdowns.

"I mean, it's only people's lives that they're playing with, but who cares about that?" said Gregg Barton, 49, taking a swig of beer. "The company is not telling us anything."

It's not only the uncertainty that has left him shaken. Barton, who is eligible for retirement next year, fears GM may declare bankruptcy and his pension will be in jeopardy.

"A lot of people don't realize just how serious this," said Barton, whose comments were greeted with nods from fellow workers.

"This is going to impact everyone," added Mike Moher. "The whole economy is going to be hurt."

Debbie Comartin, a 21-year GM veteran, always thought she would have a "stable job" with the company, but the shutdowns have shaken her confidence.

"I just assumed I'd be here for 30 years, but will I be here for nine more years?" said Comartin, 46.

CAMI, a joint venture between GM and Suzuki Corp. in Ingersoll, disclosed that it will extend downtime from three weeks to six in January and February.

In another huge production cut, Ford Motor Co. of Canada Ltd. will stop building crossover utility vehicles, including the Edge, at its Oakville complex for 10 of 19 weeks between Monday and the end of April.

Ford is also idling its sputtering car assembly plant in St. Thomas next week and the week of Jan. 5. It was down this week, too.

Chrysler Canada Inc. is halting production at its minivan plant in Windsor during January. It will also close some engine operations for two weeks this month and next.

The company is slashing output at its Brampton plant, which builds the Chrysler 300 and two sports cars, for two weeks in January.

Laid-off workers at GM, Ford and Chrysler will get about 65 per cent of their gross pay through a combination of company benefits and federal employment insurance.

Honda Canada said it's slowing output in Alliston by about 9 per cent during the next three months – despite producing the Civic, one of the most popular vehicles in North America. Workers will have the option of taking vacation time or extra training.

Toyota is also curbing January production at its Cambridge operation and a new plant in Woodstock. |

Ottawa pledges billions

to avert auto meltdown

Queen's Park joins $3.4B plan to bail out struggling GM, Chrysler

and Ford, provided U.S. aid approved and Canadian firms'

restructuring plans are sound

Dec 13, 2008

Tony Van Alphen

Business Reporter

Rob Ferguson

Queen's Park Bureau

Canada's struggling automakers will get roughly $3.4 billion in emergency aid to "keep the doors open" – but only if the Americans put money on the table first, says federal Industry Minister Tony Clement.

The aid is also conditional on restructuring plans by the Canadian arms of General Motors, Ford and Chrysler meeting government approval, Clement told a news conference last night.

"The federal and the Ontario governments are prepared to move quickly if and when the Americans approve a support package," Clement said following weeks of talks between Ottawa and Queen's Park.

"It's absolutely not a blank cheque ... we have to protect the interests of the taxpayer. This is about conditional support based on their long-term plans, based on them working with the parts suppliers, based on the unions being at the table, based on the United States continuing to be part of the solution."

The U.S. government pulled the auto industry from the brink of collapse earlier yesterday with a pledge for interim financial aid, although an amount is still being worked out.

In an escalating crisis, the Bush administration said it would step in to provide billions of dollars in loans and lines of credit for the next few months to reeling GM, Ford and Chrysler in the United States.

The move came after Republicans in the U.S. Senate stunned the industry by refusing to pass an interim $14 billion (U.S.) rescue bill late Thursday.

The Canadian aid package will be proportional to any U.S. assistance, based on the Canadian share of North American auto production, putting the price tag to taxpayers at about $3.4 billion (Canadian) based on the $14 billion American proposal.

The final amount "depends on what the U.S. administration comes up with," Clement said.

In total, the Canadian automakers are seeking up to $6.8 billion in emergency and long-term aid to cope with plunging sales and the need to restructure operations.

Hopes for a bailout didn't stop the automakers from announcing yesterday a slew of production cuts and temporary layoffs later this month and into the new year.