STUFF INDEX

Do you need to

buy rental-car

insurance?

________

Retirement

planning: How

not to outlive

your money

_______

How an

impaired

driving conviction

can affect your

car insurance

rates

_______

Pros and Cons

of Retiring

in Las Vegas

_______

What to do if

you just can't

wait until the

next rest stop

________

7 paths to

a fulfilling

retirement

_______

When can I

legally pull over

to answer a text

or phone call?

_______

Not knowing the

"Move Over"

law could cost

you $490

_______

Academy Award

Winners

March 3, 2014

_______

New test

coming soon

for elderly

Ontario

drivers

_______

Canadians

stock up on

incandescent

bulbs in wake

of ban

_______

How mature

drivers get their

groove back

_______

I didn't file a

claim. Will my

insurance go

up anyway?

________

Three surprising

ways liquor

and cars can get

you arrested

________

7 no-brainers

to save on gas

________

How can I tell

my husband

he's a terrible

driver?

________

What is funeral procession protocol?

________

For oil changes, which matters most: time or mileage?

_______

Mark Cullen's spring gardening advice

_______

CAW Local 584

Receives

Community

Service Award

from

The Knights

Table

_________

At 90, saving,

sharing and

planning

for 100

________

Long-term care

insurance can

be expensive

_______

Preparations

will keep car

safe for winter

________

5 tips for

Cyber Monday

shopping

______

Here's what to

do if your car

skids on ice

________

Ripping off

Grandma: Why

seniors should

practise tough

love

________

Is it better

to buy or

lease a car?

_______

Our kids think

we need a

seniors' home

_______

Ooma helps get

rid of monthly

phone bills

________

9 ways to protect

yourself from

computer fraud

________

2012 income

tax season:

11 questions

you are afraid

to ask

_________

The final

winner list

of 2012

Academy

Awards

_______

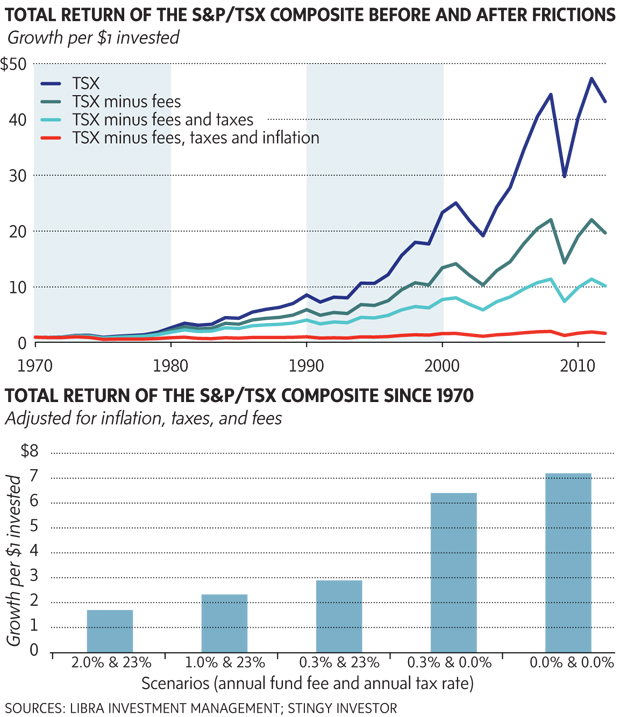

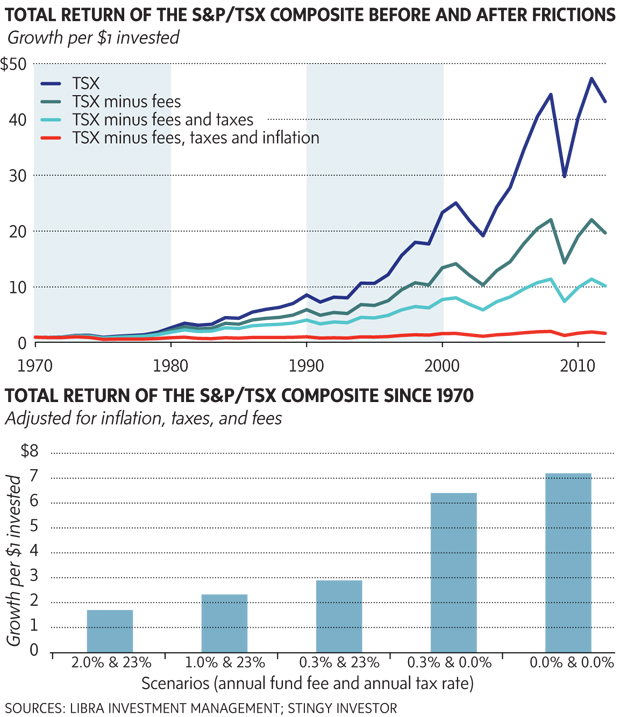

How to beat the

three villains

that can steal

your retirement

________

ABS brakes can

add to stopping

distances

________

I cut my phone

and cable bills

by asking

_________

Car warning lights

should

never be

ignored

________

How winter

tires differ

from snow

tires

_________

55,000 eligible

Canadians aren't

getting CPP.

Why?

________

Map publishers

facing a

rough road

________

Should I always have collision coverage?

________

Automated bill

payments not

always a good

idea

_________

Kids are

safest with

grandparents

behind the

wheel: study

________

Few would trade

health benefits

for $10,000 cash

________

How old is too old to drive?

________

How to choose

an executor for

your estate

_________

Why do I need a

lawyer to help

me with my will?

_________

How to

eliminate your

car's dreaded

'blind spot'

________

Five common

road offences

you might not

know

________

Lease a car or buy it? Some pros and cons

________

Should I rust-

proof my new

car?

_________

CPP survivor

benefits start

at $2,500

________

The 3 worst

things drivers

do, according

to top racer

_______

The final

winner list

of 2011

Academy

Awards

_______

What to wear

to a funeral

_______

Burial vs

cremation:

The options

________

5 things to

consider when

choosing a

funeral home

________

Is it a good idea to prepay your funeral?

_______

What happens if you declare bankruptcy

________

Oil changes: who’s right – automaker or dealer?

________

3D: mainstream in homes in two years?

________

Cross-Border Shopping Tips

_______

How often do I need to change my oil?

________

Click on a

date on any

Calendar

________

The hidden cost of 'free' rewards

________

Should I fill my tires with nitrogen?

_______

Hands free

driving laws

_______

Picking the best among the classic Mustang, Camaro and Challenger

_________

`Just a silly spider bite' leaves senior paralyzed

_______

Gratuitous Tips on Tipping

_______

Life span vs. age at retirement

_______

Why auto Ins rates are rising

________

New Border Travel Requirments

_______

CAW Pension Rally Video

April 23, 2009

Calling on Retirees

Upcoming Rally

CAW LOCAL 584 IN-PLANT ELECTION RESULTS

Clock ticks on drivers who

need new

Border licence

Ontario’s Drinking &

Driving Law

has changed

May 1, 2009

They're Shutting Detroit Down

Music Video

CAW/GM 2009

RATIFICATION

BROCHURE

Beatles Songs

& Videos

Shutting

Detroit

Down

Listen to

John Rich's

New Song

View any Newspaper from any city in the world

2009 Academy Award Winners

Click on the

year you were

born

and read

the news for

that year

Square One Senior Discounts

Flash Back

to 1990

Ratification of 2008 Contract

Chrysler Bargaining report 2008

Article by Sam Gindin on Panic Bargaining 2008

A clear choice: plasma or LCD?

Solidarity Forever - The Words & Music

10 Q&A's on Canadian Pension Income Splitting

Poem: An Old Man's Last Stand

To flash, or not to flash, for cops? |

|

Do you need to buy

rental-car insurance?

NEIL VORANO

The Globe and Mail

Oct. 30 2014

It's been a long flight and you're feeling tired as you exit the airport toward the car rental office. You can't wait to get a car to get to that beach-side villa, the one you found a great deal on over the Internet. The car rental itself was dirt cheap, too, especially since you glossed over the added insurance on the website.

However, as you're signing for the car, the clerk behind the counter asks: "Would you like the added insurance? Otherwise, you'll be liable for the car." You freeze, your tired mind wondering what that even means. "I'm insured on this," you think. But are you? Do you get the added liability coverage or stick with your own insurance? There isn't one simple answer.

"When you get to that desk, that's the last place you want to make that decision," says Steve Kee of the Insurance Bureau of Canada. Kee says that getting as much information about your own insurance before you go to the rental office is key to both protecting yourself and saving money, because the onus lies with the renter to ensure coverage for any claims. Whatever coverage you have is not necessarily the same as that of someone else.

"You want to check your limits and, again, some people's insurance is fine," says Kee. "Sometimes [with] a credit card, you need to check what the policy will include; does it include third-party liability? Not every card, not every situation will be the same."

For example, say you have just basic car insurance on an older beater; that's the coverage you'll have on the rental if you decline the added agreement. If you have an at-fault accident in the rental, you're on the hook for repairs to the vehicle or, in a worst-case scenario, the cost of the car at its present-day value. It's a good bet that rental is newer and more expensive than your car is.

Insurance and liability coverage rates vary not just by company, but also by region. Rates for a car rented in Toronto, regardless of where you drive it, is different than say, in Chicago. That's because repair costs are different from region to region. As well, some companies have added fees in the event of an accident; National Car Rental, Alamo Rent A Car and Enterprise Rent-A-Car (all owned by the same company) will charge a rental fee for a damaged car for every day it's in a repair shop. Does your car insurance or credit card cover that? Those fees are waived if you purchase the rental company's "collision damage waiver" – which is not so much insurance as it is an agreement between renter and the company that says, if the car is damaged or stolen, the renter won't be liable.

Stephen Menon advocates getting the facts before renting, but his focus is on credit cards. He's the associate vice-president for consumer card products at Toronto-Dominion Bank.

"Typically, car rental, collision, loss and damage insurance is available on our platinum or premium products, those with annual fees," says Menon. "You can check online for the terms and conditions for your card ... Or, simply give us a call from the number on the back of your card, or come into a branch, and we can walk you through your coverage."

Calling is important because, again, there are stipulations on the coverage that you may not think about.

"There are certain countries that are bound to be excluded, for various reasons," Menon says. "Also, exotic cars may not be covered, so it's important to check the terms of your card to understand the coverage you have. But with the typical car rental, you should be covered."

If you need to rent a large van or truck, chances are good your car insurance doesn't cover larger commercial vehicles. U-Haul offers an agreement that not only covers the truck itself but also the contents. It won't, however, cover a motorized vehicle you may be towing.

Generally, you won't pay a deductible for rental company coverage, but that's important to check. And having rental coverage isn't a free pass to have an accident, either. A serious crash, one that has to be reported to the police, will affect your insurance rates, as it will be reflected on your driving record at renewal time – just as it would if you got a speeding ticket in a rental.

Ultimately, you are responsible for the car you rent, whether you use your own vehicle insurance, credit card or the rental company's supplementary insurance.

"It's important for people to make that first call to your insurance company, to find out if everything would be okay," says Kee. "An extra 10-minute phone call can save you a heck of a lot of frustration."

**************************************************

Posted from Las Vegas Advisor - Oct 30, 2014

You’ve done your online due diligence and gotten the best rental-car deal you could find. You’ve resisted upsells. You’ve done your homework on insurance coverage. You’ve signed on the dotted line and received the ignition key. You’re standing in front of your rental car.

Like it or not, you still have another series of hurdles to clear.

First, in what condition do you find the car? Is it brand new and shiny without a scratch on it? Is it dirty or dusty enough that it could hide big dents? Do the tires have plenty of tread? Is the registration current? Does the interior smell of cigarette smoke? Is it "gently used," as they say in the (gentle) used-car business, with a paint chip here and a small ding there? Is the windshield pitted, even slightly? Are there any dents in the roof or dimples in the undercarriage? (Not joking; keep reading.)

If you spot a scratch, dent, chip, ding, or pit while you’re examining the car – anything that could come back at you for not being noted beforehand – inform an attendant. You’ll either need to document the damage or, in extreme cases, request a different vehicle. A lazy, incompetent, or malicious attendant might try to slough off a ding or a scratch, saying something like, "It doesn’t count," or "That won’t be held against you." But don’t believe it. Everything counts. Everything will potentially be held against you. You’ll be held accountable if you don’t have incontrovertible proof that the car wasn’t perfect when you found it. On occasion, you’ll be held accountable even if you do have incontrovertible proof.

Which is why the experts strongly recommend that you allot plenty of time to not only closely examine the car before you accept it, but also photograph or videotape it after you do. In short, pull out the cell phone or camera and start collecting evidence.

If you’re in a dark or dim parking garage, drive the car to where the light is adequate for picture-taking. Shoot at least two close-ups of the exterior of the car, including the front and rear windshields and bumpers, the fenders, tires, roof, and even the undercarriage. (Sound excessive? In researching this QoD, we read a story in which Enterprise, which showed up repeatedly as one of the most aggressive rental companies when it comes to damage claims, billed a customer weeks after he returned the car for several hundred dollars in damage it supposedly found underneath the car. Who knows when, or even if, it happened?)

Several shots of the interior should include the dashboard, all seats, ceiling, and trunk. If you want to be extra careful, take snapshots of the wheels and under the two bumpers. You can’t take too many photographs as evidence. And whether you’re shooting stills or video, hold the camera steady and time-stamp the photos, or state the date and time into the video.

Retain the images or videos (ideally transferring them to your computer) for six months. According to one ombudsman, six months was "the longest I’ve seen a car rental company wait to file a damage claim."

In addition to the photos and/or video, a lot attendant should provide a form with a diagram on which you note the condition of the vehicle and identify any problems. Don’t leave the lot without recording any pre-existing damage on this form and having a car-rental employee sign it and give you a copy.

Finally! You’ve attended to all the condition details and now it’s time to get into the vehicle and drive off. But … not so fast. Do you know how to start the car? To put it into gear?

Don’t scoff; new cars these days have all kinds of tech you might’ve never seen before. Anthony Curtis had occasion to rent a car recently and wound up in a pickup truck; he spent ten minutes looking for the gear shifter before asking someone where it was. (It turned out to be the round knob near the radio that looked like the volume control.)

Do you know how to turn on the ignition, lights, and windshield wipers? Do you know how to open the trunk and the gasoline fill door? When in doubt, ask. Also, check to see that there’s an operating manual in the glove compartment. If you’re renting the car for any length of time, chances are that at some point, you’ll have to refer to it.

An excellent precaution is to have AAA or another road-rescue service, with the an extended-towing option. You never know when you might need it, especially in a rental car for which you’re liable, but it’ll almost always be in some sort of emergency.

Speaking of which, what if the worst happens and you’re in an accident?

This is an area of major controversy. These days, rental companies take a hard line with customers who damage their vehicles. Indeed, we’ve heard a number of stories from Vegas visitors who insist car-rental companies trumped up damages; they claimed scratches or dents for which they were billed were either pre-existing or didn’t exist at all.

God forbid you’re in a major accident, but if you are, the claims process is straightforward, since no one, presumably, is disputing the damage. (One or another party might dispute the fault, but that’s for the insurance companies to determine.)

Most of the disputed damage claims are for little scratches, dings, and dents that you didn’t notice, that probably occurred when you were parked and out of the vehicle, or perhaps when a pebble hit the windshield on the freeway. (Windshield cracks are the number-one source of rental-car damage claims.)

If you’re aware of damage that occurred while you had the vehicle and alert an employee to this fact, you’ll most likely fill out a claim form on the spot. Signing the form is your admission of the damage and your agreement to pay for it. Think you shouldn’t be responsible for damage to the car while it was parked or for a pebble that dinged the windshield? Think again. If the car was damaged while it was in your possession, you’re liable.

One ombudsman writes, "Recently, some rental companies have begun charging a renter’s credit card a deductible even when there’s been no formal damage estimate. I’m skeptical of that practice. While it may be legal, I think you’re better off waiting for a bill before paying up, or asking your insurance to settle the claim."

If you paid for the rental-company insurance, you just won the wager. But if you didn’t, you’ll have to file a further claim with your personal-insurance or credit-card company (and do it promptly; there’s often a time limit on filing claims).

If you’re not aware of damage to the car, you’ll be surprised to learn about it when you receive a letter from the rental-car company (or its insurance carrier). That’s why you should go through the same evidence-collecting process upon returning the car that you did before accepting it. Date- and time-stamp the photos or video. Then find an employee, walk around the car, and have him or her sign off on the condition form, presumably certifying that you’re returning the car in the same condition in which you rented it.

The ombudsman adds, "If no one is available, go inside, ask for the name and email address of the branch manager, and send the manager a brief email with your name, rental number and a few snapshots of the car as you returned it. Is that overkill? No, and especially not if you are using your own insurance, as opposed to the optional Collision Damage Waiver offered by the rental company. It signals to the rental location that filing a frivolous claim against you will be difficult."

What if you receive a letter from the rental-car company, accusing you of damaging the car and billing you for the average $800, including the cost or repairs and loss-of-use and diminished-value fees? Naturally, you’ll peruse everything carefully, paying particular attention to the license-plate number; if it’s not the same as your car, you’re obviously in the clear. (This is also true if you receive a letter with a parking ticket or photographic evidence of a moving violation, such as failing to pay at a tollbooth or running a red light.) And obviously, if you have your own photographic evidence disputing the company’s claim, send it back and chances are the whole thing will be dropped.

What if it isn’t? Then, you’ll have to go on the offensive, which is beyond the scope of this answer; google "disputing rental-car damage claim" and good luck.

However, we will say that you should be alert to possible scams. Signs of those include an amount that approaches $500 (the usual car-insurance deductible); damage to the roof or undercarriage (yes, here we go again); exorbitant cleaning fees (for example, for pet hair or cigarette smoke, when there were no animals or smoke in the car); and other suspicious claims that quiver your red flag.

So there you have it, everything that commonly goes wrong during the car-rental process. Are you deathly afraid to rent a car now? Don’t be. The original question mentioned that one in six people who rent a car experience some sort of damage to it. This means, of course, that five in six people (83%) don’t have any problems and, presumably, most of those who do are adequately insured.

So grab your best rental-car deal, make sure you’re adequately insured, collect evidence of the car’s condition before and after the rental, and don’t worry, be happy.

UPDATE: 10-29-2014 We're actually posting some "Updates" to this one before it even goes live, since we've been accumulating email responses all week with regard to this car-rental trilogy, and we saved the "damage" stories until now. Thanks to everyone who's taken the time to share their stories, good and bad, and their additional tips and insights into navigating this potential minefield. Forewarned is forearmed, as they say, so do like Deke says and don't worry, be happy!

- "I'm sure everyone has war stories. Here are a couple of mine:

-

1. I was at Enterprise in Seattle. The were out of full size cars but the agent steered me towards a shiny new Dodge Ram pickup truck and I thought “why not?” I pointed out a small poc mark dent in the rear chrome bumper but he pulled out a plastic card and said “no problem, any dent smaller than this circle is not an issue.” When I returned the truck a few days later that dent became an issue. I repeated what the check-out agent had told me and I thought it was over. A week later I received a letter and a bill from Enterprise claims in Texas. I thought “no problem, I have Alaska Airlines VISA rental car insurance.” It was then I found out the VISA insurance in the fine print excludes pickup trucks! I argued with Enterprise over the next six weeks or so mainly about the check-out agent and his plastic card. Eventually it all went away.

2. I rented a nice Volvo S-80 from Hertz at the Boston airport. I didn’t realize it at the time but that evening when we stayed at a hotel in Boston, someone keyed both sides and the front of the car. It had been raining and I didn’t notice the damage. The next night we valet parked at the Mohegan Sun in CT. When I retrieved the car a couple of days later I noticed the damage. I assumed my irate tone of voice and talked to several casino execs about it. Finally I got them to agree they would pay for the damage (even though I later realized it had probably happened in Boston). However when I returned the car about a week later it was also raining and the scratches were difficult to see and they didn’t say a word. I never heard from Hertz.

3. I rented a nondescript full size car from Hertz in Las Vegas. After 5 days we were driving down I-15 to turn in the car when someone threw a large item (rock, piece of concrete?) at the car which hit the passenger-side door with a loud bang. I didn’t stop – freeway, you know – but when I was checking in the car the agent noticed the dent. “You’ll have to go inside and talk to one of our agents” he told me. The whole place was very busy so instead, my wife and I just hopped on the shuttle back to the airport. I never heard from Hertz. I’m not sure what the moral of these stories is. Maybe try disappearing. Or try returning the car on a rainy day. Or rent from Hertz. If none of those work, act righteous and stand on the high moral ground. . Fortunately I’ve never been in a serious accident with a rental car – yet!"

-

"You said you wanted to hear about valet horror stories... At the Marriott/Atlanta downtown the valet sideswiped the rental van. I thought something was strange when the valet brought up the van on the wrong side. Sure enough--the entire side of the van (the side that was not visible when he brought the car up to us) had been scraped on something. Damage to the entire side of the car!) Called for the manager. He said, 'well just drive to your meeting. We'll discuss later.' We said no way! Took a cab and returned to meet with the hotel. The Marriott declined responsibility saying the valet was a subcontract. I carry the Diners Club Card since they provide 'primary coverage'. Nonetheless, demanded that the valet service work with the car rental company--don't involve me! National Rent a Car billed for the damage (over $2000 as I recall) plus a week of "loss of use" while the car was repaired. The valet service finally took responsibility and paid the bill! Big hassle--luckily we found the damage immediately and confronted the employee--if we had driven the car off the property I assume they would have declined responsibility!"

-

"When I rented from Hertz in Las Vegas it was so dark and poorly lit in the garage I could not inspect the car for dents, etc. This is a common ploy of rental firms. I now take a flashlight with me to inspect the car and routinely take a video of the exterior with my cell phone. This has paid off on several occasions when a small dent or scratch was noted on check in and I simply showed the tech the video where this dent or scratch was already there."

|

Retirement planning: How

not to outlive your money

Ian McGugan

The Globe and Mail

June 13, 2014

Shortly after my great-uncle and great-aunt retired, they came up with what seemed like a foolproof plan.

They would take the modest pension that my Uncle Jim had accumulated since emigrating from Scotland, sell their house, and say goodbye to brutal Lake Erie winters forever. As my Aunt Mary told my parents, they intended to spend "the last few years we have left" enjoying the sun and heat of Florida.

Good plan. Bad timing.

The year was 1969. Over the next few years, rampant inflation gobbled up the real value of their pension. Every dollar they possessed lost half its buying power in the first decade of their Florida retirement.

And those "few years"? They stretched on and on. Uncle Jim passed away at 86; Aunt Mary just kept on going. She died in 2000, shortly before her 101st birthday.

Uncle Jim and Aunt Mary taught me that life's twists can derail even a reasonable retirement plan. Their example underlines an important truth: Stuff happens. Perhaps you live longer than you expected. Perhaps investments don't perform as you hoped.

Retirement is ultimately an exercise in risk management – and dealing with risk involves an educated understanding of how unforeseen events can sabotage your golden years.

The greatest single hazard is what planners call "longevity risk" – the possibility that you may outlive your money.

Actuaries tell us that a woman who is now 65 can expect to live, on average, to 88, while a man can look forward to reaching nearly 86. Remember, though, that those are averages – about half of retirees will outlive those figures. In fact, if you are now a 50-year-old woman, there is nearly a 10 per cent chance that you will live to celebrate your 100th birthday.

How do you plan for a retirement that may be as long, or longer, than your working life? For the dwindling number of Canadians who are members of defined-benefit plans with automatic cost-of-living adjustments, there's little to worry about. For most of us, though, there is a lot of risk in planning three decades ahead – especially given two additional hazards.

One is the danger of inflation eating away at the purchasing power of our savings. It doesn't have to be the out-of-control inflation of the 1970s – over the course of a couple of decades, even a modest 2 per cent annual rise in living costs can blow a hole in the purchasing power of a pension that's not adjusted for rising prices.

Then there's market risk as well. In theory, a steadfast investor who builds a well selected stock portfolio should do well over time. But, in practice, the payoff can require more patience than most people possess.

Someone who held an S&P 500 index fund for a decade between 2000 and 2010 would have lost money (excluding currency gains). An investor unlucky enough to retire in 2000 or 2007 with a bulging stock portfolio would have seen their holdings nearly instantly eviscerated.

A good retirement plan should address longevity risk, inflation risk and market risk. Here are the pros and cons of three key risk-management tools:

Annuities

An annuity is essentially a contract with an insurance company, which guarantees to pay you a steady stream of income until the day you die.

If you don't already have a pension, it makes good sense to devote part of your savings to purchasing an annuity. By doing so, you gain some peace of mind as well as the ability to invest the rest of your portfolio more aggressively.

But there are drawbacks. Annuity rates are tied to interest rates. With rates so low today, annuities are expensive. Plus, most offer no protection against inflation.

Work

Taking a part-time job in the early years of your retirement can make a big difference to your financial picture. Earning even $4,000 a year replaces the income you could reasonably expect to generate from a $100,000 portfolio. It also provides a buffer against unexpected inflation.

The obstacle, of course, is that many people find it difficult to find employment in their senior years. And some of us simply never want to see a workplace again.

Your portfolio

Many people can achieve big gains from simply adjusting their portfolios to reduce the cost of investing and to ensure the right mix between income producers (like bonds) and more inflation-proof investments (like stocks).

The problem? Many people don't like managing their own money. If you've never taken an interest in investing, retirement is not a good time to start taking charge of your own portfolio.

The bottom line

It all sounds very intimidating – but doesn't have to be. Despite their challenges, Uncle Jim and Aunt Mary never complained, but simply found ways to live on less.

They enjoyed their retirement. You can too. |

How an impaired driving conviction can affect your car insurance rates

JASON TCHIR

The Globe and Mail

Jun. 12 2014

Drunk driving is risky – and insurance companies say they don't like risk.

"In our view, an impaired driver is more likely to be a repeat offender and has an increased risk of causing a serious accident," says Glenn Cooper, spokesman for Aviva. "Those convicted of impaired driving, even if not involved in an accident, have made an unsafe choice putting many others at risk."

Like most private Canadian insurance companies, Aviva won't insure drivers convicted of impaired driving for three years after the conviction. Drivers who can't get insurance from a regular company have to move to facility insurance, "the market of last chance for drivers who cannot find insurance elsewhere," Cooper says.

That coverage comes with a price. It can cost up to $8,000 more a year than regular insurance.

Risky business

We asked several insurance companies for actuarial evidence to explain why the hike is so high.

Intact Insurance said their data shows that drivers with an impaired conviction are 30 to 40 per cent more likely to be involved in an accident.

"Why do drivers with an impaired conviction pay higher premiums? The obvious answer is because they're a higher risk," says CAA spokesman Kristine D'Arbelles. "We don't have any actual data that shows impaired drivers will reoffend one or two or three times, but impaired convictions tend to be a chronic issue."

MADD Canada says 30 per cent of drivers with an impaired conviction get another within 10 years.

If insurance is too high, some drive without it

Drivers with drunk driving convictions should be paying less than they're paying in Ontario, says MADD CEO Andrew Murie.

"In Ontario, a typical impaired conviction will move your insurance premiums from around $2,000 to between $8,500 and $10,000 a year – that's a lot of money," Murie says.

Because facility insurance is unaffordable for many drivers, some don't tell their insurance companies they've had a DUI, Murie says. Or, they drive without insurance entirely. Neither choice is good for the other drivers on the road, he says.

"If you don't tell them and just keep making your payments, the insurance company won't insure a crash if you have one," Murie says.

Insurance companies might not know you've had an impaired driving conviction until they check your abstract. And they don't do that as often as you might think. A 2013 U.S. poll from InsuranceQuotes.com found that only 31 per cent of drivers saw their premiums rise after traffic tickets.

"We often find in cases where we discover an existing customer has a new conviction for impaired that he/she also had prior impaired convictions," says Aviva's Cooper.

A break for drivers with ignition interlocks?

Murie says private insurers should follow the lead of Canada's government-run insurance companies and allow drivers with DUI convictions to keep their insurance and pay an extra surcharge of up to $1,000 a year if they've installed an ignition interlock.

"We need to keep these people in the system," Murie says."If they're putting on this interlock which does not allow them to drive impaired, they should be eligible for a significant reduction."

The device is a breathalyzer that doesn't let your car start if your blood alcohol level is above a set limit. Drivers also need to give breath samples while driving to keep the engine going.

Ontario and every other province except New Brunswick and Newfoundland has an interlock requirement, Murie says.

"The data shows that this technology works, it's not like they'll have to wait 10 or 15 years for the data," Murie says. "It boggles my mind that they're not doing this."

MADD has asked insurance companies to offer a break for interlock users, Murie says, but they've had no takers.

"I don't think insurance companies will willingly do it on their own," Murie says, "It will have to be up to the Superintendent of Insurance."

|

Pros and Cons of

Retiring in Las Vegas

Las Vegas Advisor

June 10, 2014

We don't often see Las Vegas promoting itself as a retirement destination. Rather, Las Vegas seems to us to be much more interested in short-term visitors with plenty of money than long-term residents moving here for myriad personal reasons.

Perhaps it's because Las Vegas' self-promotion is geared more to the four-sizes-fit-all of gambling, dining, entertainment, and shopping. By contrast, the motivations for residency, including retirement, tend to be particular, exclusive to individuals. Since you don't specify your own reasons for wanting to retire here, we can only comment in general on how Las Vegas is perceived as a retirement destination by pundits, analysts, and list-makers.

On the con side, a list published by Huffington Post (January 2014) included Las Vegas as among the seven worst places to retire. It cited not only the high foreclosure rate, but specified "bank-seized 'vampire' and homeowner-abandoned 'zombie' foreclosures." It also pointed to negative job growth, an unemployment rate 6% higher than the national average, and poor access to doctors. "Only 69.7% of Las Vegans have a usual source of health care, much lower than the national average at 82.4%, according to a study by the Commonwealth Fund."

Another example: On Sperlings' list of the 300 best places to retire, Las Vegas didn't rank in the top 100 (#129). "Although it's a fact that the weather is great and housing is pretty cheap, the city received negative scores for crime, economy, and access to good health care."

Neither did Las Vegas appear on TopRetirements.com's top 100 places to retire in 2014 (Mesquite ranked #33, Reno #73).

Las Vegas was nowhere to be seen on the Forbes' list of the top 25 best places to retire, U.S. News and World Report's list of best places to retire on $75 a day or for under $40,000 a year, or even Kiplinger's "top-ten tax heavens" in the U.S.

Beyond the volatile housing market, questionable health care, and a crime rate higher than the U.S. average, the prevalence of gambling could be enough of a temptation that some people wind up risking or losing their retirement savings. This is especially true for those who've become accustomed to a certain level of comps earned as visitors, which can change with a local address.

In addition, summers are sweltering, which impacts just about everything, including utility bills, auto maintenance, outdoor activities, travel, and health. Winter temperatures also surprise some new residents; the average low temperature in January is 37.

And although there are many nice neighborhoods, having to drive everywhere might prove off-putting to some, as could concerns about the future water supply.

Then there's the flip side, the arguments in favor of retiring here.

In February, Las Vegas was named the #1 best place to retire by MoneyJournal.com, an e-magazine, on its annual list of top tens. The website especially liked the extent of the recovery of the local economy and the active housing market, with lower home prices attractive to retirees (assuming that they'll buy houses when they retire here). Other advantages cited included abundant dining options, plenty of casinos, a warmer climate the majority of the year, and no state income tax.

One of Las Vegas's biggest draws, certainly, is that it has neither a state income tax nor an inheritance tax, leaving retirees with more money to enjoy while they're still alive and to pass on. Nevada's entire tax structure is resident-friendly; a majority of state taxes are collected from visitors.

According to several surveys, Las Vegas' cost of living is 5.8% lower than the U.S. average.

In addition, there are numerous 55+, active-adult, age-restricted, and retirement communities in all varieties: homes, villas, condos, townhomes, and apartments, most located in gated subdivisions for security.

Las Vegas is also an easy place to fly in and out of.

Chances are, you'll recognize your priorities somewhere in the above pros and cons and have a better idea if Las Vegas is an attractive retirement option for you. At the least, we hope we've given some food for thought to point you in the right direction for further research.

|

What to do if you just can't wait until the next rest stop

JASON TCHIR

The Globe and Mail

May 6, 2014

Sometimes, you can't wait for the next gas station or rest stop (or don't know when it's coming) and you have to pee at the side of the road. Especially if you have kids in the car - sometimes they just can't wait. Is it illegal, even if you find some bushes or if nobody else is coming down the road? Could a little tinkle get me a criminal record?

Urine, big trouble? Probably not, as long as you're smart about it where and how you take your impromptu rest stop, police say.

"Let's just say that in my 30 years of policing, I've never charged anyone with peeing on the side of the highway," says Ontario Provincial. Police Sgt. Pierre Chamberland. "Generally speaking there's no issue, unless they're impeding traffic or doing it in such a way that they're exposing themselves."

Pee breaks aren't addressed in Ontario's Highway Traffic Act, but pulling over is illegal on the 400-series highways except for emergencies, the Ministry of Transportation (MTO) says in an email statement.

Where pulling over is not illegal, "drivers should ensure their vehicle is parked as far from the edge of the highway as possible," the MTO says.

Would a pee break count as an emergency? It can certainly feel like one. It's up to police to decide what charges to lay.

Penal code?

Chances are, you wouldn't be charged with exposure under the Criminal Code of Canada, says Vancouver Police Constable Brian Montague.

"For a criminal charge, the actions of someone generally have to be for a sexual purpose." Montague says. "Many places may have a health by-law that may be applicable. In Vancouver it is against a city health by-law to urinate in public."

That could carry a $250 fine, but "officers have a great deal of discretion and not all incidents would result in a ticket," Montague says.

A cop might not buy "but officer, I was stung by a jellyfish," on the way from Sudbury – but they probably know what you're going through.

"Everybody with kids has had to pull over for this at some point," Chamberland says.

A UK couple tried to get their local government to close a spot used by motorists for pee breaks near their home, but a judge quashed the ruling, saying that the motorists weren't visible in the act.

The Internet is flush with advice on how to urinate on the side of the road. Tips include finding a tree, bush or shielding yourself with the car door.

Other drivers on the highway are probably busy speeding, texting , so a little pee break isn't a big deal in comparison.

If you're really shy, a wide-mouthed plastic bottle or even a portable urinal might come in handy.

When you are driving along a road and your indicator is still on right turn, and the person waiting to come from the right sets off, are you liable if a collision occurs? Or should the person on the right wait until he is sure I am turning right? Is he guilty of proceeding while unsafe? — Alberta driver

If your signal is on but you're not actually turning, the other guy's usually at fault if he hits you.

|

7 paths to a fulfilling retirement — which

is for you?

Nanci Hellmich

USA Today

Mon Apr 07 2014

People who are retiring sometimes just think about getting another job doing the same thing they've done all their lives, says Marie Langworthy, 65, a retired school administrator. But they really need to step back and and ask themselves: What do I really want to do? What do I enjoy? What am I good at?

Langworthy and Carolee Duckworth, 67, a retired Web design professor, wrote Shifting Gears to Your Life and Work After Retirement to help people see themselves in a new way. "Our goal is to help you come up with a mission statement for the rest of your life," says Duckworth.

They have identified seven retirement paths that retirees might take:

Life of leisure

Many retirees cultivate at least a partial life of leisure, pursuing hobbies passions or interests like fishing, golfing, and gardening.

Life of volunteerism

Volunteerism can provide structure, meaning and purpose to retirees' lives.

Life of a traveler

Rather than just travel as a visitor to places, stay a while. "I suggest staying in places for a week or more; so you get to know the people, not just see the museums," Duckworth says.

Life of engaging new work

Try work that's something completely different from what you did most of your lifetime.

Life of entrepreneurship

This involves identifying a need that could be fulfilled and going after it.

Life as a Creative

These are people who create art, design, music — new ideas, services and solutions to complex problems. "Coming back to your creative self is one of the glories of retirement," Duckworth adds.

Life of a student

Some study for the pleasure of learning; others to train in a new area of work or to become skilled or knowledgeable in an area of interest.

|

When can I legally pull

over to answer a text or phone call?

JASON TCHIR

The Globe and Mail

March 21, 2014

For Ontario's distracted driving law, what exactly constitutes legal parking? Does the engine have to be turned off? Do the keys have to be removed from the ignition? When can you legally use your phone?

Put simply, you can't touch a hand-held phone when you're driving unless you're pushing the hands-free button or calling 911, says Ontario's MTO.

"Ontario's law makes it illegal for drivers to talk, text, type, dial or email using hand-held cell phones and other hand-held communications and entertainment devices," the MTO says in an email statement. "The law also prohibits drivers from viewing display screens while driving, such as laptops or DVD players, that are unrelated to the driving task."

On March 18, 2014 the fine for breaking that law will rise from $155 to $280.

The MTO says drivers can touch a device to turn on or off the hands-free function, but otherwise they can't physically touch the device while driving. That includes giving instructions to the GPS and playing MP3s/

If you're parked or safely pulled over and not impeding traffic, then you're not driving. You can use the device from behind the wheel without getting charged.

There is a hitch. You have to follow other traffic laws. If it says No Parking, you can't park there. You have to be lawfully, or legally, parked. That means you can only park where parking is allowed. If there's a No Parking sign, then it's not lawful parking.

"You have to be safely in park to use a device, but the engine doesn't have to be off and the keys don't have to be out of the ignition," says Ontario Provincial Police Sgt. Pierre Chamberland.

If you're pulling over, you can't pull over where it's not allowed. For example, pulling over is banned on 400-series roads unless it's an emergency.

"If the situation is not an emergency, drivers are advised to exit the freeway at an interchange or pull into the nearest service centre," the MTO says.

If you're in traffic but not moving, like at a stop light or in traffic jam, it's illegal to use your device, even if you put your vehicle in park.

"If you're stopped in traffic, you're still driving – you're just not moving," says Chamberland. "You still have to pay attention to the lights and to other vehicles."

Deadly consequences

This week, an OPP blitz is targeting Ontario drivers who won't ditch their devices on the road.

"People are not abiding by this law and I don't know why," says Chamberland. "They're raising the fines and there's still debate in the government about adding demerits – we're hoping that will make a difference."

In 2013, distracted driving was the number one cause of death on roadways: 78 people were killed in collisions involving distracted driving, the OPP says.

That's compared to 57 impaired-driving deaths and 44 speed-related deaths. Since 2010, distracted driving has killed 325 people in Ontario.

Hands-free allowed, but is it safe?

Ontario's distracted driving law allows hands-free calling. But a 2013 study by the University of Utah and the American Automobile Association showed talking on a hands-free phone was nearly as distracting to drivers as talking on a hand-held phone, says the Canadian Automobile Association.

"We are not the only ones who have conducted this type of research," says CAA spokesman Kristine D'Arbelles in an email. "More and more studies show that cognitive distraction (from) hands-free devices is as dangerous as physical distraction."

|

Not knowing the "Move Over" law could

cost you $490

March 17, 2014

Wheels.ca

Eric Lai

Toronto Star

Enacted in 2003, the "move over" law is hardly a new one. It's been extensively reported by media outlets and all Ontario drivers were also personally notified via a notice with every licence or plate renewal letter.

Yet, during my ride-along with York Regional Police recently, virtually no one complied.

Here's what the law states: Section 159 (2,3) HTA requires motorists approaching, on the same side of the road, a stopped emergency vehicle with red or red/blue lights flashing, to slow down.

If there are multiple lanes in your direction of travel, you must vacate the lane adjacent the emergency vehicle, if it can be done safely.

For example, if there are two lanes in your direction of travel, and police/fire/ambulance are stopped on the right shoulder with lights flashing, drivers approaching in the same direction of travel should move into the far left lane, if it can be done safely. If you can't move over safely (i.e. would cut-off left lane driver), you must slow down while passing the stopped emergency vehicle.

Similar "move over" laws exist across Canada except in New Brunswick, Newfoundland and Labrador, Nunavut, and Yukon.

Some provinces extend the law to protect tow trucks and "amber light" roadside workers (Ontario does not). Your passing speed may also be legislated, for example, Alberta states 60 km/h maximum, or the posted limit if lower. In Ontario, you must slow to below the posted limit as necessary to avoid endangering roadside personnel.

In the U.S., 49 states have similar laws where drivers must move over or slow down to 20 mph (32 km/h) below the limit.

Despite all efforts to publicize Ontario's decade old "move over" law via news media, internet, mailings, billboards and police campaigns, I observed near-zero compliance on a night shift with York Police Sgt. Ryan Hogan.

During a roadside traffic stop on Hwy 404, countless motorists illegally zipped past us in the adjacent lane. Only four cars moved over. The rest came within mere centimeters of striking Sgt. Hogan, the police vehicle and/or the stopped violator at well over 100 km/h.

Any contact at those speeds could be fatal to all, including the impacting driver.

On Hwy 7, while stopped in the curb lane, not only did drivers not move away, some even changed lanes so they'd illegally pass alongside. Others didn't change out of our lane until the last second – which makes it hazardous for drivers behind them who may not see the stopped emergency vehicle ahead in time.

The "move over" violators Sgt. Hogan stopped claimed total ignorance of the law – and that could've cost them a $490 fine and three demerit points. But for roadside emergency workers, your failure to comply could cost them their lives.

UPDATE: Two nights later, York Constable Wade Nethercott was struck and injured by a vehicle that failed to move over in Newmarket.

|

List of winners at Sunday’s 86th annual

Academy Awards presented by the Academy

of Motion Picture Arts and Sciences.

Best Picture: 12 Years a Slave

Actor: Matthew McConaughey, Dallas Buyers Club

Actress: Cate Blanchett, Blue Jasmine

Supporting Actor: Jared Leto, Dallas Buyers Club

Supporting Actress: Lupita Nyong’o, 12 Years a Slave

Directing: Alfonso Cuaron, Gravity

Foreign Language Film: The Great Beauty, Italy.

Adapted Screenplay: John Ridley, 12 Years a Slave.

Original Screenplay: Spike Jonze, Her

Animated Feature Film: Frozen

Production Design: The Great Gatsby

Original Score: Gravity Steven Price.

Original Song: “Let It Go” from Frozen

Costume: The Great Gatsby

Makeup and Hairstyling: Dallas Buyers Club

Animated Short Film: Mr. Hublot

Documentary Feature: 20 Feet from Stardom

Documentary (short subject): The Lady in Number 6: Music Saved My Life

Live Action Short Film: Helium

|

New test coming soon for elderly Ontario drivers

LORRAINE SOMMERFELD

The Globe and Mail

Feb 1, 2014

On April 21 in Ontario, new changes to the licence testing for people aged 80-and-over will take effect. The Ministry of Transportation's new evaluation includes a vision assessment, in-class group education, review of the driver's record and two short exercises, the latter to determine if further assessment is required.

The big change is with the two exercises (click on this link), require drivers to draw the hands of a clock to 11:10, and to cross out each "H" from rows of letters. They are designed to evaluate basic auditory language skills, memory, motor functioning, and ability to plan and organize.

Dr. Louisa Gembora, an independent clinical psychologist specializing in rehabilitation and a driving instructor, says: "The clock drawing exercise seems simplistic, but it's reliable and viable – we've used it for many years, providing the evidence to implement it."

There is predictable anger among seniors who mistake a driver's licence with a membership-for-life card, or who understandably believe clean driving records should speak amply on their behalf.

"It's rank discrimination," Tom Trent, 84, of Kichener, Ont., wrote to me after the MTO announced the changes to reassess drivers when they hit 80.

The new evaluation procedure came from years of work with CANDRIVE, an interdisciplinary group of researchers seeking to keep the elderly driving safely. Brenda Vrkljan, assistant professor with McMaster Univeristy's School of Rehabilitation Science and a member of the CANDRIVE team, says the ministry is embracing the organization's work.

The test determines how your brain is actually working, rather than how you may make yourself appear to be functioning for a short time period.

"We put our best self forward in a test, but cognitive tests like the ones now included will reveal gaps that can be missed," Vrkljan says. "We are constantly looking for evidence-based, fair testing that protects the individual as well as public safety."

Is the government coming after Tom and his friends? Is there a conspiratorial movement to strip older driver of freedom and independence?

My mother passed a crash scene 40 years ago. The sight of the boy's backpack lying on the ground haunted her. An elderly driver had hopped a curb and pinned a young pedestrian to a fence with his vehicle. The lad lost his leg. The old man was in shock, declaring he'd never seen him, never seen the curb. It happened on the route I took home from school. .

Impaired vision, dementia and failing cognitive skills affect an individual's ability to drive. Choosing to evaluate drivers as they age is evidence-based. Statistics Canada reports that drivers over 70, when adjusted for miles driven, rank second in percentage of crashes only to those the wild teenage boys we hear so much about. And it's the seniors who are more likely to die.

Presently, Ontario requires doctors to report patients whom they believe to have diminished competence behind the wheel due to medical conditions or prescriptions . Alberta requires medical exams beginning at aged 65, and anyone can report a driver they believe to be dangerous. B.C. stipulates medical exams as a condition of renewal starting at age 80. Saskatchewan has a gradual delicencing for compromised drivers, based on times driven, distance and time of day. The AAA motor club in the U.S. says, "Seniors are outliving their ability to drive safely by an average of seven to 10 years."

I called Tom back, explained the changes, and said the test was a better, fairer judge of cognitive ability. Discrimination, based on age? Yes, but it's predicated on evidence. At 90 minutes, the test takes half the time of the old one and is a far better measure of a senior's ability to handle a car.

|

Canadians stock up

on incandescent bulbs

in wake of ban

January 14, 2014

RICHARD BLACKWELL

The Globe and Mail

Published Sunday, Jan.

It has hardly been a stampede, but Canadians have stepped up their purchases of old-style incandescent light bulbs, as buyers stockpile them in the wake of the first phase of a ban on manufacturing the power-guzzling product.

Retailers report a jump in sales as a result of the Jan. 1 implementation of federal rules that prevent 75-watt and 100-watt bulbs from being made or imported into Canada. At the end of this year, 40- and 60-watt bulbs will also come under the ban.

But the rules allow sales of the existing inventory of the 100-watt bulbs (very few 75-watt bulbs are sold in Canada), and retailers have lots in stock that they say will last for months.

"We've seen a spike, there's no question," said Ron Cleary, senior merchant for electrical products at Home Depot Canada Inc. But he expects the flurry to burn out quickly as customers realize there are many other options.

Home Depot will likely have inventory of the old 100-watt bulbs until at least March, Mr. Cleary said.

At that time the retailer will have stocked up with 72-watt halogen-incandescents, a slightly more expensive bulb that looks and behaves much like the old ones but which meets the new federal rules because it uses 28-per-cent less electricity to generate the same amount of light. It also lasts much longer than old style incandescents.

Other alternatives include compact fluorescents (CFLs), which have fallen sharply in price in recent years, and light-emitting diode (LED) bulbs, which are still expensive – as much as $30 per bulb – but have also come down in price recently. Both use dramatically less power than incandescents and last much longer.

Despite the higher-cost bulbs, the government says lower household energy use means that consumers will save more than $750-million by 2025.

Canadians spend about $300-million a year on light bulbs.

Still, there is resistance among some consumers to give up the old-style bulbs. Ontario Conservative MP Cheryl Gallant has been lobbying to have the government cancel the phase out of incandescents. She has an online petition (stopthelightbulbban.ca) on the go to try to get the rules repealed.

In the United States, the backlash is even stronger, as some see the rule change as a conspiracy among big government, lighting manufacturers, and environmentalists. One website (freedomlightbulb.org) channels the views of those who say the ban on incandescents makes no sense and is an assault on individual freedoms.

The United States is actually well ahead of Canada on cutting out incandescents. It banned manufacturing or importing of 100-watt bulbs in 2012, and eliminated 40- and 60-watt bulbs on Jan. 1 of this year. British Columbia is also ahead of the rest of Canada, banning 100-watt incandescents in 2011.

In both countries, specialty incandescent bulbs – such as decorative lamps and those used in ovens, refrigerators or three-way fixtures – will be allowed indefinitely.

Among the more widespread complaints about the changeover is that most CFLs do not work with dimmers, and that they contain mercury so they must be disposed of carefully. LEDs do not face these issues, they are still considerably more expensive. While some consumers didn't like the look of early CFLs and LEDs, both now come in a range of of hues (from yellowish warm to cooler bluish).

Sales of incandescents have been "gradually dying out for the last few years," said Alison Rennie, operations manager for the Living Lighting chain, as alternatives have come to market and people warm to the idea of energy-saving bulbs.

A delay in the incandescent ban (Ottawa originally planned it for 2012 but pushed it back to 2014) gave bulb-makers time to improve their replacement products, she added. "I'm glad we had the two-year delay because the manufacturers weren't ready."

Selling light bulbs that cost substantially more but will last for years requires a different marketing approach, said Rina Varano, a merchandiser for lighting and electrical products at Rona Inc.

She said that in the past, light bulbs were often used as loss leaders – a way to get consumers into the store. Now they are sold as an environmentally friendly technology that is worth a higher price because of the long life. Eventually sales will decline as the long-life bulbs become more ubiquitous.

While most consumers are willing to make the change, it can be an expensive up-front investment for businesses buying large quantities of bulbs, even though energy savings will help defer the costs over time.

Andrew Cowan, an independent consultant who sells lighting systems and products in Toronto, said his commercial customers – restaurants, office buildings and condominiums, for example – are scrambling to get the old bulbs because they like the look they create, and the fact that they are easily dimmable.

With the 100-watt incandescents no longer being manufactured or imported into Canada, and the ban on 60-watt bulbs looming, the pricing of remaining inventory has risen, Mr. Cowan said. He used to be able to sell them in bulk for as low as 39 cents each, but now charges around 89 cents.

|

How mature drivers get their groove back

Advanced training course aimed at older drivers

sharpens their skills — and their confidence

Toronto Star - Wheels.ca

By Carola Vyhnak

Dec 24, 2013

SHANNONVILLE—An exhilarated Marr Kelly, fresh off the skid pad, is saying she would bring her 80-year-old mother here if she hadn't hung up her car keys last year.

Funny, I was just thinking I couldn't imagine my 89-year-old mother dodging cones or doing 360s through puddles — yet she stubbornly refuses to stop driving.

Which is the whole point of the "mature" drivers program offered by Brack Driving Concepts: testing and sharpening the road skills of older motorists.

The goal is to teach ways of coping with other drivers and situations, or even get them to realize — often to family members' relief — that their driving days are over.

Kelly and I are among half-dozen participants who turned out for advanced driver training at Shannonville Motorsport Park one recent rainy day. Aimed at improving drivers of all ages, the day-long program is a longer, more-intensive version of the course for seniors.

With more than four decades of driving behind me, I'm more stewing hen than spring chicken at the wheel, but I've opted to put my skills to the test with the younger crowd.

Kelly, a lifelong car lover, is here at the behest of her bucket list, which says "be the best driver I can be in any circumstance."

She comes away impressed after a full day, which includes an hour of classroom instruction on the basics of driver position, mirrors, tires, braking and cornering, followed by numerous laps on a closed road course and skid pad, all monitored by an in-car coach.

"This could save lives," says Kelly, who manages a university sports medicine clinic in Toronto. "It's a confidence issue," she adds, musing that her mother probably would have kept driving if she'd taken the course.

The shorter, five-hour version for older folks puts them through the same paces, but with less time in class and on the track.

Instructor Chris Teixeira reminds us that driving is an "incredibly complicated task" and that the single most-important component is vision. That means constantly looking at least 10 cars ahead, as well as checking behind and on either side.

The "look ahead" mantra quickly hits home when we're on the track, trying to pinpoint the apex in a series of corners of different shapes and lengths.

I have school owner Bill Brack himself riding shotgun with me, calling out instructions. He's a three-time Canadian Driving Champion and a motorsport hall of famer who beat Gilles Villeneuve.

Brack has just done several hair-raising (to me) laps to demonstrate the fine art of cornering, and here I am bouncing off curves and trying valiantly to work up a head of steam after signalling other drivers to pass.

But something incredible happens under his tutelage. I lose my fear. I get better and go faster. And I'm thrilled to discover my creaky, aging Chevy Malibu that has travelled almost 300,000 km can still take it. There's life yet in the two old girls.

This is what our instructors want from us: to learn what the car and driver are capable of doing. That's what builds confidence and the ability to handle road challenges in the real world.

"If you had to get out of the way quickly, you can do it and know your car can do it," Brack explains.

It's all about safety for Newmarket mother Anna Trankovskaya, who drives her two children to school every day.

"Over time, you get bad driving habits," she says. "I just want to improve on basic skills." She comes away with "better control and more confidence."

Toronto resident Manish Khera worries about navigating the city's "very aggressive driving landscape," especially when his 5- and 7-year-olds are on board.

After a day on the rain-slicked track and skid pad, he's lost his tunnel vision and gained a grip on "efficient cornering," says the satisfied motorist, whose wife sent him to Shannonville as a 40th birthday present.

A dandy idea, too, for someone's 90th.

|

I didn't file a claim.

Will my insurance

go up anyway?

JOANNE WILL

The Globe and Mail

November 9, 2013

In addition to wondering whether your premium may increase, should the accident be reported to your insurance company, and what are the possible consequences of not doing so?

According to the Insurance Bureau of Canada, you must notify your insurer as soon as possible about any accident that must, by law, be reported to police, or for which you intend to make a claim under the policy. Auto insurance varies between provinces. In Alberta, total damages from both vehicles over $2,000 must be reported to the police. In Ontario, it's $1,000.

"In every insurance policy in Canada, there is a condition referred to, outside of Quebec, as statutory conditions," says Natalie Dupuis, senior product manager, auto, at RBC Insurance. "And it spells out the fact very clearly, that if there is damage to a person, property or your own automobile then you need to give notice with full particulars of all the information, and also give your insurance company your full co-operation. Some provinces go on to stipulate how many days you have to submit that information."

You believe you're at fault, and are understandably concerned about your future premiums. But just because you inform your insurance company of the accident doesn't mean you have to proceed with a claim.

It makes sense that you want to pay out-of-pocket for damages less than a thousand dollars, rather than pay a deductible and trigger a rate increase. However, what looks simple at the scene of an accident can turn out to be much more complicated.

"What sometimes happens is people think it's only small. They don't report it, and suddenly they get an estimate back from the other party," says Dupuis. "The other party has gone ahead and repaired the damage, and there's a $3,000 bill waiting for them at home. Wait – you said it was only going to be a thousand dollars!

"Well, they lifted the hood, found more damage and have gone and repaired it. Now they turn to their insurance company, well now, there's a problem. That's still a very simple one; not involving any lawyers or injuries. But sometimes people go home and they get headaches or start to hurt from the accident, and now it's more than just damages.

Now it's three to six months since the accident occurred. So, the sooner a situation can be put under control with professional advice the more contained it is."

In most provinces the other driver has up to one year to file a claim against you. In Alberta, it's two years.

In Ontario, Quebec, Nova Scotia and New Brunswick, if you're not at fault in an accident your company pays for your damages and does not go after the other insurance company. In Alberta, if you're not at fault, your insurance company will pay your damages and then turn to the at-fault insurance company to recoup – the technical term is "subrogate" – the damages.

If you pay for the damages and no claim is put forth for your damage or for the other party's damage, then your rates won't go up. But you should let your insurance company know about the accident.

"By calling your insurance company to say you've had an accident, you're at fault, you think it's minor and you'd like to pay for the damages yourself – at least you've met the conditions of your contract. You've called your insurance company and let them know. Plus, they may give you some advice as to what to do. If the other party changes their mind and goes to their insurance company, at least your information is already on file," says Dupuis.

|

Three surprising ways

liquor and cars can

get you arrested

Drinking and driving? Obviously. But here are three

things you probably DIDN'T know were illegal

Toronto Star

October 29, 2013

We all know drinking and driving is a huge no-no. But some of the finer points of the law as it pertains to liquor and vehicles may surprise you, not to mention get you in trouble. Here, Wheels columnist Eric Lai shares some common actions you might not know are illegal:

1: You can't drink liquor even if your car is turned off and you're not in it.

Under the Liquor Licence Act, having an open liquor container in a vehicle, or liquor readily available to the driver (in the front seat) are offences. In a pickup without a backseat or locking cargo area, front seat transport is okay, provided the container seals are unbroken.

Drinking alcoholic beverages in or around your vehicle is illegal, whether or not the ignition is on. It's considered unlawful consumption.

Some examples include drinking beer when parked in public areas, such as a parking lot, by the lake, or in a park.

2. Tailgate parties are illegal.

"Tailgate parties" where revellers drink beer in a stadium, ballpark or arena parking lot are also against the law.

Alcoholic beverages may only be consumed on private property or a location that possesses a permit, notes York Regional Police Const. Laura Nicolle. "Drinking in a public parking lot is definitely illegal."

You can have a drink in a motorhome, provided it's parked at its overnight location, such as an RV site, and is actually being used as a temporary or permanent residence at the time, rather than as a means of transportation.

3. Drinking in a parked car is illegal (if the key is with you)

If your car or truck is parked on the street outside your home and you decide to watch a video on the in-car DVD player while having a beer, charges of unlawful consumption/open container, impaired care or control of a motor vehicle, or public intoxication (walking back to your house) might all apply, depending on the circumstances.

Even if you're asleep, parked on the roadside to sleep off a bender, you may still be charged with impaired care or control of a motor vehicle — provided you have the key in your possession.

The point is: while referred to as "drinking and driving" laws, in many instances you don't actually have to be drinking or driving at the time for charges to apply. An open container or being intoxicated with a car key in your pocket will suffice.

|

7 no-brainers to

save on gas

By John Okoye

August 22, 2013

As gas prices continue to rise, many drivers are left wondering how best to curb the cost of fuel. Depending on where you live and how much you drive, gas expenses can be a significant hit to your wallet.

Of course there are hybrid cars available, but maybe you aren't ready to make the jump just yet. Maybe you just want to hang on to the vehicle that you have for the near future. Fortunately, there are many simple steps that you can take to cut down on the cost of fuel.

1. Fill up your tank efficiently

While it may be tempting to fill your gas up in increments, it is also likely to cost you more money. The need to travel back and forth to refill your gas tank ends up being more expensive than simply filling up your tank completely.

"Fill the tank full", says Stephanie Nelson, CEO of Couponmom.com. "The more money you try to save by adding $10 today and $20 tomorrow will be wasted since you have to travel to the station."

2. Find the lowest gas rates

You would be surprised at the difference in gas prices in any given area. For this reason, finding the cheapest gas available can save you a significant amount of money each month. Luckily, there are apps available that make this process simple.

"Gas Buddy is one of the most popular gas price checking tools, and it has been for many years now," said Lou Carlozo, contributor for Dealnews. "It ranks among the granddaddies when it comes to finding low gas prices."

3. Use cash back rewards

There are several Cash Back Rewards systems that can help you cut down considerably on fuel costs. These rewards may be from credit cards, bank accounts or even grocery store coupons. Some of these programs simply reward you with cash back for each visit to the pump while others allow you to put your rewards towards things like student loan repayments and savings accounts.

According to research released by the U.S. Energy Information Administration this past winter, American households spent almost $3,000 worth of gasoline in 2012. With 3% back on these purchases consumers would be rewarded with close to $100 back in their pockets just by using the Cash Back Rewards card."

4. Remove clutter from vehicle

A great way to improve your car's fuel efficiency is to get rid of any unnecessary and heavy items that may be in your trunk. While they may not seem like an inconvenience, these items are actually weighing your vehicle down and forcing it to burn more fuel to compensate for the weight difference. By simply removing these items from your car, you can easily improve your fuel efficiency.

5. Inflate your tires

Make sure that you keep your tires adequately inflated. Driving with improper tire pressure is not only dangerous, but it's also fuel inefficient. According to the U.S Department of Energy, inflating tires can increase fuel efficiency by up to 3.3% alone. Check your vehicle manual and find out your car's optimal tire pressure level. Be sure to monitor it at least twice a month.

6. Don't speed

Speeding is one of the least efficient ways to drive your car. If you are looking to cut back on fuel expenses, try driving the speed limit. You may not get where you are going quite as fast, but it will save you a great deal of gas and money.

"Drive the speed limit and you'll decrease your gas costs - fuel efficiency drops tremendously once you exceed 60 mph," said Andrew Schrage, co-owner of Money Crashers. "Avoid sudden accelerations and sudden stops as well. Take advantage of cruise control when driving on the highway if your automobile comes with that feature."

7. Tune engine

Maintaining your engine is a great way to keep your car as fuel efficient as possible. Take your car to a mechanic and have an emissions test done. While fixing minor engine problems can end up saving you about 4% of your gas tank, repairing major engine problems can raise your fuel efficiency by up to 40%. That will make a huge difference at the pump. |

How can I tell my husband he's a terrible driver?

LORRAINE SOMMERFELD

The Globe and Mail

August 16, 2013

'My husband is a terrible driver. ... a truly horrible driver. He tailgates constantly and can't even keep the car in the lane. On highways, he routinely hits the rumble strips. ... and even that is not enough to convince him that he's not staying in the lane. He thinks he's a great driver. So now our oldest daughter is 16 and ... he wants to teach her to drive. WHAT DO I DO?"

I came across this letter to an advice columnist in the Washington Post. It wasn't in a driving section; it was where it should be: a living section. Because this isn't a driving issue, it's a behavioural one. "Send her to a professional," came the reply.

A young woman pulled me aside a few months ago, said that she wasn't a good driver, and asked if I had any advice on how she could get better. I paused for a couple of beats, because nobody ever admits they are poor drivers. This girl had progressed through the necessary lessons, but knew it wasn't enough. The first thing I did was tell her it was just as important that she recognized it, as it is rare.

Telling someone they're a terrible driver is like telling them they're a terrible lover. They won't believe you, it will anger them, and now they're going to wonder who else agrees with you. They might also start to question all those times they've been stuck driving alone.

For most, driving is not an innate skill. It takes practice, experience and dedication. Enjoying it isn't enough to make you good at it; you have a role when you're piloting a car that involves the rights and safety of everybody else on the road as well as your passengers. Some people respect this, and some just don't care. It's an uphill battle when people use the yardstick of how many crashes they've been in as a measure of their competence behind the wheel. I don't want to leave a bunch of angry near-misses in my wake, either.

An instructor once noted that our natural line of vision is still essentially that of a caveman: we are looking low and near so we can chase after a woolly mammoth on foot to catch it. In a car, we have to aim at something farther away that we'll get to much faster, and much of driving is vision. If a driver is still chasing woolly mammoths, he's going to be routinely surprised by that car pulling out of the driveway.

Here's a handy litmus test to determine a driver's skill: you either feel safe when they're behind the wheel or you don't. There are also many categories of bad drivers. There are those who don't have enough experience and can get better; there are those who are experiencing a deterioration of health or loss of cognitive skills at the twilight of a driving career; and there are those who believe they are excellent drivers and think I'm talking about somebody else.

If the number one fight between couples is about money, I'm going to venture that driving is up there, too. The choices are bleak – you can say nothing as you grind your teeth down to nubs, or you can say something and start another fight.

Something the advice seeker up top seems to forget however, is that daughter has been driving with her dad for all her life now. Bad habits get ingrained through automotive osmosis: that speed limits are merely suggestions, that stop is short for stop-tional, and it only matters if you get caught. He is not only endangering her safety, he is passing along his terrible habits.

The answer was good, but incomplete. Many people can see the wisdom in letting a pro teach your teen how to drive. But I worry about a bigger issue: how do you empower your kid to refuse to drive with someone they feel is endangering them? Do you yourself leave room for someone to express that concern to you?