Recent Contract Changes

to the

CAW-Ford 2012

Agreement for Retirees

OCTOBER 2012

Pensions

There will be no increases to the retirees monthly pensions during the 4 year life of this agreement. PCOLA continues to be suspended.

Dental

Dental fee schedule has been updated (Effective Jan 1, 2013) to 2011 rates (from 2008) and will lag 2 years behind until 2016 when the rate will be at 2014 fee schedule. Also dental implants will covered up to the cost of bridge work (payable at 50% of the allowable charge) on or after January 1, 2013.

Ford Health Care Contribution

There is no increase in the Ford Health Care Contribution however the process of collection will change. Starting on January 1st. 2013 in order to reduce or eliminate subscribers from being accidentally dropped from the plan for non-payment the process will now be a quarterly charge of $97.20 (under 65) and $48.60 (over 65) collected from your first use of any medical benefit and continues for each use until that amount is paid during that quarter. If you do not use the system in the quarter no charge will be implemented. (The Ford/CAW bargaining report on page 5 had the contributions as being every 6 months which was an error and should read quarterly) Bank account deductions will be eliminated December 31, 2012. (Heath Care Contributions will not apply to Out of Province or Long term Care claims)

Prescription drugs

Prescription drugs charges and deductables will be status quo. Co-pay remains at 10% to a maximum of $310.00. Because of tax implications, all over the counter drugs (except life sustaining drugs and diabetic meters) will no longer be a covered benefit effective January 1, 2013.

Over the counter drugs that have been eliminated (Click Here)

Over the counter drugs that are still covered (Click Here)

Long Term Care Coverage (Nursing Home)

Effective January 1st. 2014 long term care coverage will be reduced again from the current $1200 per month to $800. Anyone in the program prior to the effective date will stay at the old rate and will be grandfathered in.

Out of Province

Out of province coverage remains unchanged.

** It should be noted that Semi-private hospital coverage was eliminated in 2009 negotiations.

*********************************

For any other questions or concerns please call Benefit Rep Claudio Parise at (905) 454-6074

|

CANADA PENSION PLAN

Click Links Below

2012 C.P.P. Application Form

Old Age Security (OAS) Program

2012 O.A.S Application Form

Do you have a question about the Old Age Security program? The following frequently asked questions might help:

Contact information for the Old Age Security program:

|

2010 Tax reporting of the

Health care premiums

• Ford Retirees should have received a statement from

Morneau

providing payment confirmation of these premiums.

The Health care premium is an medical expense and can be reported on your Income Tax Return on line 330 of Schedule 1.

|

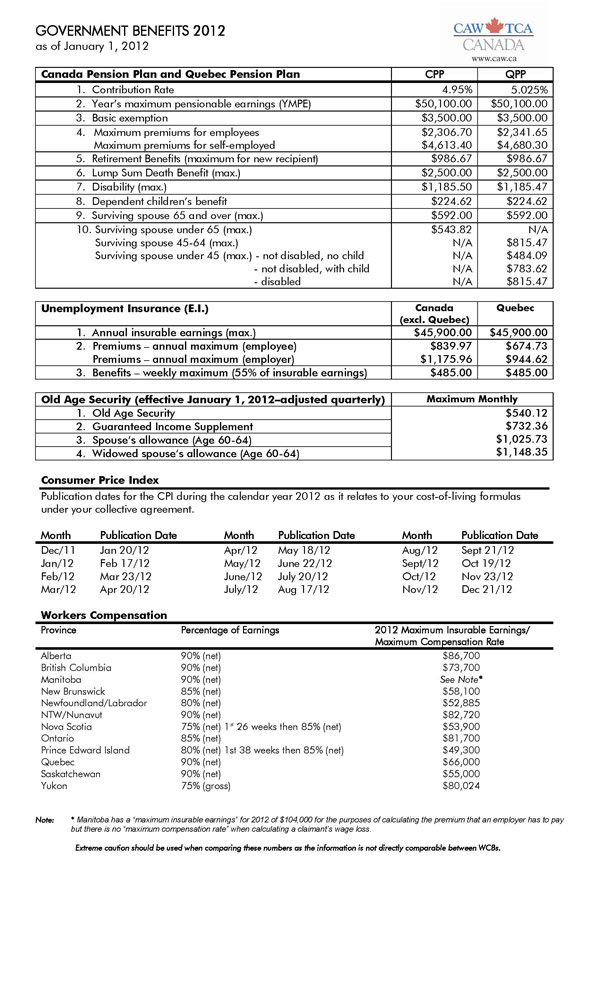

GOVERNMENT

BENEFITS 2011

as of January 1, 2011

Canada Pension Plan and Quebec Pension Plan |

CPP |

QPP |

1. Contribution Rate |

4.95% |

4.95% |

2. Year’s maximum pensionable earnings (YMPE) |

$48,300.00 |

$48,300.00 |

3. Basic exemption |

$3,500.00 |

$3,500.00 |

4. Maximum premiums for employees

Maximum premiums for self-employed |

$2,217.60

$4,435.20 |

$2,217.60

$4,435.20 |

5. Retirement Benefits (maximum for new recipient) |

$960.00 |

$960.00 |

6. Lump Sum Death Benefit (max.) |

$2,500.00 |

$2,500.00 |

7. Disability (max.) |

$1,153.37 |

$1,153.34 |

8. Dependent children’s benefit |

$218.50 |

$69.38 |

9. Surviving spouse 65 and over (max.) |

$576.00 |

$576.00 |

10. Surviving spouse under 65 (max.)

Surviving spouse 45-64 (max.)

Surviving spouse under 45 (max.) - not disabled, no child

- not disabled, with child

- disabled |

$529.09

N/A

N/A

N/A

N/A |

N/A

$433.34

$110.98

$402.35

$433.34 |

Unemployment Insurance (E.I.) |

Canada

(excl. Quebec) |

Quebec |

1. Annual insurable earnings (max.) |

$44,200.00 |

$44,200.00 |

2. Premiums – annual maximum (employee)

Premiums – annual maximum (employer) |

$786.76

$1,101.46 |

$623.22

$872.51 |

3. Benefits – weekly maximum (55% of insurable earnings) |

$468.00 |

$468.00 |

Old Age Security (effective January 1, 2011–adjusted quarterly) |

Maximum Monthly |

1. Old Age Security |

$524.23

$661.69

$961.18

$1,065.45 |

2. Guaranteed Income Supplement |

3. Spouse’s allowance (Age 60-64) |

4. Widowed spouse’s allowance (Age 60-64) |

|

October 2009 Ford-CAW Addendum Language to the 2008 Collective

Agreement

Click here for language updates

This extends the current collective agreement by one year to September 17, 2012 |

CPP, Disability, OAS

Canada Pension Plan (CPP)

Please visit sections of the Social Development Canada website for detailed information about the Canada Pension Plan (CPP).

For information about general retirement benefits, please go to the CPP general benefits section.

For information about CPP Disability eligibility and benefits, please go to the CPP Disability section.

Old Age Security Program (OAS)

The Old Age Security (OAS) program, the cornerstone of Canada’s retirement income system, provides you with a modest pension at age 65 if you have lived in Canada for at least 10 years. If you are a low-income earner, you may be eligible for other benefits as early as age 60.

For detailed OAS information, please visit Human Resources and Skills Development Canada’s OAS website.

|

Ontario Sales Tax

Transition Benefit

As part of Ontario's new comprehensive tax package, the Ontario Sales Tax Transition Benefit provides temporary relief to Ontarians to help ensure a smooth transition to the new sales tax system. The benefit will be paid by three tax free installments in the form of direct deposit or cheques sent to eligible recipients in June 2010, December, 2010 and June 2011.

Learn more about the Ontario Sales Tax Transition Benefit (Click Here).

|

Update on the Ford/CAW

Health Care Contributions

Updated Feb 4, 2010

Letters now to be mailed week of February 1st

Here is a copy of the letter that you will receive:

Ford Motor Company of Canada, Limited

Ford du Canada Limitée

Dear Member,

Re: Ford Health Care Contribution (Ford H/C CTB)

As you may be aware, Ford of Canada and the CAW recently completed an addendum to the 2008 Collective

Agreement which extends the current collective agreement by one year to September 17, 2012.

As part of this addendum, effective January 1, 2010 a Health Care Contribution came into effect as follows:

• Employees and retirees under age 65 will pay $30.00 per month

• Employees and retirees who are 65 or older will pay $15.00 per month

• Surviving spouses will pay $15.00 per month

The Provinces of Ontario and Quebec charge sales tax for health care contributions. Residents in Ontario will be

subject to an 8% Retail Sales Tax, and residents in Quebec will be subject to a 9% Quebec Sales Tax.

Collection of this contribution will begin on March 15, 2010. Your first contribution in March will include the

contributions for January, February and March. In April, your contribution will be the regular monthly amount.

For your convenience, a pre-authorized debit from your bank account will be used to collect your Health Care

Contribution on or about the 15th of each month. To sign up, please complete the enclosed Pre-Authorized Debit

(PAD) Agreement and ensure it is received by the Ford Benefits Centre by February 16, 2010.

There are two ways to return the Agreement to the Ford Benefits Centre:

• Fax to 1-877-891-5369

• Mail to the Ford Benefits Centre:

Ford Benefits Centre

895 Don Mills Road, Suite 700

One Morneau Sobeco Centre

Toronto, ON M3C 1W3

Please note that failure to make the required contributions will result in cancellation of health care coverage.

Additional information regarding pre-authorized debits is enclosed. Should you have any questions regarding your

contributions, please contact the Ford Benefits Centre at 1-866-376-9501.

Sincerely,

Ford Benefits Centre

1-866-376-9501

*To download forms and FAQ please Click Here

* Please note that you should wait for your

personalized copy before sending anything back.

**********************

The Cost of coverage per Retiree per month will be:

Under Age 65 - $30 per month plus tax of $2.40

Over age 65 - $15 per month plus tax of $1.20

Surviving Spouses will pay $15.00 a month plus tax of $1.20

* These fees are only for the subscribers and not their dependents.

**************************

Other Recent Benefit Changes

The 10% drug co-pay for out of pocket

maximum expenses

will be $270 as of Jan 1, 2010

The Drug Dispensing fee has been reduced to

$9.00 per prescription from $11.00 as of Jan 1, 2010

Semi-Private Hospital coverage has

been eliminated as of late last year.

Reimbursement levels for Dental will remain

at the 2008 Ontario dental Association (ODA)

fee guide for the duration of the agreement.

Long Term Care has been set to a maximum

of $1,200 per month for new entrants as of Jan 1, 2010.

The $2,600 New Car Discount Program

Has been discontinued as of December 31, 2009

|

Retiree Car Voucher

Employees that retired from the company following the effective date of the 2008 collective agreement, and with a car voucher incentive, will have until the extended expiration date (September 17, 2012) to use the car voucher.

Updated Feb 2010 |

GOVERNMENT

BENEFITS 2010

as of January 1, 2010

Canada Pension Plan and Quebec Pension Plan |

CPP |

QPP |

1. Contribution Rate |

4.95% |

4.95% |

2. Year’s maximum pensionable earnings (YMPE) |

$47,200.00 |

$47,200.00 |

3. Basic exemption |

$3,500.00 |

$3,500.00 |

4. Maximum premiums for employees

Maximum premiums for self-employed |

$2,163.15

$4,326.30 |

$2,163.15

$4,326.30 |

5. Retirement Benefits (maximum for new recipient) |

$934.17 |

$934.17 |

6. Lump Sum Death Benefit (max.) |

$2,500.00 |

$2,500.00 |

7. Disability (max.) |

$1,126.76 |

$1,126.73 |

8. Dependent children’s benefit |

$214.85 |

$68.22 |

9. Surviving spouse 65 and over (max.) |

$560.50 |

$560.50 |

10. Surviving spouse under 65 (max.)

Surviving spouse 45-64 (max.)

Surviving spouse under 45 (max.) - not disabled, no child

- not disabled, with child

- disabled |

$516.57

N/A

N/A

N/A

N/A |

N/A

$426.10

$109.12

$395.62

$426.10 |

Unemployment Insurance (E.I.) |

Canada

(excl. Quebec) |

Quebec |

1. Annual insurable earnings (max.) |

$43,200.00 |

$43,200.00 |

2. Premiums – annual maximum (employee)

Premiums – annual maximum (employer) |

$747.36

$1,046.30 |

$587.52

$822.53 |

3. Benefits – weekly maximum (55% ) |

$457.00 |

$457.00 |

O.A.S. (effective January 1, 2010–adjusted quarterly) |

Maximum Monthly |

1. Old Age Security |

$516.96

$652.51

$947.86

$1,050.68 |

2. Guaranteed Income Supplement |

3. Spouse’s allowance (Age 60-64) |

4. Widowed spouse’s allowance (Age 60-64) |

|

Ford/CAW Pension

Funding Update

The CAW/Ford Council has agreed to allow the company to extend their funding from 5 to 10 years as requested in their letter to Retirees sent in August 2009.

The Ford Council is recommending that you do not send the reply letter back.

A no reply signifies that you are in agreement with this proposal

Ford Council

September 15, 2009

|

Benefit Update

Benefit Audits

When a retiree or surviving spouse receives an audit to be completed for continuance of benefits it is imperative that they provide the information required and send it back as soon as possible.

Address Changes

Make sure that your current address is up to date with Ford and the Union as some retirees/spouses have had their coverage terminated as the audits have never been received. Also you will not receive any important correspondence from both Local 584 and Ford.

New Vehicle Purchases

This is a reminder that all retirees are eligible for an additional negotiated *$2,600.00 discount on top of all other new car programs once during this agreement*.

If they have any questions please contact Sharon Burton in the Benefit office at (905) 454-6074.

*This $2,600.00 Discount has been discontinued as of December 31, 2009

|

Benefit Audits

When a retiree or surviving spouse receives an audit to be completed for continuance of benefits it is imperative that they provide the information required and send it back. If they have any questions please contact the Sharon Burton in the Benefit office at (905) 454-6074.

|

|

Changes to Benefit Plan

Ford letter to Employees and Retirees

February 3, 2009

Click here

|

*The $2,600 Automotive Discount Program

Has been discontinued as of December 31, 2009

Plus

|

|

|

Canada & Quebec Pension Plan |

|

CPP |

QPP |

1. Contribution Rate |

4.95% |

4.95% |

2. Year's max pensionable earnings |

$46,300.00 |

$46,300.00 |

3. Basic exemption |

$3,500.00 |

$3,500.00 |

4. Maximum premiums for employees |

$2,118.60 |

$2,118.60 |

Maximum premiums for self-employed |

$4,237.20 |

$4,237.20 |

5. Benefits (maximum for new recipient) |

$908.75 |

$908.75 |

| Pension age 60 (Increased 6% per year) |

$636.13 |

$636.13 |

6. Lump Sum Death Benefit (max.) |

$2,500.00 |

$2,500.00 |

7. Disability (max.) |

$1,105.99 |

$1,105.96 |

8. Dependent children's benefit |

$213.99 |

$67.95 |

9. Surviving spouse 65 and over (max.) |

$545.25 |

$545.25 |

10. Surviving spouse under 65 (max.) |

$506.38 |

- |

Surviving spouse 55-64 (max.) |

- |

$745.77 |

Surviving spouse under 55 (max.) |

- |

$745.77 |

Old Age Security (effective Jan 1, 2009 - adjusted quarterly)

|

1. Old Age Security |

- |

$516.96 |

| 2. Guaranteed income supplement (max.) |

- single |

$652.51 |

| |

|

- couple |

- |

3. Max spouse's allowance (Age 60-64) |

- |

$947.86 |

4. Max widowed spouse's allowance (Age 60-64) |

- |

$1,050.68 |

Unemployment Insurance (E.I.) |

| |

Canada |

Quebec |

1. Annual insurable earnings (maximum) |

$42,300.00 |

$42,300.00 |

2. Premiums - annual max (employee) |

$731.79 |

$583.74 |

Premiums - annual maximum (employer) |

$1,024.51 |

$817.24 |

3. Benefits - weekly maximum (55% of insurable earnings) |

$447.00 |

$447.00 |

|

New Prescription

Drug Co-pay

Effective January 1, 2009

The prescription drug co-pay for

actives and retirees will increase to

10% per prescription with a maximum

per family of $250 for the 2009 year.

Once the yearly maximum is reached the retiree will not be required to pay any deductibles till the new year starts again.

2009 - $250/Family/Year

2010 - $270/Family/Year

2011 - $290/Family/Year

For retirees over 65

who are on the Ontario Drug Plan (ODB)

The first $100 that the government

takes will be reimbursed to you

through your Green Shield Plan,

minus the 10% co-pay ($10).

After this you will be required to pay 10% of the dispensing fee for each prescription which presently is $6.11 which works out to be $0.61

|

2008 BENEFIT CHANGES

The following are changes to

our benefits that will take effect on

October 1, 2008:

• Chiropractic care- annual maximum

increased $15 to $465

• Psychologist- annual maximum

increased $25 to $625

• Vision care (available every 24

months)- increased $20 in each

category:

o Single vision: from $200 -

$220

o Bifocal: from $255 - $275

o Multi-focal: from $325 to

$345

o Contacts: from $210 to $230

• Eye examination coverage

increased $20 to $85.

• New vehicle purchase plan- See below

Starting January 1, 2009

The prescription drug co-pay for

actives and retirees will increase to

10% per prescription with a maximum

cap per year.

2009 - $250/Family/Year

2010 - $270/Family/Year

2011 - $290/Family/Year

For retirees over 65

and are on the Ontario drug plan

the first $100 that the government

takes will still be reimbursed to you

through your Green Shield plan,

minus the 10 percent co-pay. After this you will be required to pay 10% of the dispensing fee for each prescription which presently is $6.11 which works out to be $0.61

************************

Effective January 1, 2009 the

maximum rate of coverage for long

term care will be $1,543.95 per

month for new entrants.

Current

residents of long term care facilities

will be exempt from this and will

continue at the previously capped

semi-private rate. If a member of

your family is strongly considering

entering a long term care facility it

may be advantageous to do so

before January 1, 2009 to take

advantage of the current coverage

of $1,725 per month.

|

New Vehicle Discount Program!* Discontinued

During 2008 negotiations, the parties discussed an employee automotive discount purchase program.

The parties agreed to implement an automotive discount program consisting of the following features:

- *$2,600.00 discount for eligible retirees from the Retiree New Vehicle Purchase Plan price on eligible vehicles. *This has been discontinued as of December 31, 2009

- Applicable to ONE (1) purchase or lease made on or after October 1, 2008 and during the term of the 2008 Collective Agreement only.

- Eligible vehicles are new vehicles assembled in North America eligible under the Employee/Retiree New Vehicle Purchase Plan.

- Eligible retirees are retirees (or their surviving spouses) who are receiving a normal, early (regular or special), or disability retirement benefit at the time of the purchase or lease.

- The $2,600.00 New Vehicle Discount Program is NOT combinable with the $35,000.00 Car Voucher Program.

|

World Access

Canada -

Name Change

Please be advised of the following for Out of Province Coverage:

June 5, 2008

World Access Canada - Name Change

Effective June 1, 2008 World Access will be known as Mondial Assistance.

The immediate impact will be:

All Call Centre and Claims staff will answer OP questions in the same manner as now except they will refer plan members to Mondial Assistance as of Monday June 2.

World Access will continue to answer their phones as follows: "Green Shield Canada Travel Assistance" when the calls come in on the Green

Shield Canada line. If calls come in on their general line they will answer: "Mondial Assistance - formerly World Access." All of their claim forms and explanation of benefits (EOB's) will now refer to Mondial Assistance. An insert communication explaining the change will be included. This will continue for six months.

Going forward, there will not be any changes required to Green Shield Canada ID cards since they refer to 'Green Shield Canada Travel Assistance Group.'

The Mondial/WAC phone number will not change.

If there are booklets with a reference to WAC they will be changed as new ones are requested.

Green Shield Prepaid Services |

Green Shield has removed natural health products from the

formulary as of April 1/08

What are Natural Health Products (NHPs)?

Vitamins and minerals

Herbal remedies

Homeopathic medicines

Traditional medicines (such as traditional Chinese medicines)

Probiotics

Other products like amino acids and essential fatty acids

How are NHPs regulated?

Because NHPs were not strictly regulated, some of them were assigned

DINs and were therefore included in some GSC drug plans.

Under new regulations, NHP products which had previously been assigned

DINs are now to be assigned NPNs (Natural Product Numbers) rendering

them ineligible for reimbursement because they are no longer classified

as drugs.

|

More Information on

ODB antibiotic drug delisting

| NOT A BENEFIT |

LISTED BRAND |

|

(Dispensed for

ODB

recipients) |

|

|

Amoxicillin 250mg

Capsule |

Novamoxin 250mg

Capsule |

|

|

| |

|

Amoxicillin 500mg

Capsule |

Novamoxin 500mg

Capsule |

|

|

| |

|

Amoxicillin 25mg/mL

Oral liquid |

Novamoxin 25mg/mL

Oral liquid |

|

|

|

|

Amoxicillin 50mg/mL

Oral liquid |

Novamoxin 25mg/mL

Oral liquid |

|

|

| |

|

Cefaclor 250mg

Capsule |

Apo-Cefaclor 250mg

Capsule |

|

|

|

|

Cefaclor 500mg

Capsule |

Apo - Cefaclor

500mg Capsule |

|

|

| |

|

Cephalexin 250mg

Tablet |

Apo-Cephalex

250mg Tablet |

|

|

| |

|

Cephalexin 500mg

Tablet |

Apo-Cephalex

500mg Tablet |

|

|

| |

|

Cloxacillin 250mg

Capsule |

Novo-Cloxin 250mg

Capsule |

|

|

|

|

Cloxacillin 500mg

Capsule |

Novo-Cloxin 500mg

Capsule |

|

|

| |

|

Cloxacillin 25mg/mL

Oral liquid |

Novo-Cloxin 25mg/mL

Oral liquid |

|

|

| |

|

Penicillin V-K 60mg/mL

oral liquid |

Novo-Pen-VK-500

60mg/mL O/L |

|

|

| |

|

Penicillin V-K

300mg Tablet |

Novo-Pen-VK-500

300mg Tablet |

|

|

| |

|

Cefaclor 25mg/mL

Oral liquid |

Apo-Cefaclor 25mg/mL

Oral liquid |

|

|

| |

|

Cefaclor 50mg/mL

Oral liquid |

Apo-Cefaclor 50mg/mL

Oral liquid |

|

|

|

|

Cefaclor 375mg/5mL

Oral liquid |

Ceclor 375mg/5ml

Oral liquid |

|

|

| |

|

Cephalexin 125

25mg/mL

Oral liquid |

Novo-Lexin 25mg/mL

Oral liquid |

|

|

|

|

Cephalexin

50mg/mL

Oral liquid |

Novo-Lexin 50mg/mL

Oral liquid |

|

******************************************

Ontario Drug Benefit (ODB) stops paying for over 30 antibiotic generic

products

January 18, 2008

Ever since the introduction of Ontario's Transparent Drug System for

Patients Act, 2006, the landscape continues to change, creating a 2-tier

system between the private and public sector. Increases in the prices of

generics, combined with off-loading expenses to private payors and plan

members, are increasing the costs to Canadian employers and their

employees.

The most recent change occurred this week when the Ontario Ministry of

Health announced the ODB would no longer pay for over 30 highly utilized

antibiotic generic products.

The issue

On January 1, 2008, generic manufacturers raised their prices by 20-90%

for 5 classes of antibiotics, including Amoxicillin, Penicillin V,

Cephalixin, Cloxacillin and Cefaclor.

In response to the significant price increases, the ODB Program changed

the benefit status of over 30 highly utilized, first line antibiotic

generic products from "General Benefit" to "Not-a-Benefit". A drug

classified as "Not-a-Benefit" is not paid for by ODB, but is still

listed on the ODB formulary and considered eligible for

interchangeability with other listed products.

However, one generic drug product for each strength and dosage form,

from each affected class of antibiotics, remains listed as a "General

Benefit" and is covered by ODB.

What does this mean?

All Ontario residents over the age of 65, including retirees and "active

at work" employees, will no longer have coverage through ODB for these

commonly prescribed antibiotics.

Providers may be attempting to transfer the full cost of the claim to

the private payor as would be the usual practice for drugs that are not

covered by ODB.

Because only one antibiotic generic product remains listed as a "General

Benefit" and is covered by ODB, it has compounded the issue since many

pharmacies do not carry the lone generic product that is covered.

Pharmacies that carry the covered products are exhausting their

supplies.

Patients have the option to pay out-of-pocket for the non-covered drug,

wait for the drug supply to come in for the sole covered drug in that

class, or have the prescription changed to a covered drug in another

class.

What has Green Shield Canada done?

Upon receiving the notice of these changes from the Ministry of Health,

Green Shield Canada immediately updated the eligibility status of these

drugs.

Green Shield Canada will diligently monitor this situation and will

provide information on any further developments.

|

**********************

Government Benefits 2008

| Canada Pension Plan and Quebec Pension Plan |

CPP |

QPP |

| 1. Contribution Rate |

4.95% |

4.95% |

| 2. Year's maximum pensionable earnings |

$44,900 |

$44,900 |

| 3. Basic exemption |

$3,500 |

$3,500 |

4. Maximum premiums for employees

Maximum premiums for self-employed |

$2,049.30

$4,098.60 |

$2,049.30

$4,098.60 |

| 5. Benefits (maximum for new recipient) |

$884.58 |

$884.58 |

| 6. Lump Sum Death Benefit (max.) |

$2,500 |

$2,500 |

| 7. Disability (max.) |

$1,077.52 |

$1,077.52 |

| 8. Dependent children's benefit |

$208.77 |

$66.29 |

| 9. Surviving spouse 65 and over (max.) |

$530.75 |

$530.75 |

10. Surviving spouse under 65 (max.)

Surviving spouse 55-64 (max.)

Surviving spouse under 55 (max.) |

$493.28

-

- |

-

$745.77

$745.77 |

Old Age Security

(effective Jan. 1, 2008 - adjusted quarterly) |

| 1. Old Age Security |

- |

$502.31 |

| 2. Guaranteed income supplement (max.) |

single |

$634.02 |

| 3. Maximum spouse's allowance (Age 60-64) |

- |

$921.00 |

| 4. Maximum widowed spouse's allowance (Age 60-64) |

- |

$1,020.91 |

********************************

Calcium Supplements

Calcium supplements are no longer a benefit.

Health Canada has removed the DIN #'s

They are now labelled as a natural health product not a drug.

Anyone who has repeats on their prescriptions should buy the product off the shelf.

If they use their prescriptions they will be charged the dispensing fee

(Dec 2007)

|

******************************

OHIP will cover cost of

PSA

tests by 2009

BRAMPTON - Men aged 50 and older will have their annual prostate cancer screenings covered by OHIP starting in 2009, Ontario's Liberal government announced recently.

"We want to extend men's lives," said Ontario Health Minister George SmithermanSmitherman. "We're urging more men over 50 to get tested for prostate cancer and helping them to get tested by covering the test through OHIP."

Prostate cancer is the third leading cause of cancer death for Canadian men.

However, it's also one of the most treatable forms of cancer-- particularly when it is detected early.

The Prostate Cancer Antigen (PSA) test, which normally goes for roughly $30, allows doctors to detect illness at an early stage so that treatment can begin.

Currently, OHIP covers tests such as pap smears and mammograms for women.

Ian Smith of Brampton-based Blue Ribbon, a newly formed prostate cancer awareness and support association, said the announcement is a positive step forward.

"We welcome this announcement. We just wish it had been available a long time ago," Smith told The Guardian. "Women get various cancer tests covered by OHIP but men don't so this is good news."

PSA is an enzyme produced in the ducts of the prostate and absorbed into the bloodstream.

Although it doesn't always mean a person has cancer, Smith said the test looks for high PSA levels in the blood, which sort of acts like a red flag for patients who then may want to get tested further.

Smith said not everyone in the medical establishment agrees that PSA tests are reliable.

"But the important thing is the PSA test itself is perfectly accurate when it comes to detecting the amount of PSA in the blood. And what it says is there is something in the blood that shouldn't be there and it's a reason for further investigation," Smith said.

Smitherman said moving forward, Queen's Park will focus on improving breast, cervical and colorectal cancer screening rates and cover the HPV vaccine to prevent cervical cancer.

*******************************

GM and Chrysler already have coverage for the PSA test negotiated in 2005 Bargaining.

|

*******************************

*******************************

BENEFIT COVERAGES FOLLOWING

2005 BARGAINING

Eye Exams (New)

In recognition of government delisting of eye exams, coverage will now include one eye exam every 24 months, paid to a maximum of $65 per exam. (Effective October 1, 2005).

Vision Care

Effective October 1, 2005, the vision care plan will provide benefit coverage as follows:

• Single vision: $200 every 24 months

• Bifocal: $255 every 24 months

• Multi-focal: $325 every 24 months

Dental Plan

• The annual maximum has been established at $2,800.

• The orthodontic lifetime maximum will now be $3,600.

(Both of these maximums are effective October 1, 2005).

• Effective January 1, 2006, benefits payable shall be based on the Provincial Dental Association fee guide in effect for the previous year.

Chiropractic Benefits

The annual maximum has been set at $450, effective Oct.1, 2005.

Speech Therapy

The annual maximum benefit for Speech Therapy will be$1,100, effective Oct.1, 2005.

Paramedical Coverage

The annual maximums for Naturopaths and Podiatrist/Chiropodist have each been increased to $325,effective Oct.1, 2005.

Psychologist Services

The annual maximum will now be available to be appliedagainst the cost of a psychological assessment for children under the age of 14.

Prescription Drug Program

• Effective January 1, 2006, prescription drugs will becovered at the cost of available generic drugs.

Brand name drugs will be provided where determined to be medically required.

• The maximum dispensing fee under the plan will be capped at $11 per prescription.

• The current 35¢ co-pay per prescription has been maintained.

Semi Private Hospital

Effective January 1, 2006, semi private hospital room coverage will be provided to a maximum of $200 per day.

Long Term Care

Effective January 1, 2006, the maximum rate for semi-private accommodation will be set at the current level of $1,724.32 per month. Current residents of long term care facilities will be exempt from this provision.

|

*****************************

|

CAW LEGAL SERVICES PLAN

Coverage Information

The Benefit Schedule is a detailed list of services and fees. It only applies to those who use Staff Lawyers or Co-operating Lawyers (or Co-operating Notaries in Quebec).

CLICK HERE TO VIEW FULL BENEFIT SCHEDULE

Staff Offices

Staff Offices are law offices owned and operated by the Plan. Eligible Participants who so choose can receive legal services at these locations from Staff Lawyers, who are employed by the Plan. Staff Offices are also the Plan's Intake Centres. Participants who wish to be informed about their coverage entitlements and to arrange for referral or reimbursement should contact the Staff Offices closest to them (see below). Participants who live elsewhere should contact our Head Office Intake Centre at 1-800-268-7573.

Head Office

Suite 600

1 St. Clair Avenue West

Toronto, Ontario

M4V 3C3

(416) 960-2410

(800) 268-7573

Fax: (416) 960-8047

|

Locations

Brampton Office

Suite 2

23 Regan Road

Brampton, Ontario

L7A 1B2

(905) 790-6400

(877) 332-2444

London Office

Suite 102

1069 Wellington Rd. South

London, Ontario

N6E 2H6

(519) 681-7730

(800) 890-9772

Oakville Office

Suite 406

700 Dorval Drive

Oakville, Ontario

L6K 3V3

(905) 842-3101

(800) 465-9701

Oshawa Office

Oshawa Shopping Centre

Oshawa Executive Tower

Suite 603

King Street West

Oshawa, Ontario

L1J 2K5

(905) 433-4242

(800) 387-6592

Quebec Office

Suite 220

940 Grande Allee

Boisbriand, Quebec

J7G 2J7

(450) 437-6560

(800) 880-7959

St. Catharines Office

Suite 206

55 King Street

St. Catharines, Ontario

L2R 3H5

(905) 641-1313

(800) 318-0782

Toronto Office

Suite 904

505 Consumers Road

Toronto, Ontario

M2J 4V8

(416) 491-1211

(800) 221-5515

Windsor Office

2345 Central Avenue

Windsor, Ontario

N8W 4J1

(519) 944-5222

(800) 381-2209

***************************************

The Plan - Frequently Asked Questions (FAQ)

This page contains the answers to common questions about the CAW Legal Services Plan.

1. What is it?

The Plan is a self-administered, non-profit trust. It provides quality legal services at affordable prices to eligible CAW members and their families.

The Plan is established by collective agreements negotiated between each sponsoring company (Corporate Sponsors) and the CAW.

2. Who runs it?

Each separate Plan agreement establishes a Board of Trustees called the Administrative Committee. Each Committee has equal company and union representation and an independent chairperson.

In order to achieve significant cost savings, each separate plan uses the same central administration, run on a day-to-day basis by an Executive Director who reports to the trustees.

3. How is it financed?

Plan benefits and administrative expenses are paid from a trust fund. Contributions to this fund are made by the sponsoring companies in amounts established through collective bargaining.

4. Who is eligible?

Each separate Plan agreement has its own eligibility requirements. Most provide eligibility for bargaining unit employees (in most cases with at least one year of seniority) and retirees. Eligibility ceases in most cases if the employee has been continuously laid off for 18 months.

In most cases, spouses and surviving spouses of employees and retirees are also eligible, as are unmarried, dependent children, under age 26, who reside at home.

5. When does coverage start?

The effective date of Plan coverage varies for each sponsoring company. Check your collective agreement or call a Staff Office near you to find out when your coverage commenced.

Please note: Any matter that started before your commencement date is not covered.

Real Estate:

a) There is no coverage for purchases or sales if the Agreement of Purchase and Sale was signed prior to the date on which you became eligible for the Legal Services Plan benefit.

b) There is no coverage for Mortgages if the letter of commitment to the lender was signed prior to the date on which you became eligible for the Legal Services Plan benefit.

Other Matters:

c) There is no coverage if you hired the lawyer prior to the date on which you became eligible for the Legal Services Plan benefit.

d) Benefit changes only apply to cases that start on or after the effective date of the change.

6. How do I use it?

CALL THE PLAN FIRST! When you call, be sure you have your social insurance number, employee number and seniority date available. Your eligibility will be checked and the Plan coverage for the legal service that you require will be explained. The addresses and telephone numbers of all Plan offices are displayed on the Staff Offices page.

Call the Staff Office nearest to you. If there is no Staff Office near you, call the Head Office in Toronto.

1 St. Clair West Ave.

Suite 600

Toronto, Ontario

M4V 3C3

(416) 960-2410

(800) 268-7573

7. What if I have a complaint?

Please notify our Head Office in Toronto by calling 1-800-268-7573 or contact us.

8. What is excluded from Plan Coverage?

The Plan will not provide benefits or in any other manner pay for the following:

- fines and penalties, whether civil or criminal

- any judgment for civil damages, including judicially awarded costs

- costs attendant to the purchase or sale of real estate, such as registration fees, land transfer taxes, surveys, real estate agent commissions, title insurance premiums, and fees for title searches

- all disbursements such as court filing fees, process serving, transcripts, expert witnesses, etc.

- legal services outside of Canada or the U.S.A.

- services provided by non-lawyers, except Notaries in Quebec and British Columbia

- legal services which are for a Participant's business

- matters involving federal, provincial, municipal or local election to any public office

- any proceeding against the Participant's employer, its subsidiaries, dealers, directors, officers or agents

- any proceeding against the Participant's union, its subordinate or affiliated bodies or the officers or agents of such, or any labour union or association representing employees of the Participant's employer

- any proceeding arising under applicable labour relations acts, labour codes or labour standards acts

- any bankruptcy proceeding that would result in discharge of a debt owed to the Participant's employer, its subsidiaries, dealers, directors, officers or agents, the Participant's union or any benefit plan or trust established or maintained by the employer

- proceedings against or arising from any benefit Plan established or maintained by the Participant's employer, including proceedings against any trust or insurance carrier through which such benefits are provided to the employer, its employees or retirees including any dispute involving the Plan

- Workers' Compensation or Employment Insurance matters involving the Participant's employer

9. What about GST and sales tax?

The Plan does not pay sales or any other taxes related to lawyer or notary fees. The Plan does not pay GST.

10. How is the service delivered?

CALL THE PLAN FIRST! Plan Participants must contact the Staff Office located nearest them or the Head Office in Toronto to determine their eligibility and benefits under the Plan. Participants may go to a Staff Lawyer in the Staff Office, a Co-operating Lawyer or Notary or Non-co-operating Lawyer or Notary for their legal services.

Staff Lawyers are employed by the Plan, work in Staff Offices and provide legal services to Participants according to the Plan fee schedule.

Co-operating Lawyers and Notaries are in private practice and have contracted with the Plan to provide legal services to Participants according to the Plan fee schedule.

(Please Note: Co-operating Lawyers are not "CAW Lawyers". They are lawyers in private practice in your community who have agreed to bill according to our fee schedule. The Plan is not responsible for any act or omission by any Co-operating Lawyer or Notary.)

Non-co-operating Lawyers and Notaries are in private practice and have not contracted with the Plan to provide legal services to Participants according to the Plan fee schedule. They may extra-bill Participants over and above the Plan fee schedule.

No matter what kind of lawyer or notary you use, it is important to CALL THE PLAN FIRST to determine your eligibility and the benefit available to you under the Plan.

11. Who pays?

For legal fees paid by the Plan (see "Prepaid" and "Mixed" below) the Plan will pay directly for the services of Staff Lawyers or Co-operating Lawyers or Notaries. If you choose to use a non-co-operating lawyer or notary you pay him or her directly and submit the account to the Head Office in Toronto. The Plan will reimburse you up to the amount of the Plan fee schedule.

For legal fees that are your responsibility (see "Mixed" and "Referral" below) you pay the lawyer or notary directly. If you so choose and if available, the Plan will refer you to a Co-operating Lawyer or Notary who will only charge you in accordance with the current Plan fee schedule. For most cases, you will be charged an hourly rate; for others (e.g. Probate and some uncontested Family matters) you will be charged a fixed amount.

12. What types of benefits are provided?

There are three types of benefits available:

PREPAID (P): means that the Plan will pay all legal fees, except title search fees, at the Plan fee schedule rate. You are responsible for all disbursements and taxes (e.g. GST).

MIXED (M): means that the Plan pays for the first part of the legal fees (except taxes and GST) at the Plan fee schedule rate. Payment for subsequent legal fees is your responsibility. There are five types of Mixed Benefits.

M-2: The Plan pays for the first two hours.

M-4: The Plan pays for the first four hours.

M-10: The Plan pays for the first ten hours.

M-12: The Plan pays for the first twelve hours.

M-30: The Plan pays for the first thirty hours.

REFERRAL (R): means that, if you so choose and if available, the Plan will refer you to a Co-operating Lawyer or Notary or to a Staff Lawyer who will only charge you in accordance with the current Plan fee schedule rate. You are responsible for all fees, taxes and disbursements.

|

Please Note:

1. The Committee that administers this benefit has the authority to make decisions, from time to time, that affect the benefits and coverage provided to members. Consequently, the information provided here is subject to change. Although every effort will be made to update this website, it is important for you to check with the Plan as to benefit coverage and eligibility whenever legal services are required. ALWAYS CALL THE PLAN FIRST!

2. Co-operating Lawyers are not "CAW Lawyers". They are not employed by the Plan. They are lawyers in private practice in your community who have agreed to bill according to our fee schedule. The Plan is not responsible for any act or omission by any Co-operating Lawyer.

3. In all cases in which there is a conflict of interest between the eligible employee and a spouse or dependent, the Plan coverage provided for the legal services required will extend ONLY to the employee or retiree. The spouse or dependent will be reimbursed for no more than one hour of initial advice and consultation at the Plan fee schedule hourly rate. |

|